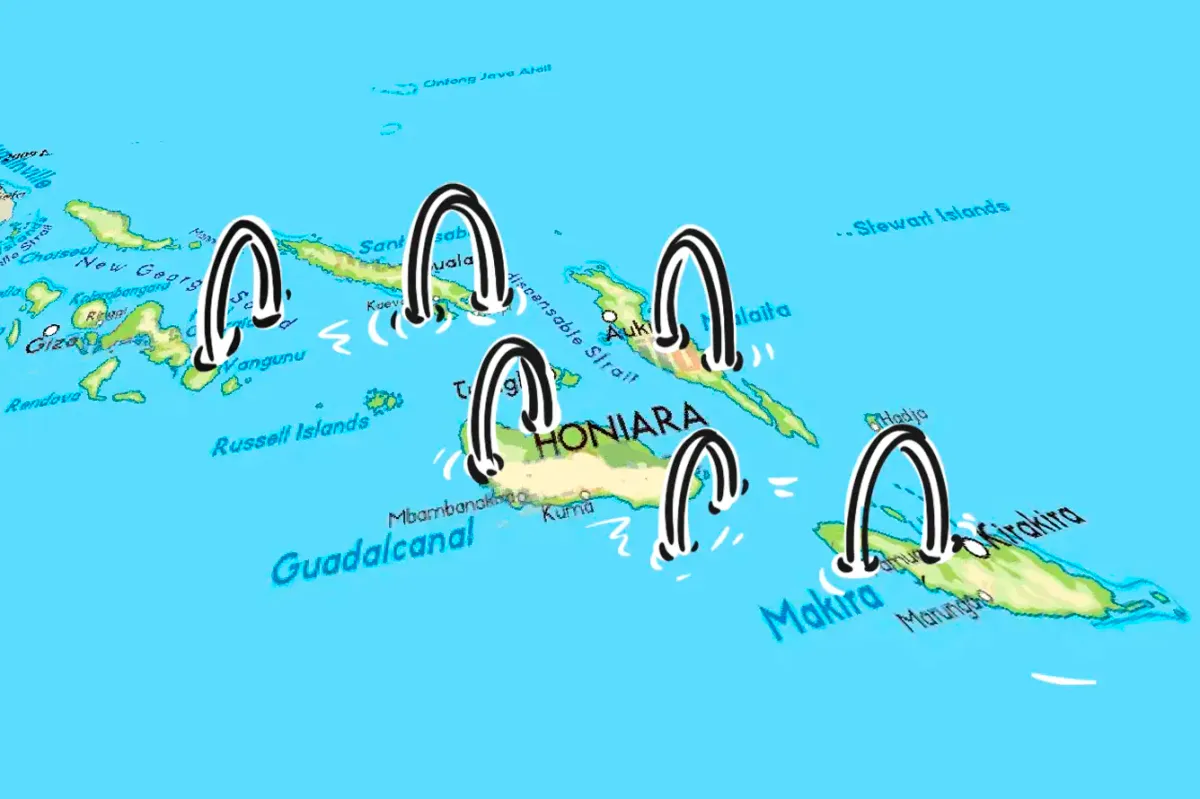

The Solomon Islands, a nation consisting of over 900 islands located around 1700km northeast of Australia, announced the launch of its Central Bank Digital Currency (CBDC) proof-of-concept project this week. The prime minister of the country, Manasseh Sogavare, addressed the official launch ceremony, calling it a ‘historic moment for the Solomon Islands’.

In his speech Sogavare described the CBDC initiative as a catalyst to include all citizens, especially those living in remote locations, in the country’s formal economy. The digital currency system, being developed in collaboration with Japanese FinTech company Soramitsu and with aid from the Government of Japan, is envisioned as a user-friendly, mobile solution, with a QR code interface and digital identity verification features.

Soramitsu is an active player in the region with similar CBDC projects in Cambodia and Laos. The company has recently announced plans to leverage its experience with local digital currency solutions to build a pan-Asian payment network.

The move by the Solomon Islands is not particularly unusual for small island development states (SIDS). The Marshall Islands, Palau, Eastern Caribbean nations and many others are also looking into the technology to solve the logistical and financial infrastructure problems inherent in their geography. In this respect, we Observe that the often-asked question, “Why launch a CBDC?” finds a solid answer, at least in some parts of the world.

The Solomon Islands has called its future digital money Bokolo Cash. Bokolo, also depicted on the Central Bank of the Solomon Islands (CBSI) logo, is a special form of unique local money, made of a clamshell, which locals use to pay for special purposes, such as bridal dowries, land, tribal reconciliation and compensation.

Bokolo Cash will be accepted at selected merchants in the capital Honiara, by the participants of the pilot project. Additionally, the CBDC will be tested in a wholesale setting, for interbank payments between the CBSI and/or commercial banks.

Soramitsu has released the preliminary technical characteristics of the proposed solution. Notably, besides the project's private blockchain, commonly used in such cases, the company also plans to test a connection with a public blockchain to facilitate cross-border remittances.

The implementation of the pilot project required legislative changes by the CBSI in the Solomon Islands. The parliament recently passed a bill that added the ‘electronic money’ definition to the existing framework as well as amended certain aspects of the central bank’s regulation to accommodate the new technology.

Whether through the necessity of their island geography or the relative lack of cumbersome legacy systems and legislation, SIDS are rapidly becoming the new flag bearers of CBDCs.