For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, stablecoins and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

On February 16, the U.S. Federal Reserve (Fed) published a note discussing the role of the digital dollar (CBDC) on the dollar's dominance in the world. The Fed's notes are articles in which its board staff offer their own views and present analysis on various topics in economics and finance.

Although the authors conclude that "the international role of the dollar as a unit of account and especially as a store of value is unlikely to be affected by the introduction of a CBDC, even by a stable and large non-U.S. jurisdiction", it is clear that developments in the Chinese and European digital currencies are concerning for experts on the U.S. monetary system. They also touched upon stablecoins as an important factor to be considered in the future money-tech landscape.

China undoubtedly seems to be leading the current CBDC race. Yesterday, the Financial Secretary of the Hong Kong SAR Government, Paul Chan Mo-po, mentioned the latest developments involving digital Hong Kong dollars and China's e-CNY in Hong Kong when releasing his 2024-2025 budget. The Secretary announced the continuation of the the pilot project of the Hong Kong's digital dollar, extending to new use cases. He also mentioned that this year they expect to launch the first phase of services under the cross-border mBridge project, including making China's CBDC available to Hong Kong's citizens.

U.S. private banks are busy examining recent crypto charts and seem to have started experiencing FOMO (Fear Of Missing Out) since the approval of spot Bitcoin ETFs. Charles Schwab and Robinhood had already started offering the product, while Bank of America’s Merrill, Wells Fargo and UBS have just dived in. Morgan Stanley is currently reported to be evaluating adding spot Bitcoin ETFs to its platform.

U.S. banks have also been successful in lobbying for relief from the U.S. Securities and Exchange Commission's (SEC) digital asset accounting rules that prevented them from entering the spot bitcoin ETF custody business. Two weeks ago the commercial banks in the U.S. requested that the SEC adjust the rule. Yesterday, the House Financial Services Committee passed a resolution to reject the SEC’s accounting rule, which will provide more space for the banks once passed by Congress. Currently, 90% of the almost $40 billion Bitcoin ETF assets are under the custody of Coinbase.

DZ Bank of Germany presented its "Decentralized Settlement" solution during the Digital Euro Conference this week. In 2023 the bank introduced the Smart Derivative Contract for automation of derivative transactions on blockchain. The new solution basically extends its functionality to cross-chain applications. The solution uses the hash lock concept and assumes a zero-knowledge settlement agent on a decentralized network. The bank's representatives emphasized that such functionality is important for the establishment of "solid functional bridges" between CBDC and other decentralized platforms. Unusually for a commercial bank, the work is published in a scientific journal and open-sourced for use by other developers.

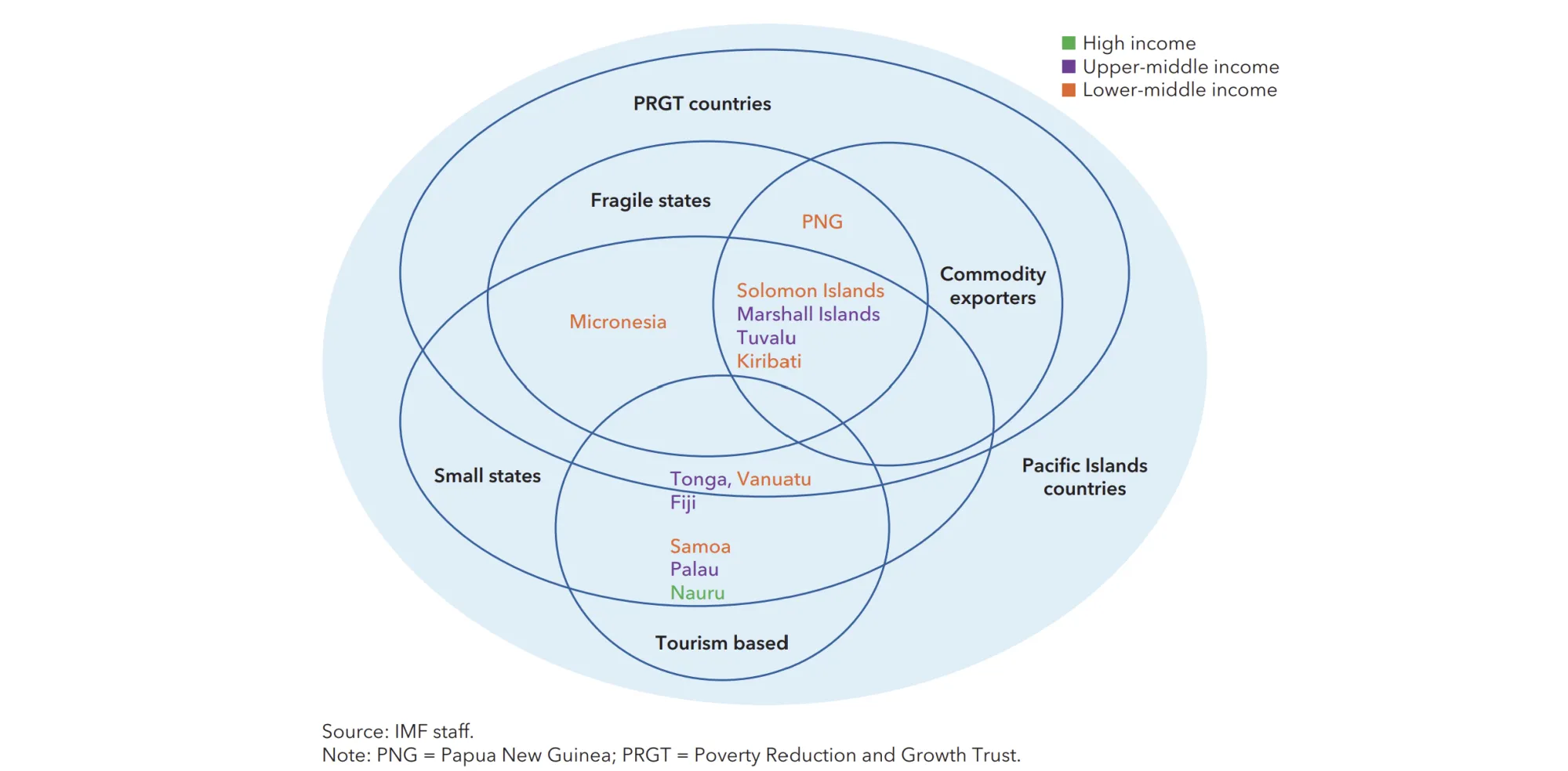

The International Monetary Fund (IMF) published a review of CBDC developments in the Pacific Islands. Notable developments mentioned in the review include the Marshall Islands project with Bitt, Palau's partnership with US-based crypto company Ripple, and Soramitsu's projects in Fiji and Solomon Islands.

The IMF recommends selecting a digital currency model that can be tailored to the economic specifics of this very diverse region, yet at the same time following a regional interlinking approach. Adopting stablecoins as legal tender is not excluded from the IMF's options for countries without their own currency.

The IMF also advised digital money service providers working with these countries to develop business models that generate sustained revenue and cover their own running costs. It suggests a preference for digital money that can be used in various use cases, including by tourists who provide a large part of the regional income.