Latest Articles

270 Articles

Stablecoins are digital assets that are referencing (pegged to) other assets, usually fiat currencies such as U.S. dollar and euro

Stablecoins are digital assets that are referencing (pegged to) other assets, usually fiat currencies such as U.S. dollar and euro

The legal representative of Do Kwon is trying to appeal the decision of the Court in Montenegro and the issue of extradition of Kwon from Montenegro is also being resolved. South Korea is once again launching a prosecution against a former Terra employee, Daniel Shin.

Users of the platform Bit2Me can make transactions with Tether Gold (XAUT) and Euro Tether (EURT).

Circle's partnership with cryptocurrency start-up Noble will bring the USDC natively to the Cosmos ecosystem.

Alex Harutunian

Circle's partnership with cryptocurrency start-up Noble will bring the USDC natively to the Cosmos ecosystem.

Alex Harutunian

The legal representative of Do Kwon is trying to appeal the decision of the Court in Montenegro and the issue of extradition of Kwon from Montenegro is also being resolved. South Korea is once again launching a prosecution against a former Terra employee, Daniel Shin.

Alex Harutunian

Users of the platform Bit2Me can make transactions with Tether Gold (XAUT) and Euro Tether (EURT).

Alex Harutunian

Arthur Hayes, the co-founder and former CEO of crypto exchange BitMEX, criticized both custodian and decentralized stablecoins and proposed a new stablecoin called the Satoshi Nakamoto Dollar, or NakaDollar (NUSD). Unlike existing stablecoins, NUSD would be supported only by Bitcoin.

Alex Harutunian

Datachain, Mitsubishi UFJ Trust and Banking Corporation, and Soramitsu announced a technology alliance to enable smooth transfer and exchange of stablecoins to be issued in Japan.

Alex Harutunian

In a new report, Moody's analyzed the impact of the traditional banking system on stablecoins, as well as the possible tightening of regulation against the background of the recent banking crisis.

Alex Harutunian

The well-known messaging app Telegram has added the functionality for users to buy, store, and send Tether (USDT), the world's largest stablecoin.

Alex Harutunian

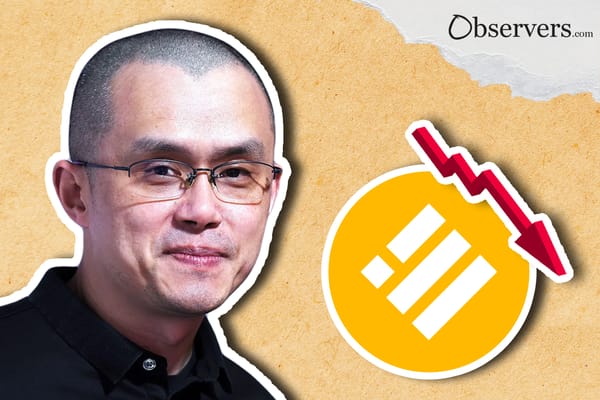

Binance continues to get rid of BUSD by converting its own stablecoin into other crypto assets in the Industry Recovery Initiative and the SAFU funds.

Alex Harutunian