For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

CBDC Updates

China is incentivizing the use of its CBDC with "red envelopes" in the e-CNY wallets. Presenting cash bills in red envelopes on New Year and other occasions is a tradition in China. Now the e-CNY wallet has a special section of red envelopes where the users can use digital envelope covers for each occasion as well as get envelopes filled with purchase discounts and airdrops.

Most recently the municipality of Chaoyang city in the North East of China issued 5 million digital RMB in red envelopes to promote a local shopping festival. The previous issue of 1 million e-CNY in April has been reportedly used by 67%, driving a total transaction volume of 2.441 million yuan.

China is also leading the works in Project mBridge, a cross-border CBDC initiative of China, UAE, Thailand, and Hong Kong central banks in collaboration with the Bank of International Settlement (BIS). This week the project reported the completion of an MVP (minimum viable product) and invited private sector firms to participate with solutions and use cases on it. Saudi Arabia has signed up to join Project mBridge which now counts 5 full member banks and 26 observer central banks and organizations. Observers mention that over time, this could fuel de-dollarization by allowing trades to be settled in alternative currencies.

This week BIS announced the launch of another cross-border CBDC project Realto, focused on modular foreign exchange components of wholesale currency payments. There are limited details in the announcement – only that the project will be run by the Singaporean Innovation Hub of BIS, with the participation of multiple central banks.

As ever, there's continued caution in the EU over whether a digital euro will ever see the light of day. Speaking at the Money 20/20 conference in Amsterdam, Evelien Witlox from the European Central Bank said there is a "highly likelihood" that a CBDC will launch — "but it is not inevitable at the moment."

A driving concern for the ECB is the continent's reliance on "non-European players" for payment processing, which undermines economic sovereignty. She added:

"Also a lot of data are involved in payments, so we really do see this as a serious concern."

Despite all of this, there are promising signs that there would be public appetite for a digital euro.

