The Bank for International Settlements Innovation Hub Hong Kong Centre and the Hong Kong Monetary Authority cooperated to create a two-tier CBDC system that mirrors the current Hong Kong currency system and features unusual CBDC-backed stablecoins.

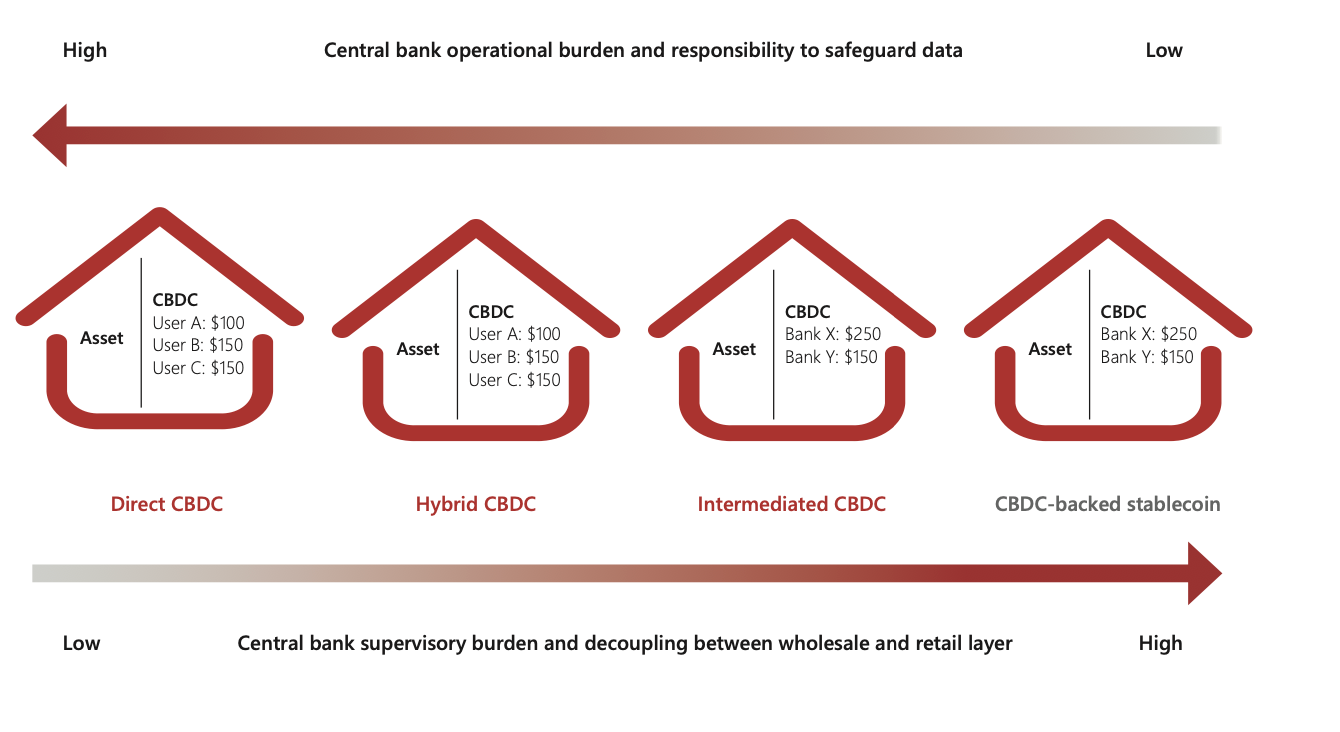

The task of the project was to “bring to life two very different types of retail tokens: intermediated CBDC, also referred to herein as CBDC-tokens, and CBDC-backed stablecoins, or in short, stablecoins through the creation of a technology stack comprised of:

