The research is based on a database on retail use of crypto exchange apps at daily frequency for 95 countries over 2015–2022.

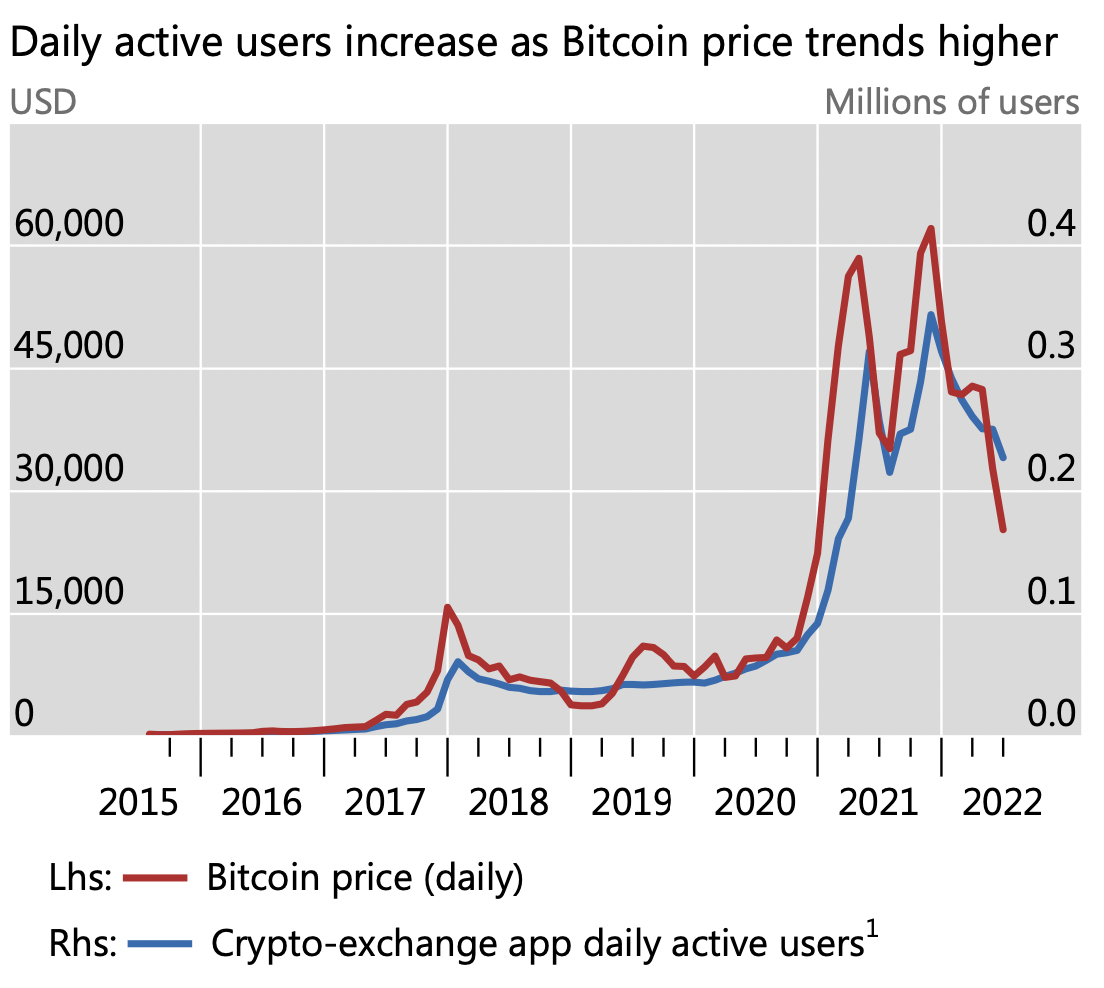

The analysis showed that a rising Bitcoin price was followed by the entry of new users (i.e. new investors). It is possible to suggest that users enter the system attracted by high prices and expect that prices will continue to rise. The analysis demonstrates that a one-percentage point increase in the Bitcoin price is on average associated with an increase in the monthly average number of daily active users by 1.1%. The researchers have also proved that there is no reverse causality and that the relation between the entry of new users and the Bitcoin price is not driven by other observable macro-factors.

