After the bankruptcy of Silicon Valley Bank, which had a profound impact on the USDC and the stablecoin market in general, Moody's rating agency analyzed the connection between stablecoins with traditional banks and compiled its report. The report clearly shows two main results. The first is that the problems of traditional finance can lead to the withdrawal of the largest stablecoins, the second is that against the background of the USDC's depeg, it is possible to strengthen control by regulators. Let's look into this in more detail.

In the past, when the relationship of cryptocurrencies with traditional finance was considered, the risks associated with the influence of cryptography on the traditional economy were assessed. Recently, when the bankruptcy of banks caused a crisis in the stablecoin market, this made us think about the opposite effect. In their report, Moody's stressed that the impact on the stability of traditional finance and cryptocurrencies can be affected both ways.

«Traditional finance problems cause leading stablecoins to lose their peg Although market participants have historically been concerned about the possibility of crypto finance affecting the real economy, the failure of Silicon Valley Bank shows that risks from traditional finance can also spill over to the crypto industry,» - the report says.

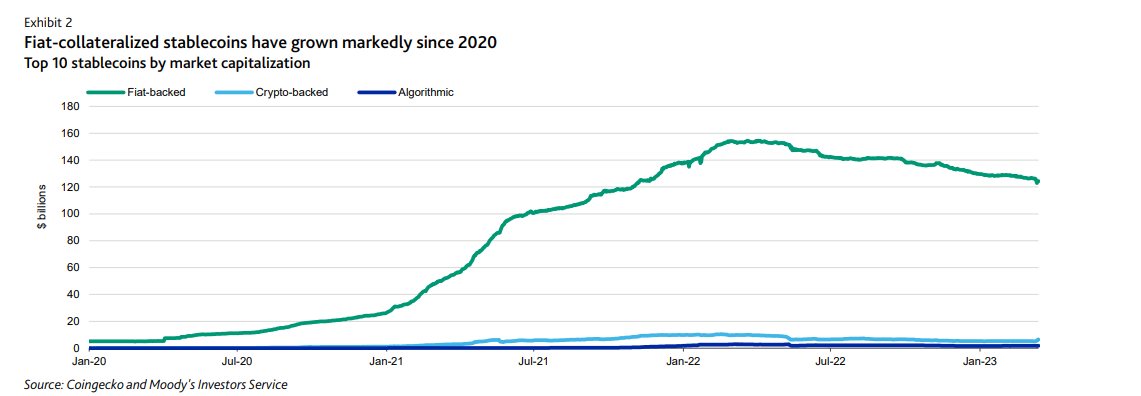

According to Moody's, the fall of banks showed that stablecoins backed by fiat currency are not as stable as they were previously thought. Despite this, Moody's noted that stablecoins performed well during the collapse of the FTX exchange and their total market capitalization has been going up of late.

“Vulnerabilities will hinder fiat-backed stablecoins' growth, could prompt more regulation Until now, large fiat-backed stablecoins had shown remarkable resilience, having emerged unscathed from past scandals such as the collapse of FTX. Their total market capitalization has increased significantly in recent years… However, recent events have shown that the reliance of stablecoin issuers on a relatively small set of off-chain financial institutions limits their stability.”

Moody's experts also analyzed how this crisis situation may affect regulation. If during the fall of Terra, regulatory authorities turned their attention to the reserves of stablecoins and called for transparency in this matter, then the loss of the USDC binding opens up a new problem - these reserves need to be competently diversified so as not to experience major difficulties with the negative influence of the custodians.

“The Silicon Valley Bank and Signature Bank failures could trigger additional requirements, notably on counterparty diversification. Financial institutions may reconsider adopting stablecoins to settle agreements involving tokenized securities out of concern over the coins' potential volatility,”- the report says.

Thus, the recent crisis has once again shown that the digital and financial economies are closely linked and have a strong influence on each other. Also, this situation has shown that different types of crypto assets can open up new problems for regulators. We will continue our observations of the world of stablecoins and inform you about the news.