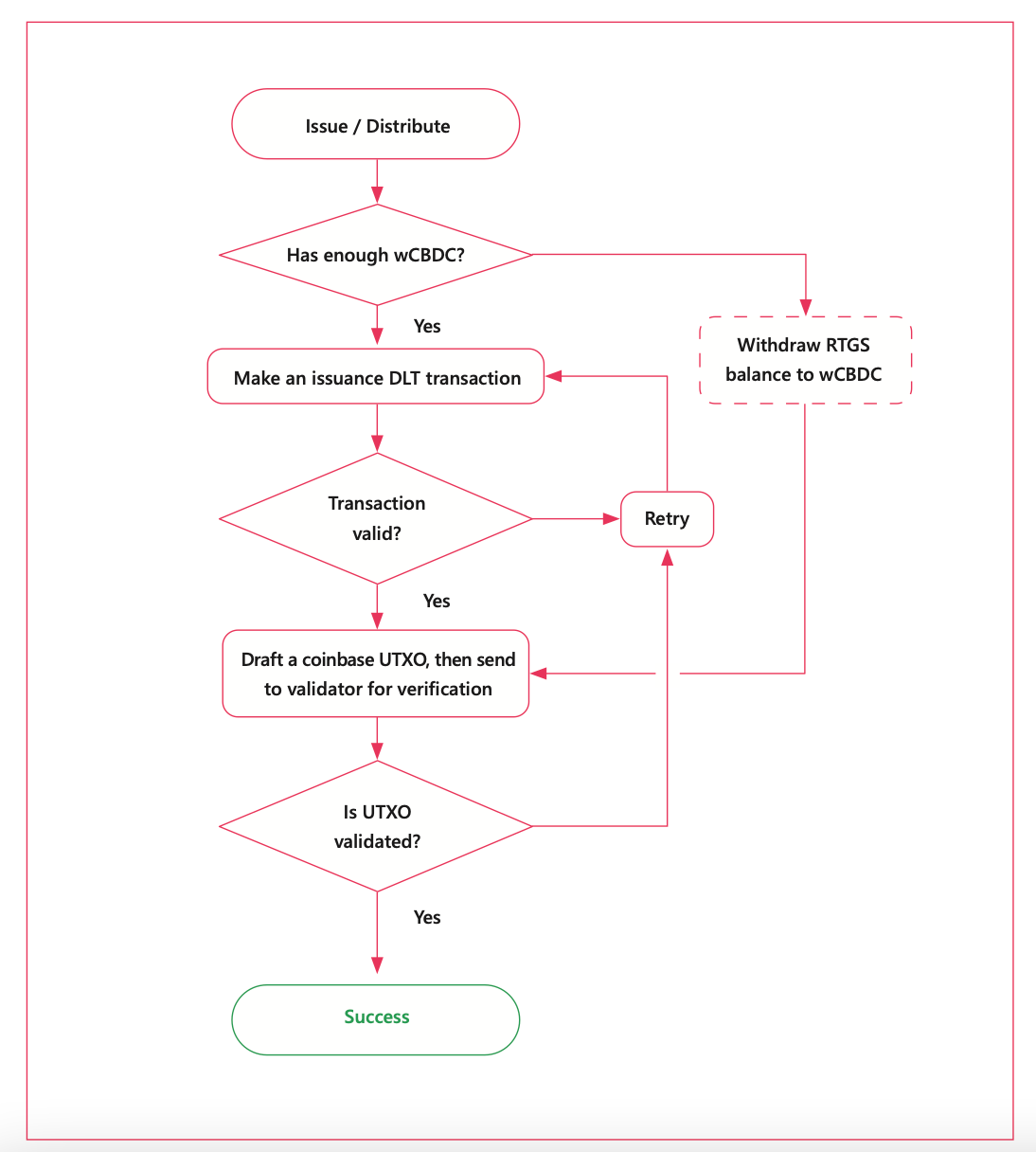

- a wholesale interbank system in which the wholesale CBDC (wCBDC) is issued to banks for onward distribution to retail users, and

- a retail e-wallet system in which the retail CBDC (rCBDC) circulates among retail users”.

The CBDC-backed stablecoins are supposed to reflect Hong Kong’s existing currency system, in which bank notes are issued by three financial institutions and backed by the central bank.

