For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

This week, the governor of the Philippines Central Bank (BSP), Eli M. Remolona Jr. made headlines by promising that the country's wholesale CBDC would be ready in two years. At the same time, he disclosed that it would not be based on blockchain or use Distributed Ledger Technology (DLT). BSP has already tested the wholesale CBDC on Hyperledger in conjunction with their interbank Real Time Gross Settlement (RTGS) system, and it seems that a decision was made to stick with the RTGS.

The BSP leadership is also reportedly skeptical about the benefits of introducing a retail CBDC, due to the many alternative payment systems already in existence. However, the central bank is still a partner in the cross-border focused CBDC mBridge project.

Meanwhile, in the most recent draft of the legislation being developed for the European Union's CBDC, the embrace of DLT was expanded to allow Digital Euro transactions on permissionless systems:

Conditional payments in Digital Euros may also be carried out on permissionless distributed ledgers where until now only privately issued assets like crypto-assets or stable coins are available as a means of payments. With the approval and under conditions set by the European Central Bank, the Digital Euro would be made available as a token to be referenced on these chains.

Other changes to the legislation concerned legal clarification of the CBDC holding limits, offline usage and the ECB's scope of responsibility for CBDC operations. This 'scope of responsibility' now includes the line "adopting standards in order to allow the Digital Euro to be referenced on distributed ledgers". This may potentially help to increase the share of euro-denominated stablecoins, which currently lags significantly behind that of those which are USD-pegged.

Coinbase this week proudly reported that it holds 90% of the almost $40 billion Bitcoin ETF assets under custody. Largely excluded from this business niche due to strict sector regulations, the commercial banks in the U.S. have requested that the SEC adjust its definition of crypto assets. Signed by the Bank Policy Institute, the American Bankers Association, the Financial Services Forum and the Securities Industry and Financial Markets Association, the plea points to the concentration of risk due to Coinbase's dominant position in spot bitcoin ETF custody and asks for relief from the current accounting treatment of crypto balances. In the proposed scheme, banks would not need to reserve capital for their crypto holdings and would be able to keep them off their balance sheets.

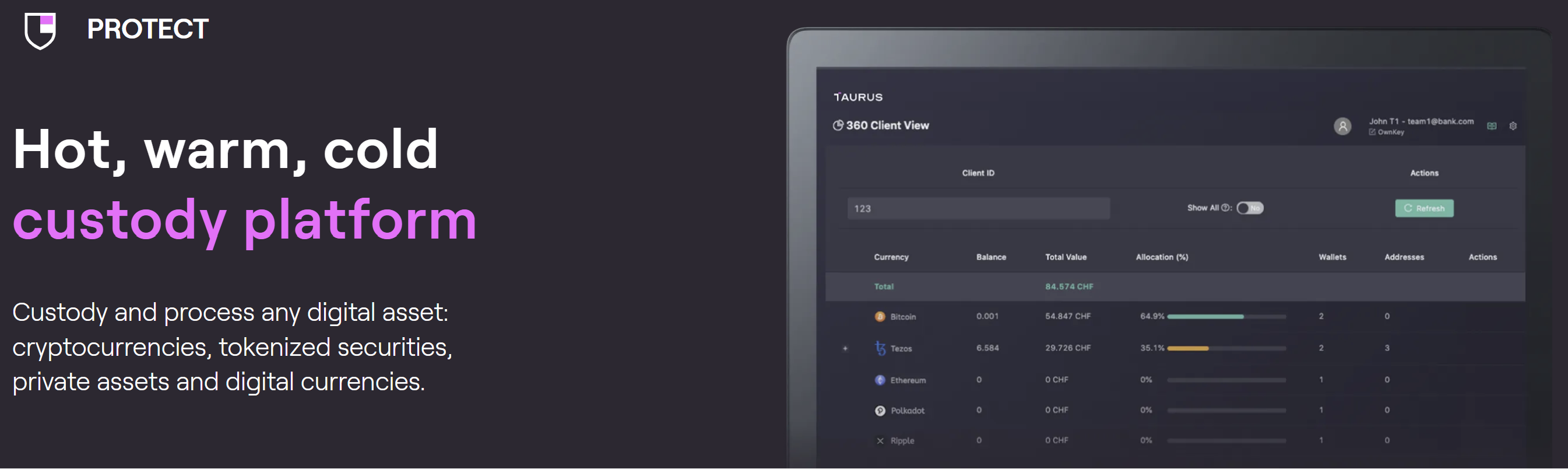

Over in Europe, digital asset firm Taurus is helping banks to enter the crypto space. Taurus partnered with Ethereum staking giant Lido to integrate Ethereum staking functionality into its Taurus-PROTECT digital asset custody software. The software is used by Swissquote, Temenos and Deutsche Bank.

And, in RWA tokenization news, Citibank reported this week that it has successfully completed a proof of concept on the tokenization of private funds in partnership with Wellington Management and WisdomTree. The bank used the testnet of the Avalanche blockchain and DTCC Digital Currency (formerly Securrency) as a tokenization service for the project.