Stablecoins, Centralized stablecoins, DeFi, Banks, USD Coin (USDC), Circle, MakerDAO, JustinSun, VitalikButerin

MakerDAO: When CeFi Hits DeFi

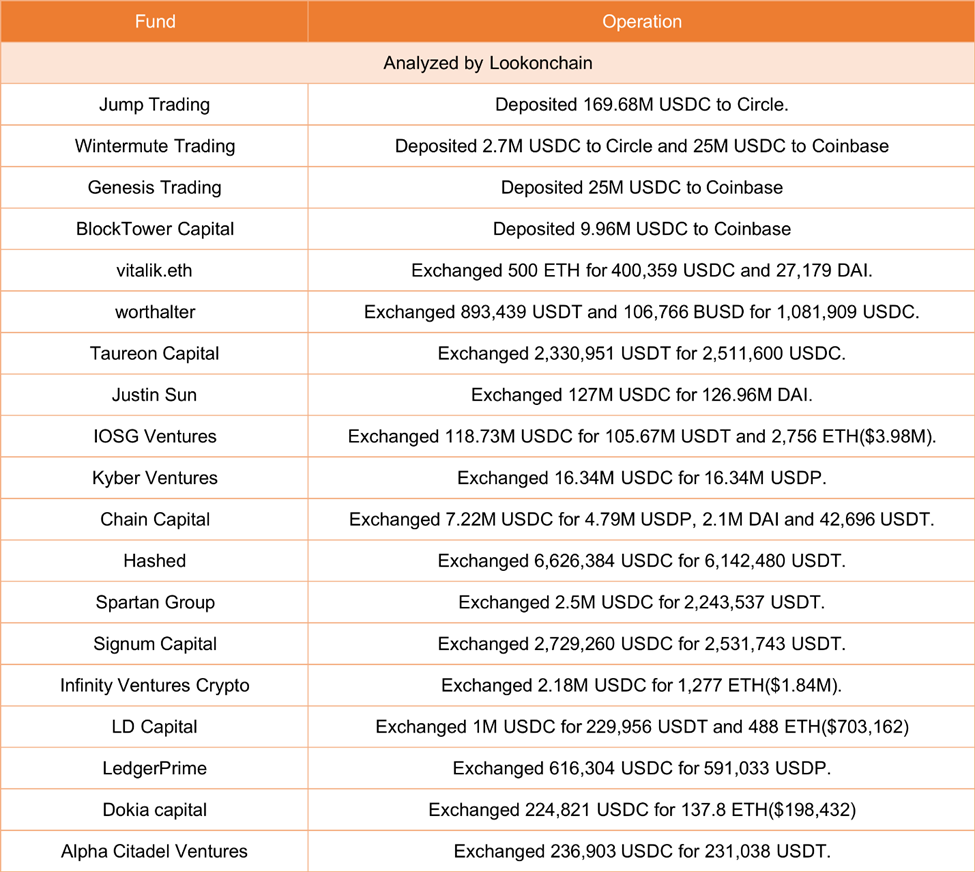

The collapse of Silicon Valley Bank (SVB) affected, among others, the USDC’s reserves and this “blue-chip” stablecoin has lost its peg to the dollar. Ironically, the only decentralized unicorn stablecoin project, MakerDAO is now in trouble due to its “reinforcing” USDC-backed component.