Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian

From Polymarket’s stripped-down design to Kalshi’s regulatory breakthrough, prediction markets are turning collective opinion into a financial asset class — and a new battleground over who defines truth

Alex Harutunian

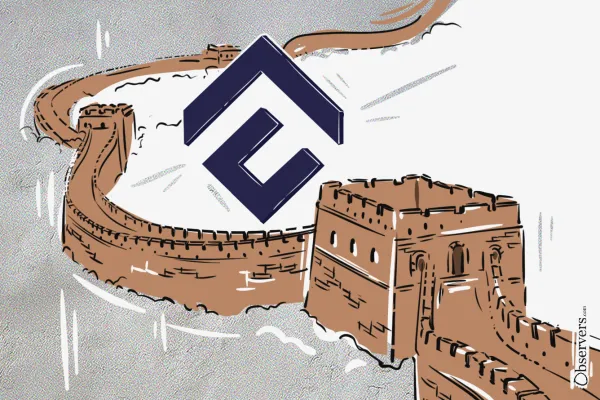

While crypto remains banned, China’s state-backed blockchain ecosystem — led by Conflux — is expanding across Asia and into global finance. Conflux Network bridges China’s academic research, state strategy, and open blockchain innovation.

Alex Harutunian

DeFi is moving from standalone apps into the backend of exchanges, with Coinbase and Crypto.com leading by embedding Morpho’s lending vaults. This “embedded DeFi” model raises a key question: are exchanges becoming banks, or just UIs? The answer will define DeFi’s role in future banking.

Alex Harutunian

After years of development, blockchain games still capture only a sliver of the gaming industry. The promise of true asset ownership, stable economies, and transferability remains unmet. Recent trends suggest blockchain was more hype feature than genuine necessity

Alex Harutunian

Triggered by a routine macro shock, crypto once again unraveled faster than any other market. Not because of sentiment alone, but because CEX risk engines, DEX liquidation incentives, and always-on leverage turn small moves into cascading stress.

Alex Harutunian07.01.2026 US Senate Banking and Commerce committees to work on comprehensive crypto legislation this month. 07.01.2026 Polymarket to supply its market data and indicators to Barron’s, The Wall Street Journal, and other Dow Jones publications. 07.01.2026 Chen Zhi, founder and chairman of Prince

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

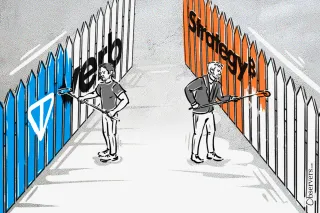

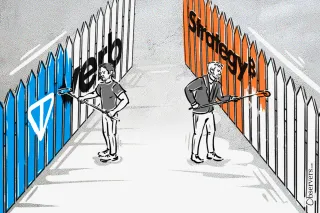

TON Strategy Company, formerly Verb Technology, has rebranded as a Toncoin treasury, holding $713M in TON and targeting over 5% of supply. By staking its holdings and adopting financial engineering akin to Strategy’s playbook, it aims to turn crypto reserves into shareholder returns

From $GOAT to $FART, memecoins show how hype burns fast and budgets vanish faster. Market caps in the tens of millions may look like real businesses, but behind the joke lies sunk marketing spend, fragile communities, and the math of attention that always runs out of breath

Seven Japanese mayors were awarded with NFTs for utilising digital technology to solve local issues as well as fostering the digital…

Alex Harutunian

Binance announced that from September 29, USDC, USDP and TUSD stablecoins balances on their platform will be automatically converted into…

Alex Harutunian

Venture capital company Andreessen Horowitz (a16z) recently introduced a series of “Can’t Be Evil” licences that let creators grant NFT…

