BIS devoted one third of its 2022 Annual Economic Report to the discussion of the Future Monetary System. In their vision, Central Banks will have the core role, adopting innovations of DLT, leading and supervising the ecosystem of banks, PSP and other participants.

It is not the first time BIS is talking about the future of the monetary system in a technological context. Since 2017 such talks necessarily have involved the overview of the crypto field. With developments in crypto and related tools, this overview has been getting larger and deeper, but nevertheless BIS has always been sceptical.

The current review was no different. The description of the main developments and innovations is coupled with theoretical and practical explanations of connected pitfalls.

Fragmentation and search for an anchor. BIS researchers point to the current challenges of Distributed Ledger Technology (DLT) such as fragmentation and stablecoins. For the former, an interesting point is raised that the reason for the blockchain dilemma is not purely technical, but also has its roots in the concept of incentives for the decentralized network of participants: the larger the funds that this network services, the more incentives are required to align the interests of the participants. For stablecoins, the report concludes that their growth is connected with the “search for an anchor” in the cryptocurrency segment that is the fundamental need for any monetary system.

Speculative utility and fraud. The overview also touched upon the older problems of cryptocurrency being a dominant speculative utility with fraudulent participants. The recent studies showed strong correlation between the increase of Bitcoin price and inflow of new users to the trading platforms. Regulatory arbitrage allowed some of the participants in DeFi markets to perform activities not covered with appropriate risk safeguards.

Spill overs and new intermediaries from growth. As the market cap of crypto grows and many legacy institutions get involved in crypto activities, there is a risk of spillover of possible crypto crunches into other areas of the financial markets. Also, there are observable centralization and dominance of large technical and financial intermediaries in certain areas of decentralized products such as staking pools, hosting service providers and reserve providers.

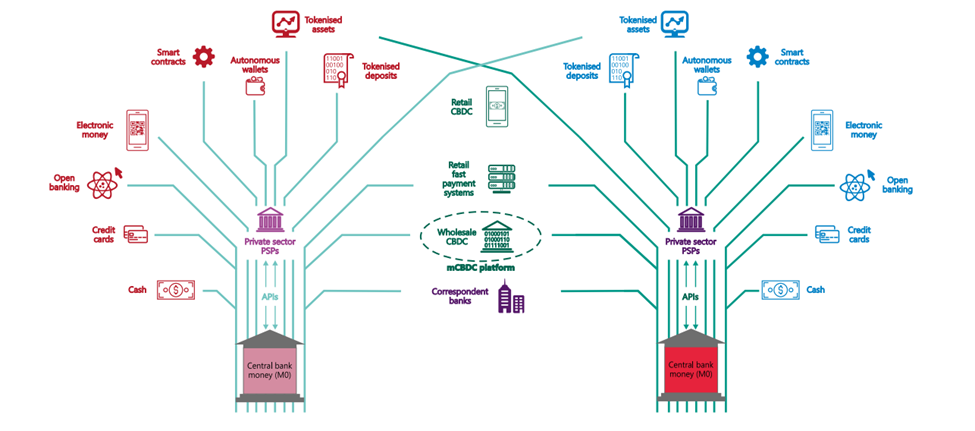

So, after all this what is the vision of BIS for the Future Monetary Systems? Only one answer: central banks -- everything is constructed around the central banks as in the images below:

The central banks will be the foundation and all customer facing activities are delegated to the private sector. The connection between the central banks and the private sectors is through API (application to application connection). BIS envisages that CBDC will utilize the innovative features of DLT such as programmability of money, composability [lego type] and tokenization. The declared functionality for retail CBDC is: 24/7 real time payment and inclusive design. The “wholesale” CBDC and multi-CBDC (mCBDC) platforms, the instruments for cross border and inter central bank settlements will use smart contracts but will be permissioned.

There are still unresolved technical issues in CBDC such as the “tension between the payment integrity and transactional privacy”. Even in the closed, permissioned systems the users are able to see beyond their transaction – so called “backchain” problem. The research into problems is done in a “zero-knowledge” (ZK) proof direction. In permissionless DLT systems the privacy solutions are available through specialized mixers.

According to the report, globally a full 90% of central banks recently surveyed are doing some form of work on wholesale or retail CBDCs. A number of wholesale CBDC pilots are under way, often involving several central banks in different jurisdictions. There are three live retail CBDCs and a full 28 pilots. This includes the large-scale pilot by the People’s Bank of China, which now counts 261 million users. Over 60 countries are now working on retail fast payment systems (FPS), including Cambogia Bakong, and US FedNow. The BIS Innovation Hub is developing mCBDC platforms in partnerships with member central banks. These are Project Jura (with the central banks of Switzerland and France), Project Dunbar (with Singapore, Malaysia, Australia and South Africa), and mBridge (with Hong Kong, SAR, Thailand, China and the United Arab Emirates).

“Innovation must start from an understanding of the concrete needs of households and businesses in the real economy – and of the policy demands they put on a monetary system”, concluded the authors of the report. How these needs are assessed and whether they will be addressed in the design of the future monetary system is the subject of our future observations.