Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian

From Polymarket’s stripped-down design to Kalshi’s regulatory breakthrough, prediction markets are turning collective opinion into a financial asset class — and a new battleground over who defines truth

Alex Harutunian

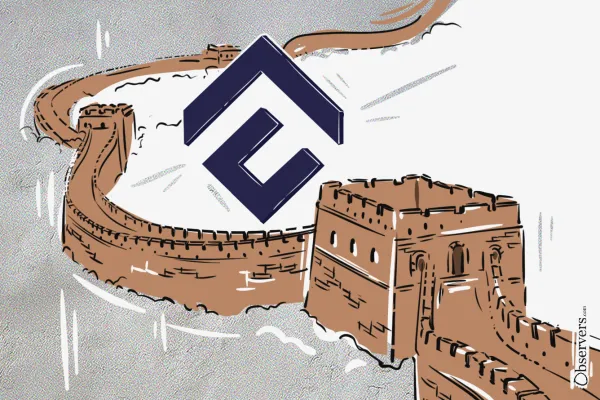

While crypto remains banned, China’s state-backed blockchain ecosystem — led by Conflux — is expanding across Asia and into global finance. Conflux Network bridges China’s academic research, state strategy, and open blockchain innovation.

Alex Harutunian

DeFi is moving from standalone apps into the backend of exchanges, with Coinbase and Crypto.com leading by embedding Morpho’s lending vaults. This “embedded DeFi” model raises a key question: are exchanges becoming banks, or just UIs? The answer will define DeFi’s role in future banking.

Alex Harutunian

After years of development, blockchain games still capture only a sliver of the gaming industry. The promise of true asset ownership, stable economies, and transferability remains unmet. Recent trends suggest blockchain was more hype feature than genuine necessity

Alex Harutunian

Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian07.01.2026 US Senate Banking and Commerce committees to work on comprehensive crypto legislation this month. 07.01.2026 Polymarket to supply its market data and indicators to Barron’s, The Wall Street Journal, and other Dow Jones publications. 07.01.2026 Chen Zhi, founder and chairman of Prince

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

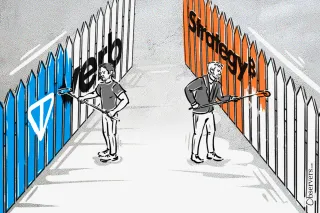

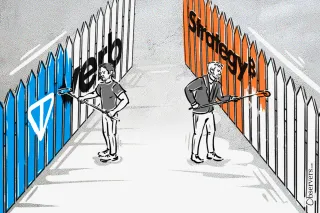

TON Strategy Company, formerly Verb Technology, has rebranded as a Toncoin treasury, holding $713M in TON and targeting over 5% of supply. By staking its holdings and adopting financial engineering akin to Strategy’s playbook, it aims to turn crypto reserves into shareholder returns

From $GOAT to $FART, memecoins show how hype burns fast and budgets vanish faster. Market caps in the tens of millions may look like real businesses, but behind the joke lies sunk marketing spend, fragile communities, and the math of attention that always runs out of breath

On the first of November, the next meeting on the Celsius bankruptcy case took place. The key note of this meeting was a decree from a Federal judge to conduct an investigation, which would show whether Celsius worked under a Ponzi scheme. The request for an investigation was the result

Alex Harutunian

Synonym is a bitcoin open-source software company that is developing peer-to-peer protocols and applications for global Bitcoin adoption. It promotes “hyperbitcoinization” - a future state where Bitcoin is more widely used as a default value and payment system.

Sasha Markevich

Elon Musk becoming the CEO of Twitter has made a lot of noise in the media. Still, his net worth keeps taking a hit. As well as his other businesses. Elon Musk finalized the deal for purchasing Twitter for $44 billion on October 27, which made him the largest shareholder

Observers

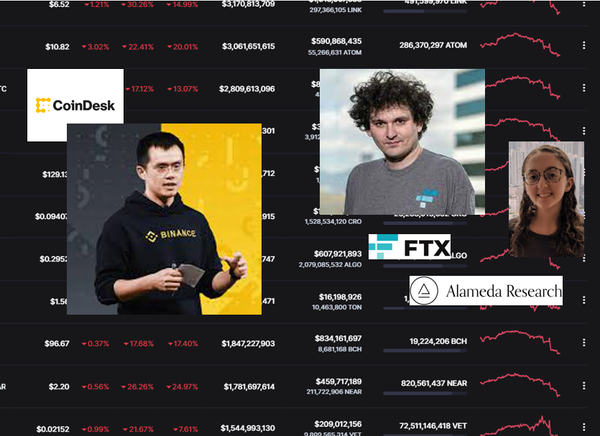

We present the timeline of events surrounding Alameda's $14.6 billion assets and the mysteries behind their ties with FTX and how Binance stepped into the game.

Alex HarutunianAt the end of October, Bloomberg, citing its sources, published an article stating that a new investigative team is taking over looking into the alleged fraud of the Tether leadership. Tether's reaction followed very quickly. In a message on the official website, the company accused Bloomberg of lying

Alex Harutunian

According to the Korean Broadcasting System (KBS), the South Korean prosecutor's office has received evidence of price manipulation of the collapsed stablecoin by Do Kwon. Against the background of these events, Kwon appears live on Twitch.

Alex Harutunian

The blockchain project LBRY that is developing “decentralized” Youtube, Odysee, lost the court case against SEC. Observers see a precedent for the Ripple case.

Alex Harutunian07.01.2026 US Senate Banking and Commerce committees to work on comprehensive crypto legislation this month. 07.01.2026 Polymarket to supply its market data and indicators to Barron’s, The Wall Street Journal, and other Dow Jones publications. 07.01.2026 Chen Zhi, founder and chairman of Prince

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

TON Strategy Company, formerly Verb Technology, has rebranded as a Toncoin treasury, holding $713M in TON and targeting over 5% of supply. By staking its holdings and adopting financial engineering akin to Strategy’s playbook, it aims to turn crypto reserves into shareholder returns