Latest Articles

112 Articles

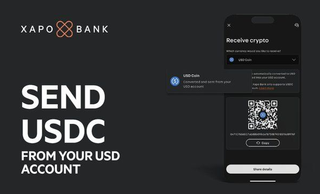

The move makes Gibraltar-based Xapo the first fully licensed bank in the world to offer USDC on-and off-ramps as a fast, free, 24/7 alternative to the expensive and slow SWIFT system used for international payments.

The WSJ released a report earlier in March accusing Tether of shady dealings, citing emails and records from 2018. In response to the WSJ's allegations, Tether published an official statement on their website.

Binance continues to get rid of BUSD by converting its own stablecoin into other crypto assets in the Industry Recovery Initiative and the SAFU funds.

Alex Harutunian

Binance continues to get rid of BUSD by converting its own stablecoin into other crypto assets in the Industry Recovery Initiative and the SAFU funds.

Alex Harutunian

The move makes Gibraltar-based Xapo the first fully licensed bank in the world to offer USDC on-and off-ramps as a fast, free, 24/7 alternative to the expensive and slow SWIFT system used for international payments.

Jack Martin

The WSJ released a report earlier in March accusing Tether of shady dealings, citing emails and records from 2018. In response to the WSJ's allegations, Tether published an official statement on their website.

Alex Harutunian

USDC depeged from USD after US Silicon Valley Bank collapsed. Exchanges paused their conversion as users rushed into other assets. Now the stablecoin has got back to 1:1 ration, but what’s done is done…

Sasha Markevich

After Saturday saw the value of the USDC fall, trust in the stablecoin Tether (USDT) increased, driving its growth.

Alex Harutunian

The Wall Street Journal accuses Tether of shady transactions and forgery of documents, referring to emails made available to journalists. Tether refutes the information.

Alex Harutunian

The collapse of Silicon Valley Bank (SVB) affected, among others, the USDC’s reserves and this “blue-chip” stablecoin has lost its peg to the dollar. Ironically, the only decentralized unicorn stablecoin project, MakerDAO is now in trouble due to its “reinforcing” USDC-backed component.

Alex Harutunian

The European Union's upcoming MiCA Regulation is set to impose strict requirements on stablecoins, and issuers will be required to meet a range of criteria to ensure compliance. MiCA has two categories for stablecoins, so close in their definitions, that distinctions are difficult to spot.

Mathieu Legrand