Circle’s USDC, the second-largest stablecoin by market cap, depeged on March 10 and reached a low of $0.88 on March 11, after it was revealed that $3.3 billion of its reserves were stuck at SVB which was shut down by regulators.

1/ Following the confirmation at the end of today that the wires initiated on Thursday to remove balances were not yet processed, $3.3 billion of the ~$40 billion of USDC reserves remain at SVB.

— Circle (@circle) March 11, 2023

This led to panic among crypto holders who rushed into exchanging USDC for other assets, paying out their USDC-denominated loans, trying to earn on arbitrage etc.

Exchanges reacted immediately. On March 10 Coinbase paused conversions between USDC and USD:

We are temporarily pausing USDC:USD conversions over the weekend while banks are closed. During periods of heightened activity, conversions rely on USD transfers from the banks that clear during normal banking hours. When banks open on Monday, we plan to re-commence conversions.

— Coinbase (@coinbase) March 11, 2023

USDC conversions resumed 3 days later on Monday, March 13, as it restored its dollar peg:

USDC:USD conversions have been reinstated and are now operating as normal via API and UI. USDC will not be auto-converted to USD on Coinbase Exchange.

— Coinbase (@coinbase) March 13, 2023

Another major exchange, Binance, discontinued auto-conversion of USDCto BUSD which was launched last September.

❓ Read more about auto-conversion here: Conversion of USDC to BUSD. Good or Bad?

While centralized exchanges blocked some transactions, the volume on decentralized exchanges, where trading is not managed by any central party, soared. Uniswap recorded one of the highest volumes ever, close to $12 billion.

Yesterday had the highest daily USD volume ever on the @Uniswap Protocol!

— Austin Adams (@AustinAdams10) March 12, 2023

$11.84b, almost double the second place day.@DuneAnalytics: https://t.co/KMQxfmlIlo pic.twitter.com/pn9X9yBNHq

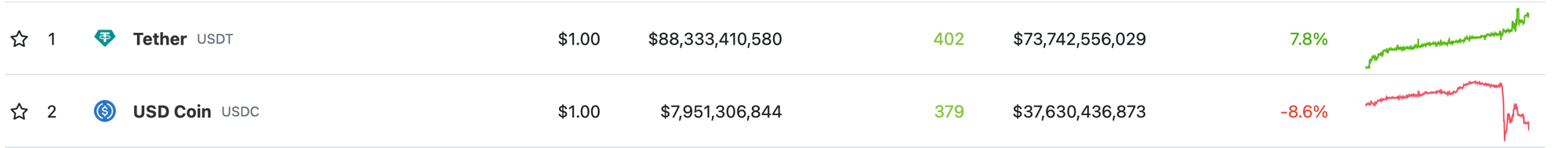

Currently, USDC has regained its value and is freely converted on exchanges, but the situation has significantly undermined its position on the market. All traders rushed to swap USDC for ETH and USDT which has changed the balance of forces in the market. Circle has removed about 3.9 billion USDC from circulation. You can read more about it in our article "USDC Depeg Fuels USDT Growth".

If the most reliable and regulated stablecoin can lose 10% of its value in just one day, it is not a healthy sign… Despite the fact that now USDC is ’pegged-back’, exchanges state that customers’ assets are safe, and it seems that everything is fine, the current situation still can result in another round of crypto market troubles. We feel that this is not the end of the story and that recent events in the banking sector might bring more unpleasant surprises to the crypto industry.

❗ In case you missed it: BUSD, another major stablecoin, also faces troubles. Coinbase suspended trading for Binance USD on March 13, 2023.

In the context of banks collapsing and stablecoins being unstable, how do you keep your assets? What is the safest option in your opinion? What will happen to the industry in forthcoming weeks? Share your thoughts in the comments and stay tuned!