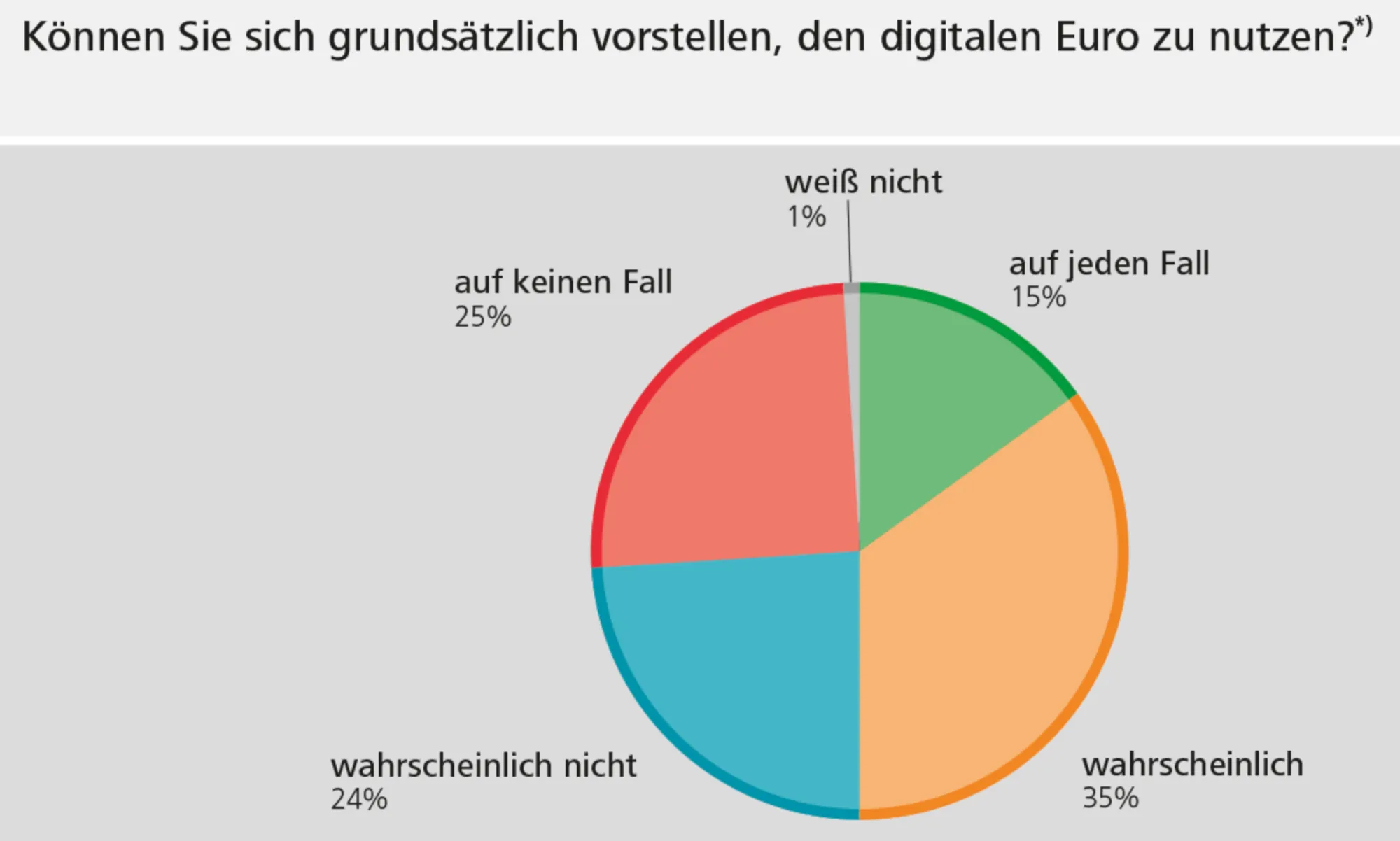

A new poll carried out for the Deutsche Bundesbank shows about half of respondents could imagine embracing a CBDC as a payment option — on the condition of robust privacy protections.

But the research did expose a greater need for education about central bank digital currencies. Why? Because 59% of those surveyed had never even heard of it.

Soraya Hakuziyaremye, the Deputy Governor at Rwanda’s Central Bank shared Rwanda's plans for launching their CBDC. According to her, the first research phase has been completed, and the country authorities see a lot of benefits for the country's ICT agenda. However, she emphasized, that the final decision will be based on the assessment of the needs and opinions of the Rwanda population.

Tokenization Updates

The House Financial Services Committee held a hearing on the tokenization of real-world assets this week.

Opening the session, chairman French Hill declared that — aided by blockchain technology — this could automate "critical processes" in financial transactions, streamlining settlement and reducing fees as a result.

Carlos Domingo, the CEO of Securitize, was among the experts giving evidence — and argued that wider adoption would "improve how money flows from companies to investors."

But others on the panel, including Professor Hilary Allen, were less convinced about the technology underpinning tokenization. She warned:

"Blockchains suffer from inescapable inefficiencies and operational fragilities that make them unsuitable as supporting infrastructure for real-world assets."

While authorities and lawmakers debate the tokenization's pros and cons, technology firms are actively preparing to embrace it. Chainlink and Ripple unveiled their tools for the tokenization market which is expected to reach 16 trillion by 2030.

And we end this week with a pretty cool use case: a 300-year-old Stradivarius violin worth $9 million has been tokenized by Galaxy Digital.

Owned by Animoca Brands chairman Yat Siu, the Empress Caterina — which dates back to 1708 — was previously owned by Catherine the Great.

Siu is now using the tokenized violin as collateral for financing. Galaxy's founder Mike Novogratz said:

"We are not just preserving the legacy of one of the world's most precious musical instruments, but we are also setting a precedent for how the latent value of real-world assets can be accessed and utilized."