Latest Articles

46 Articles

USD Coin (USDC) is a stablecoin that is pegged to the US dollar. USDC is classified as a centralized stablecoin, backed by U.S. dollars or dollar-denominated assets like U.S. Treasury securities. It is issued by Circle.

USD Coin (USDC) is a stablecoin that is pegged to the US dollar. USDC is classified as a centralized stablecoin, backed by U.S. dollars or dollar-denominated assets like U.S. Treasury securities. It is issued by Circle.

After Saturday saw the value of the USDC fall, trust in the stablecoin Tether (USDT) increased, driving its growth.

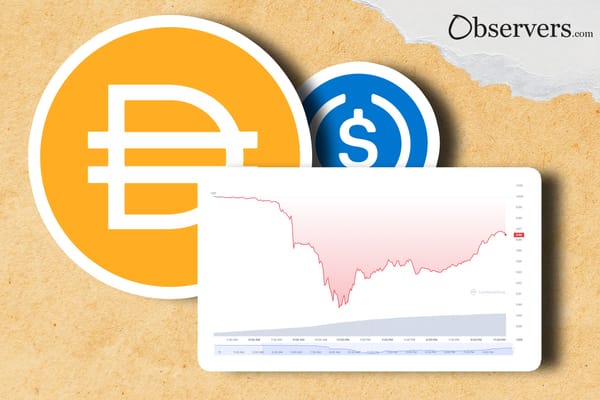

The collapse of Silicon Valley Bank (SVB) affected, among others, the USDC’s reserves and this “blue-chip” stablecoin has lost its peg to the dollar. Ironically, the only decentralized unicorn stablecoin project, MakerDAO is now in trouble due to its “reinforcing” USDC-backed component.

USDC depeged from USD after US Silicon Valley Bank collapsed. Exchanges paused their conversion as users rushed into other assets. Now the stablecoin has got back to 1:1 ration, but what’s done is done…

Sasha Markevich

USDC depeged from USD after US Silicon Valley Bank collapsed. Exchanges paused their conversion as users rushed into other assets. Now the stablecoin has got back to 1:1 ration, but what’s done is done…

Sasha Markevich

After Saturday saw the value of the USDC fall, trust in the stablecoin Tether (USDT) increased, driving its growth.

Alex Harutunian

The collapse of Silicon Valley Bank (SVB) affected, among others, the USDC’s reserves and this “blue-chip” stablecoin has lost its peg to the dollar. Ironically, the only decentralized unicorn stablecoin project, MakerDAO is now in trouble due to its “reinforcing” USDC-backed component.

Alex Harutunian

Paxos will increase the share of its USDP stablecoin in Maker's DAI Peg Stability Module (PSM). To facilitate this Paxos will transfer MakerDAO 45% of the income it gets from its own reserves on the deposited coins.

Alex Harutunian

Circle has created a protocol that replaces cross-chain bridges - CCTP. The launch is planned in the middle of the first quarter of 2023 on Ethereum and Avalanche.

Alex Harutunian

SPAC Concord, chaired by former Barclays CEO Bob Diamond, has canceled USDC's Circle acquisition deal worth USD9 billion.

Alex Harutunian

Circle, which owns one of the most popular stablecoins – USDC, has made changes to its financial forecasts due to the automatic conversion of USDC into BUSD stablecoin and the risks after the collapse of FTX, outlining them in a new document for the Securities and Exchange Commission.

Alex Harutunian

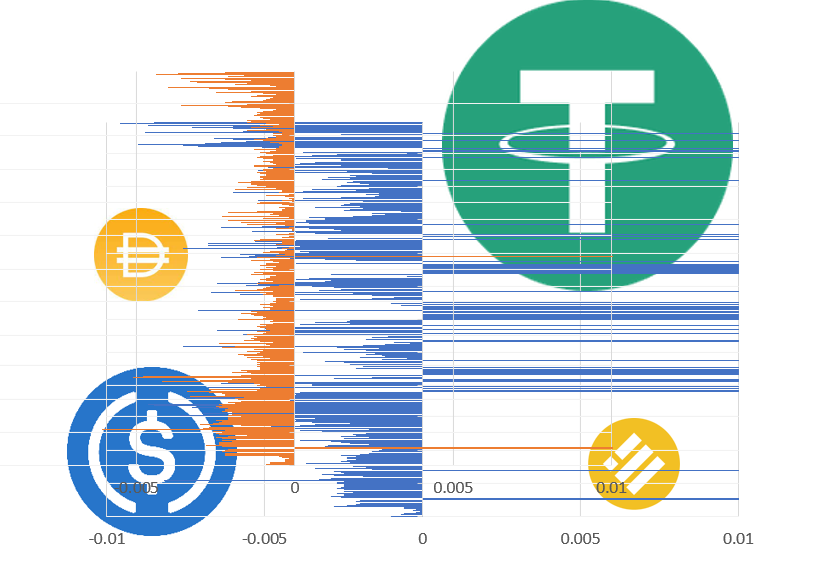

This year was an eventful year in the world of crypto. In particular, the collapsed Terra and FTX crisis affected the entire crypto market, and again attracted the attention of regulators to crypto and stablecoins. Stablecoins are valued for their technological features, while, at the same time, maintaining a stable

Alex Harutunian