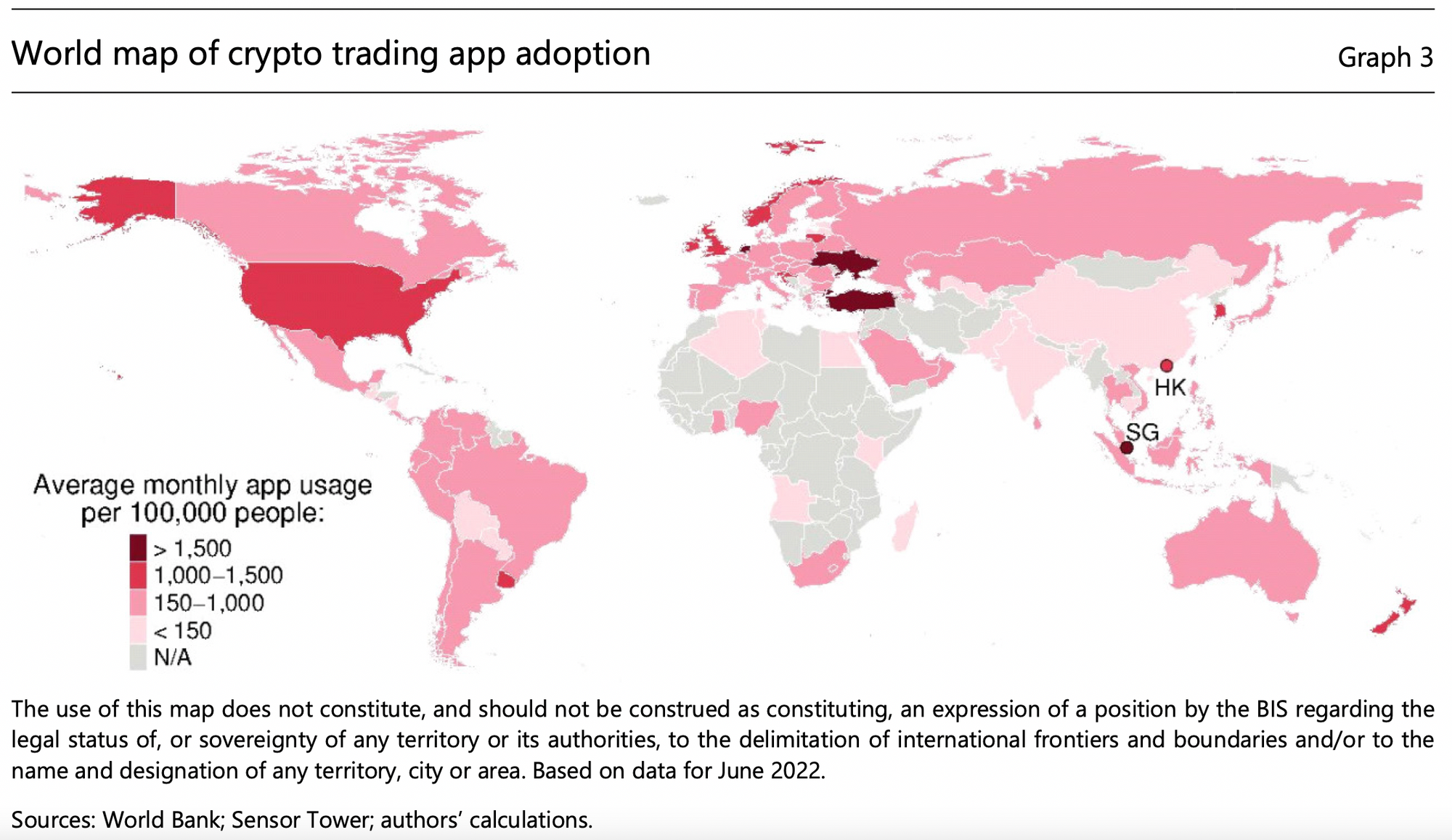

Another finding is that over the period of analysis, crypto exchange app adoption was highest in Turkey, Singapore, the United States and the United Kingdom and lowest in China and in India, where legal restrictions prevent further retail adoption. The average monthly usage is highest in Turkey, Ukraine, Singapore and Netherlands. Surprisingly Uruguay has the same usage rate as the USA, Hong Kong and Great Britain, despite the country not having issued cryptocurrency regulations and legal framework as yet.

At the same time, the research says that world macro factors and country characteristics do not have much influence on crypto adoption:

“a) The Bitcoin price explains almost 50% of the overall variation in entry of new users, followed by the price of gold with 25%.

b) While the price of Bitcoin explains over 55% of the total variation, country characteristics (eg total population, real GDP, the use of payments apps, or institutional quality) explain less than 15% each”.

Also, it was found that 40% of exchange apps users were men under 35, identified as the most “risk-seeking” segment of the population. They are more likely to make active use of crypto exchanges after a rise in the price of Bitcoin, than women and older people. Other studies on the crypto market confirm this information.

One of the findings is a bit discouraging: most of the users who invest in Bitcoin lose their money.

“Assuming that each new user bought $100 of Bitcoin in the month of the first app download and in each subsequent month, 81% of users would have lost money. The median investor would have lost $431, corresponding to 48% of their total $900 in funds invested”.

☝ Read our article on Binance Crypto Indices, maybe it will give you a hint how to invest in crypto without loosing that much.

To sum up, this research confirmed once again that Bitcoin is still the most powerful instruments in crypto world and has a huge impact on crypto adoption and development, but it’s not that easy to make money using it.