After years of legal uncertainty, U.S. regulators have opened the door for on-chain shareholder records. From Galaxy and Securitize to DTC’s pilot, equity is moving into the blockchain mesh—reshaping settlement, trading, and the future architecture of capital markets.

Alex Harutunian

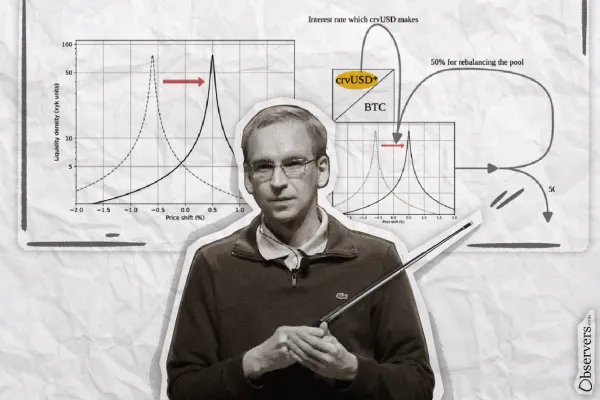

Vitalik Buterin’s recent posts reflect a shift from idealistic decentralization toward pragmatic system design. Rather than rejecting Ethereum’s core principles, he questions where complexity, governance, and the current development path fail under real-world constraints.

Alex Harutunian

Hyperliquid is evolving from a perp DEX into a vertically integrated financial stack. By launching its own L1, native stablecoin, and spot markets, it prioritizes market fit over ideology. Started on Arbitrum, its roadmap reveals a larger ambition: to become the global base layer for all trading.

Alex Harutunian

Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian

DeFi is moving from standalone apps into the backend of exchanges, with Coinbase and Crypto.com leading by embedding Morpho’s lending vaults. This “embedded DeFi” model raises a key question: are exchanges becoming banks, or just UIs? The answer will define DeFi’s role in future banking.

Alex Harutunian

After years of legal uncertainty, U.S. regulators have opened the door for on-chain shareholder records. From Galaxy and Securitize to DTC’s pilot, equity is moving into the blockchain mesh—reshaping settlement, trading, and the future architecture of capital markets.

Alex HarutunianNASHVILLE, Tenn. Nakamoto Inc. (NASDAQ: NAKA) (“Nakamoto” or the “Company”) today announced that it has entered into merger agreements to acquire BTC Inc, the leading provider of Bitcoin-related media and events, and UTXO Management GP, LLC (“UTXO”), an investment firm focused on private and public Bitcoin companies (collectively, the “Transaction”

The digital euro is increasingly framed as a tool of EU sovereignty. China’s interest-bearing e-CNY shows no banking disruption so far. Tokenization goes mainstream as the ECB validates DLT collateral and the U.S. SEC distinguishes issuer-backed from wrapper tokens.

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

• Aptos tokenomics cuts: staking APR from 5.19% to 2.6%, increases gas fees 10× • Ethereum outlines its 2026 upgrade priorities. • Polymarket acquires Dome, a startup building a unified API for prediction markets.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Lately, we have heard a lot about the troubles of crypto companies’ and collapses. This time Binance made us worry when it halted USDC withdrawals.

Sasha Markevich

Artist Emily “pplpleasr” Yang co-founded the NFT platform Shibuya, which has garnered $6.9 million in seed funding backed by heavyweights Andreessen Horowitz and Variant Fund.

Alex Harutunian

Elon Musk shared his thoughts regarding the current monetary system and his views on the role of crypto within it. Elon Musk took part in a live coverage held by Mario Nawfal, founder & CEO of IBC Group and host of the Roundtable show, the biggest live show in crypto.

ObserversSouth Korean news agency Yonhap reported that Do Kwon, who has been on the international wanted list on INTERPOL for several months now, maybe staying in Serbia.

Alex Harutunian

A Chinese court has found that NFTs share the same characteristics of property, such as value, scarcity, disposability, and tradability. Hence NFTs should have the same protections as physical property under Chinese law.

Alex Harutunian

Recently BIS published a working paper on crypto trading and retail adoption. The main idea was “to provide cross-country evidence that retail investors enter the market following Bitcoin price increases”.

Sasha MarkevichNASHVILLE, Tenn. Nakamoto Inc. (NASDAQ: NAKA) (“Nakamoto” or the “Company”) today announced that it has entered into merger agreements to acquire BTC Inc, the leading provider of Bitcoin-related media and events, and UTXO Management GP, LLC (“UTXO”), an investment firm focused on private and public Bitcoin companies (collectively, the “Transaction”

The digital euro is increasingly framed as a tool of EU sovereignty. China’s interest-bearing e-CNY shows no banking disruption so far. Tokenization goes mainstream as the ECB validates DLT collateral and the U.S. SEC distinguishes issuer-backed from wrapper tokens.

Bermuda is integrating USDC stablecoin into its economy. In a dollar-pegged island state, stablecoins aren’t replacing money—they’re upgrading the rails. If it works, dozens of “Other Bermudas” could emerge as the next growth engine for stablecoins.

• Aptos tokenomics cuts: staking APR from 5.19% to 2.6%, increases gas fees 10× • Ethereum outlines its 2026 upgrade priorities. • Polymarket acquires Dome, a startup building a unified API for prediction markets.

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch