For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

CBDC Updates

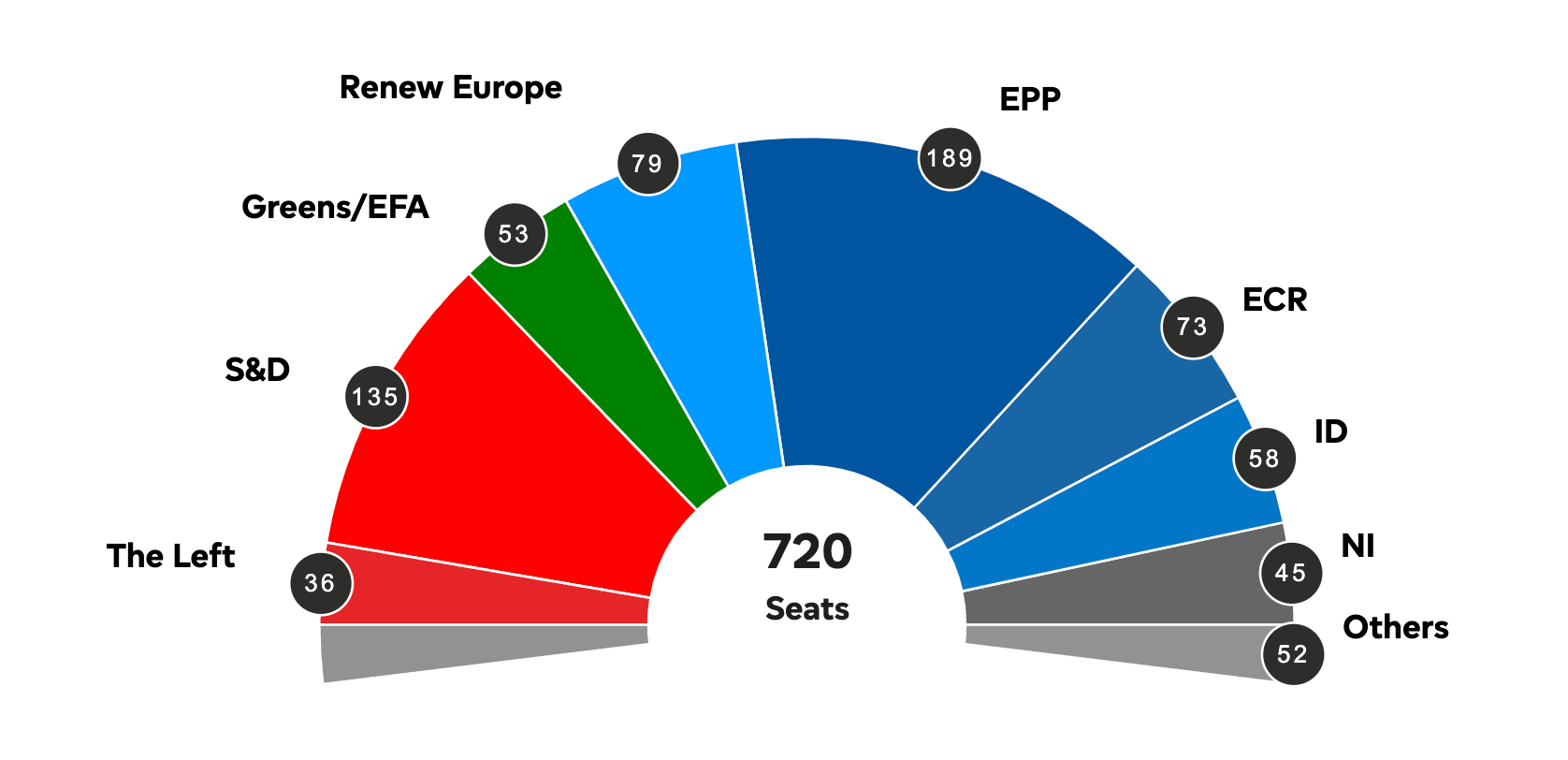

European Parliament elections have concluded — with the centrist coalition that has spearheaded development of the digital euro remaining in power. Several lawmakers who played an instrumental role in CBDC policy have been re-elected.

However, it'll be interesting to see whether a lurch to the far right in this latest poll dent enthusiasm for central bank digital currencies in Brussels. Many of this political persuasion have long railed against CBDCs — warning they could serve as tools for surveillance, erode privacy, and even used to control consumer spending.

Meanwhile, European Central Bank President Christine Lagarde has been asked about the timeline for a digital euro by reporters in Paris. When asked if a CBDC would be publicly available before her term expires in 2027, she said this will only be possible if there's an "accelerated process."

Lagarde also suggested that she has more pressing priorities, adding:

"My ultimate goal is 2% inflation. That’s what I’m obsessed with. But I also want to make sure that the ECB is fit for the future. And if the preference of Europeans follows the digital route that we observe, I think it’s really important to have some central bank money in a digital form and accessible to all those who want to use it."

Donald Trump, who has been repositioning himself as a crypto-friendly presidential candidate, spoke of his opposition to CBDCs on the campaign trail this week. Writing on Truth Social, the Republican nominee declared:

"VOTE FOR TRUMP! Bitcoin mining may be our last line of defense against a CBDC. Biden’s hatred of Bitcoin only helps China, Russia, and the Radical Communist Left. We want all the remaining Bitcoin to be MADE IN THE USA!!! It will help us be ENERGY DOMINANT!!!"

