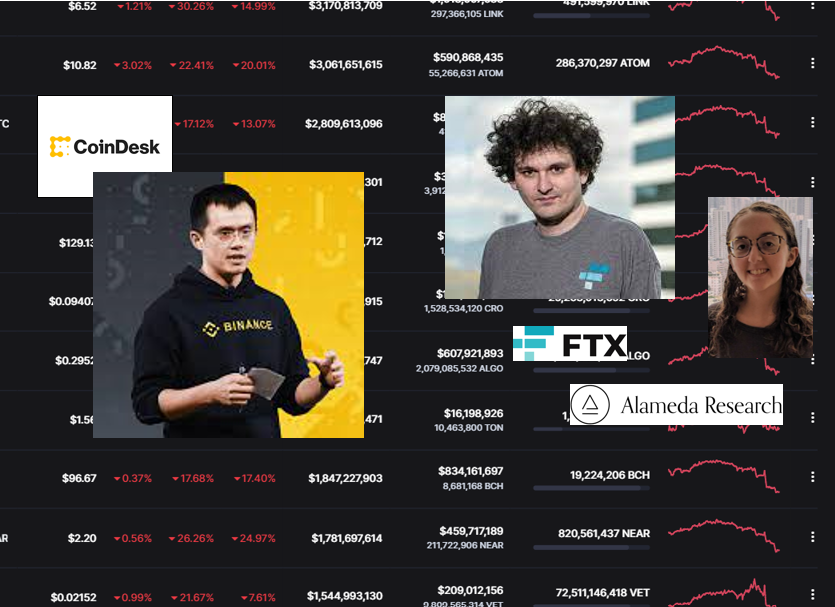

FTX, Alameda. Binance

We present the timeline of events surrounding Alameda's $14.6 billion assets and the mysteries behind their ties with FTX and how Binance stepped into the game.

We present the timeline of events surrounding Alameda's $14.6 billion assets and the mysteries behind their ties with FTX and how Binance stepped into the game.

We still need to analyze and understand what exactly happened once the "fog of war" settles. Presenting below our observations of facts and a timeline of the events so far:

2 November, 2022. Coindesk publishes an article about the assets of Alameda

Alameda had $14.6 billion of assets as of June 30, according to a private document CoinDesk reviewed. Much of it is the FTT token issued by FTX, another Bankman-Fried company.

The "private document" was not included in the article but the figures implied about 40% of the firm's assets were in FTT coins.

The financials make concrete what industry-watchers already suspect: Alameda is big. As of June 30, the company’s assets amounted to $14.6 billion. Its single biggest asset: $3.66 billion of “unlocked FTT.” The third-largest entry on the assets side of the accounting ledger? A $2.16 billion pile of “FTT collateral.”

Other significant positions that the article mentions is $3.37 billion "crypto held" and around $1 billion Solana tokens. Nothing strange for a crypto trading firm so far.

Other significant assets on the balance sheet include $3.37 billion of “crypto held” and large amounts of the Solana blockchain’s native token: $292 million of “unlocked SOL,” $863 million of “locked SOL” and $41 million of “SOL collateral.” Bankman-Fried was an early investor in Solana. Other tokens mentioned by name are SRM (the token from the Serum decentralized exchange Bankman-Fried co-founded), MAPS, OXY and FIDA. There is also $134 million of cash and equivalents and a $2 billion “investment in equity securities.”

Coindesk article mentions that the locked token values in the "private document" may be different, siting Alameda's footnote on 50% fair value discount from FTX market price. However, Coindesk further dramatizes that the values "may be low".

Also, token values may be low. In a footnote, Alameda says “locked tokens conservatively treated at 50% of fair value marked to FTX/USD order book.

2-6 November, 2022 the founder of Alameda and FTX, Sam Bankman-Fried seems to be unaware of the situation and posts about puppies, Twitter, US elections and their Voyager bailout

6 November, 2022 CZ of Binance informs publicly about the liquidation of FTX tokens from their books. The tweet replies are restricted

As part of Binance’s exit from FTX equity last year, Binance received roughly $2.1 billion USD equivalent in cash (BUSD and FTT). Due to recent revelations that have came to light, we have decided to liquidate any remaining FTT on our books. 1/4

— CZ 🔶 Binance (@cz_binance) November 6, 2022

6 November, 2022. CEO of Alameda Research, Caroline Ellison responds in Twitter, rejects accusations, tells that the data is not complete and mentions improved debt positition of the company.

- the balance sheet breaks out a few of our biggest long positions; we obviously have hedges that aren’t listed

— Caroline (@carolinecapital) November 6, 2022

- given the tightening in the crypto credit space this year we’ve returned most of our loans by now

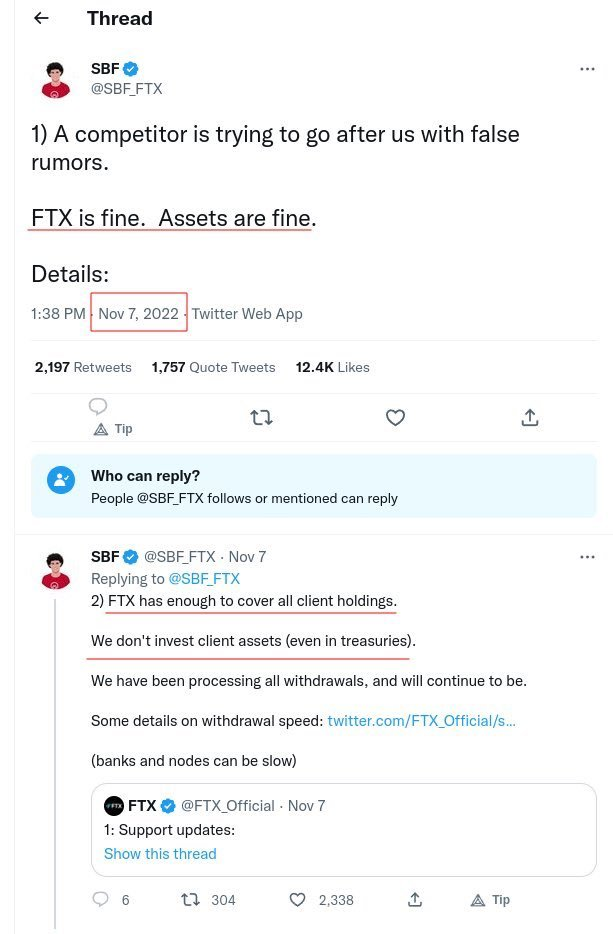

7 November, 2022 the founder of Alameda and FTX, Sam Bankman-Fried tweets "all good" - now deleted.

8 November, Binance's CZ announces their intent to buy FTX and starts a "full due diligence".

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

8 November, 2022, Sam Bankman-Fried deletes the "competitor Binance" tweet and posts and "ally Binance" tweet

1) Hey all: I have a few announcements to make.

— SBF (@SBF_FTX) November 8, 2022

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

We continue to observe.