Do not confuse:

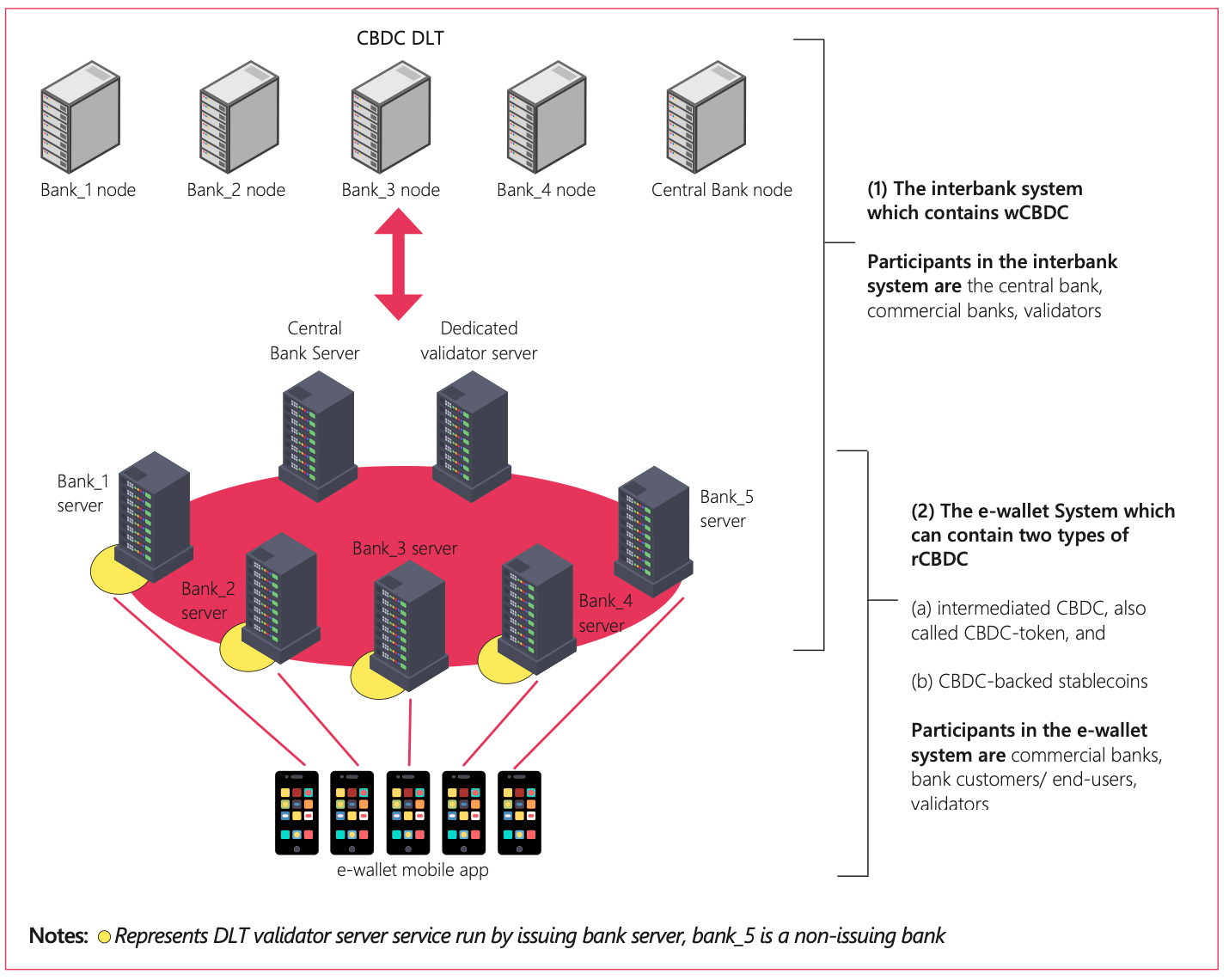

- CBDC-backed stablecoin: one of the two types of digital currency in the retail e-wallet system. It is issued by an issuing bank and is thus a liability of the issuing bank.

- CBDC-token: one of the two types of digital currency in retail e-wallet system. Banks obtain CBDC-tokens from the interbank system through a process called CBDC-token distribution. The CBDC-token is a liability of the central bank.