In other developments, the chair of the Financial Markets Committee in Russia's State Duma has predicted that countries will widely pay each other using CBDCs soon — a hint that they could be used for de-dollarization. Anatoly Aksakov said cross-border transactions using the digital ruble could commence in the second half of 2025, adding:

"Fundamentally, there are few countries that have made serious progress in using national digital currencies. This is why technologically they are simply not ready to launch a digital currency in mutual settlements with other countries. However, I am confident that it will be common practice within five years."

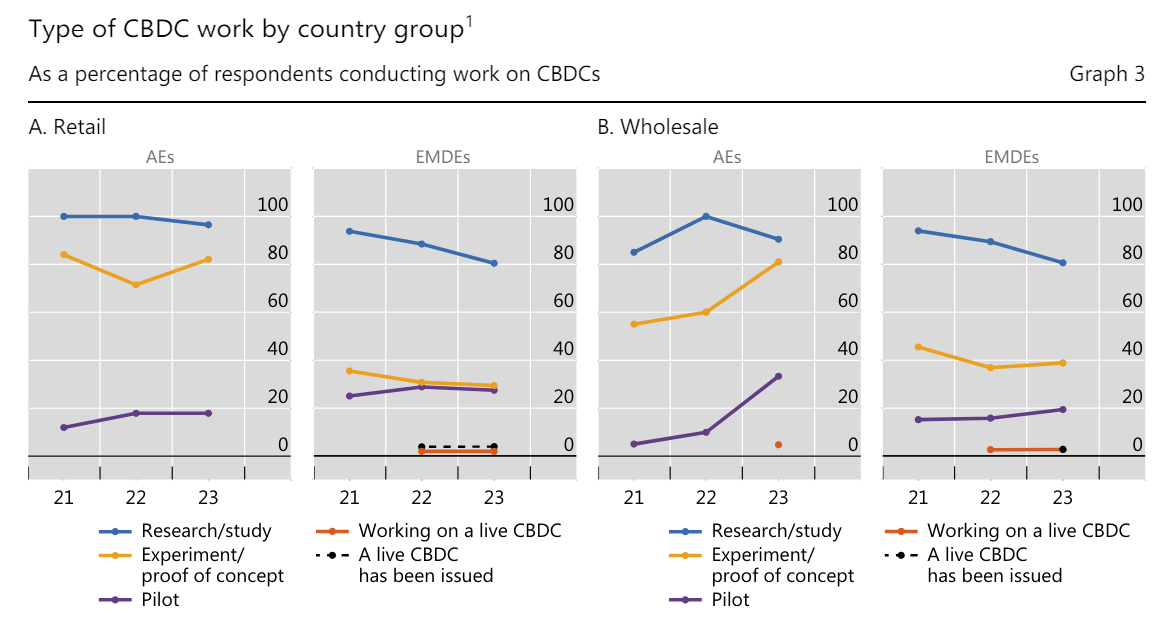

The Bank of International Settlements (BIS) published the results of its seventh annual survey of CBDC developments around the world. According to it, in 2023 the central banks were advancing more on the wholesale CBDC scene, as measured by the number of pilot projects launched, while the retail CBDC plans were pushed to the right. The trend is particularly visible in the countries that BIS has classified as Advanced Economies (AE):

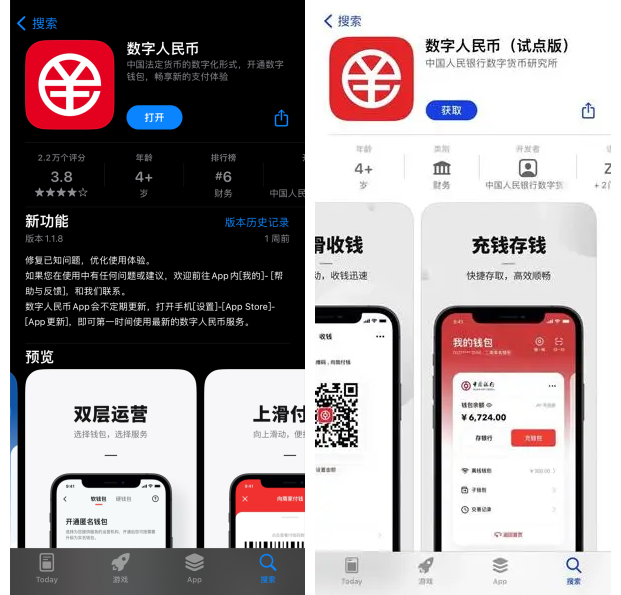

Standing out of the trends is China where the words 'pilot version' were removed from e-CNY retail CBDC application title. The update gave place for speculations that the project had entered into full production mode.

Several commercial banks in China have also reportedly responded to the call to make use of the recently launched cross-border MVP of the mBridge project.

Tokenization Updates

Fidelity International has announced that it has tokenized a money market fund on JPMorgan's Onyx blockchain. The company believes this could help drive down transaction fees, and offer a plethora of other benefits to its clients.

The Swiss crypto-financial services provider Bitcoin Suisse has chosen a local Obligate platform for its first tokenized bond issuance. The parties have not disclosed any details about the size of the issuance but communicated that the raised funds will be used for the growth of Bitcoin Suisse’s domestic lending business. According to the Bitcoin Suisse website, the firm has surpassed CHF 5 billion in digital assets under its custody.

The word 'tokenization' can also be used in the context of securing access via sending a secure token, such as the links mailed for the recovery of passwords.

A recent announcement from Mastercard used the tokenization plans in this context. The payment processing giant has set an ambition for 100% e-commerce tokenization in Europe by the end of the decade. The payment processing giant is hoping to phase out manual card entry online, improving safety in the process.

The company pointed to research that suggests online payment fraud will surge beyond $91 billion in just four years' time, and secure tokens could replace the long number on payment cards. It's chosen Europe because of its track record in embracing innovative payment solutions.