Observers

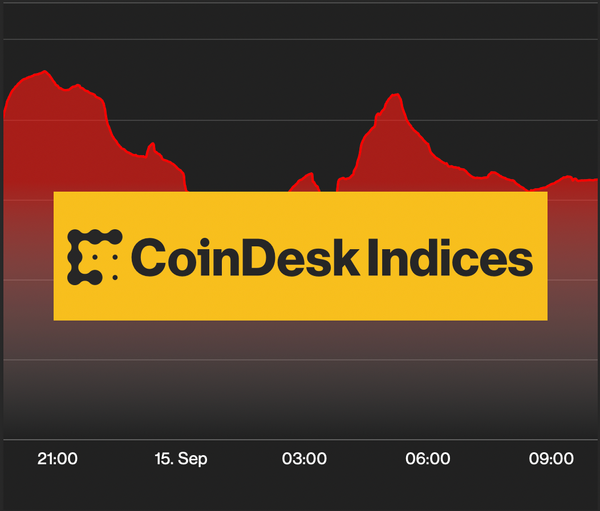

CoinDesk published a new market index based on the company’s classification standard DACS. The index is to become an analogue of S&P500 in the crypto industry.

Sasha MarkevichChainalysis, a crypto analytics company, announced in a blog post on September 8 that it has helped the US government recover around $30 million stolen from a play-to-earn crypto game Axie Infinity earlier this year. Erin Plante, senior director of investigations at Chainalysis, said in the post that this event

Observers

This year has been a wash with bear crypto market cautions and alerts, with prices of the most popular cryptocurrencies crashing dramatically. However, the Crypto market is not just about the price of Bitcoin, there are way more significant events to monitor.

Observers

The Bybit crypto exchange has entered into cooperation with the Circle Internet Financial company, which owns the USDC stablecoin. The…

Observers

In February 2022, Apple introduced the Tap to Pay feature, which allows you to use the iPhone as a payment terminal, also it can be used to…

Observers07.01.2026 US Senate Banking and Commerce committees to work on comprehensive crypto legislation this month. 07.01.2026 Polymarket to supply its market data and indicators to Barron’s, The Wall Street Journal, and other Dow Jones publications. 07.01.2026 Chen Zhi, founder and chairman of Prince

01.01.2026 EU crypto tax transparency directive DAC8 takes effect, requiring crypto-asset service providers to report user data to national tax authorities. 01.01.2026 MiCA comes into force in Spain. 31.12.2025 Ethereum smart contract deployments hit a record high in Q4. 2026 OUTLOOK Haseeb Qureshi (Dragonfly

Balancer Protocol was exploited through a tiny rounding bug in its code. As losses neared $100 million, projects froze pools, rolled back blockchains, and clawed back funds—revealing the centralized and still untamed side of decentralized finance

01.12.2025 Telegram’s Pavel Durov announces Cocoon, a decentralized confidential AI compute network. 01.12.2025 SushiSwap CEO steps down as Synthesis invests $3.3M in the struggling DEX. 01.12.2025 Grayscale to launch the first Chainlink ETF in the US. 01.12.2025 Germany and Switzerland

29.10.25 Ondo Finance launches Ondo Global Markets on BNB Chain. 29.10.25 Ethereum Foundation launches portal to guide institutional adoption. 29.10.25 Securitize goes public via SPAC merger with Cantor Fitzgerald’s CF Acquisition Corp VIII. 28.10.25 Trump Media & Technology Group to launch

Kazakhstan launched a state-backed crypto reserve, Alem Crypto Fund, partnering with Binance Kazakhstan and starting with an investment in $BNB. SWIFT is building a blockchain ledger with 30+ banks using Consensys. Polish lawmakers passed a Crypto-Asset Market Act, aligning rules with the EU’s MiCAR. Vitalik Buterin opposes EU’s

Uniswap’s Unichain has boosted L2 volumes past $40B, but liquidity tells a different story. TVL has halved since July, exposing the limits of incentive-driven growth. Despite cheaper fees, users remain on Ethereum—where Uniswap continues to be one of the network’s largest revenue engines.

TON Strategy Company, formerly Verb Technology, has rebranded as a Toncoin treasury, holding $713M in TON and targeting over 5% of supply. By staking its holdings and adopting financial engineering akin to Strategy’s playbook, it aims to turn crypto reserves into shareholder returns