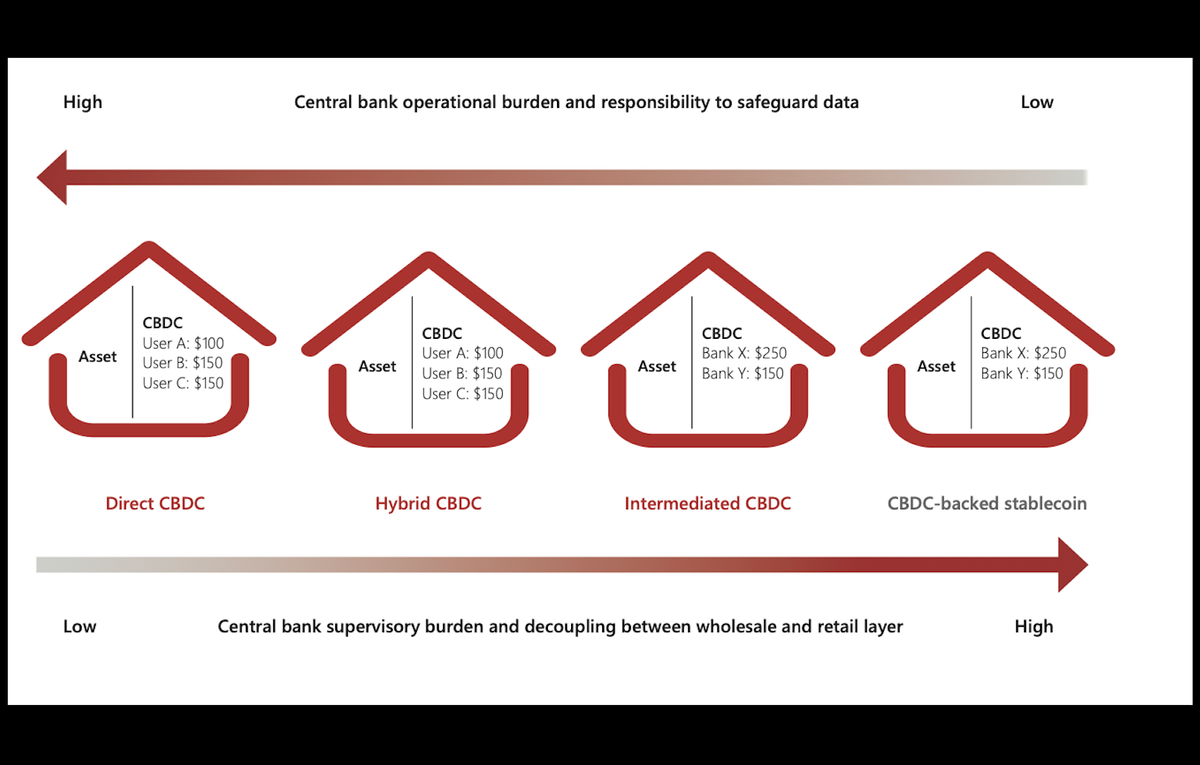

Comparing with direct CBDCs, intermediated CBDCs and CBDC-backed stablecoins lower Central Bank operational burden and shift its role to supervision:

Here’s the result: Aurum, a full-stack (front-end and back-end) CBDC system, comprising of a wholesale interbank system and a retail e-wallet system. The e-wallet is hosted by a local bank and has a smartphone interface for the end-users.

Each commercial bank in the system can be a validator for other banks and owns the following accounts:

- A RTGS account (real time gross settlement) that is managed by the central bank.

- A wCBDC account (wholesale CBDC) in the interbank system that is managed through DLT.

- An e-wallet account. A bank may receive stablecoins issued by other banks. It may also receive CBDC-tokens. Hence, it will create its own e-wallet account to store these assets.

This picture should make clear the relationships between different types of assets and three participants of the system(Central Bank, Banks, End-Users):

When a bank requests the issuance of rCBDC (retail CBDC) from the interbank system, the smart contract will transfer an equivalent amount of wCBDC from the bank’s wCBDC account to the custodian account to serve as the backing asset. The reverse is released when the bank requests redemption of the rCBDC - it happens when the end-user exchanges his rCBDC back to his savings account.

A validator system prevents bank over-issuance and user double redemption.

All in all, the system seems to be thoroughly researched and well-crafted, but let’s observe if the prototype becomes a real-world project and proves its viability and feasibility.

You can download the full BIS report or watch the video presentation to study the system in greater detail.