Paxos buys space in MakerDAO reserves

Paxos has offered to place up to $1.5 billion of its USDP stablecoin in MakerDAO’s Peg Stability Module (PSM). The current debt ceiling in the PSM for USDP is $450 million. In this deal, Paxos will pay MakerDAO monthly fees dubbed “marketing payments” from the income it receives from the placements of these coin reserves, in the amount of 45% of the Effective Federal Funds Rate (EFFR).

Paxos USDP is a centralized, fully backed stablecoin, regulated by the New York Department of Financial Services (NYDFS). Around 80% of its reserves is in US government Bonds and the rest are in US FDIC-insured bank deposits, so the benchmark rate reflects its own earnings. At the time of writing EFFR is 4.3%.

USDP is also the seventh-largest stablecoin by market cap. However, the market capitalization of the stablecoin, according to CoinGecko, is about $900 million - 50% less than the proposed amount to be put in MakerDAO PSM. The daily transaction volume is around $2 million which barely puts it in the top 20 stablecoins.

MakerDAO needs Paxos

There is clear interest from MakerDAO in this deal. The first point in the “Motivation” paragraph of the proposal is the revenue estimate - a total of $29 million per annum at current rates. It is interesting to note that this amount is calculated on the whole proposed sum of 1.5 billion including the existing $450 million of USDP reserves for which MakerDAO was not paying anything before.

This revenue will make up a significant portion of MakerDAO investment income which decreased in 2022 from around $30 million per quarter to around $4 per quarter due to the poor performance of DeFi assets.

MakerDAO engineer Sam MacPherson shared his excitement on Twitter:

FYI if accepted by the DAO this will bring recurring revenues to about 70m / year.

— Sam MacPherson (@hexonaut) January 19, 2023

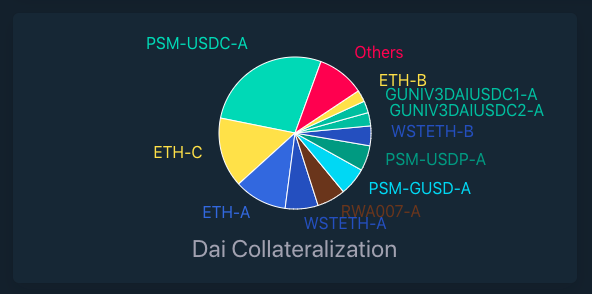

The increase in revenue is not the only advantage that MakerDAO will receive from cooperation with Paxos. Currently, around 30% of DAI is collateralized by USDC and around 40% of new DAI is generated by USDC collateral. Increasing the USDP PSM debt ceiling can help reduce DAI’s exposure to USDC.

You may recall that Maker's Peg Stability Module (PSM) is a special type of Maker vault that holds stablecoins in its reserves. Unlike other vaults DAI is “swapped to” rather than “borrowed against” the collateral. It is considered as the last line of defence for DAI’s stability peg, at the same time often criticized for its dependency on centralized assets. PSM is around $3 billion compared to the total market cap of DAI of around $5 billion.

This problem is definitely relevant for MakerDAO, since, DAI has already experienced problems with its USDC reserves after US Treasury sanctioned the Tornado Cash mixer. This case showed the vulnerability of USDC to censorship - something a decentralized smartcontract-based coin like DAI cannot technically handle.

Overall, the proposal is in line with Maker’s strategy to diversify its reserves, including by adding real-world assets and to improve the income on its reserves.

MakerDAO votes

According to the governance structure, the proposal discussion on the official (off-chain) forum is the first stage of approval. If overall responses are positive, the decision is moved to on-chain voting. Most of the 25 responses so far were positive, some however pointed to the limited utility and illiquid characteristics of USDP. We will be observing the further discussion of this proposal in the MakerDAO community, as well as the upcoming vote, and we will definitely inform you about the news.