On April 16, the non-profit organization Democracy Forward filed an amicus curiae brief on behalf of law experts Todd Phillips and Beau J. Baumann in support of the U.S. Securities and Exchange Commission (SEC) in its battle against cryptocurrency exchange Kraken.

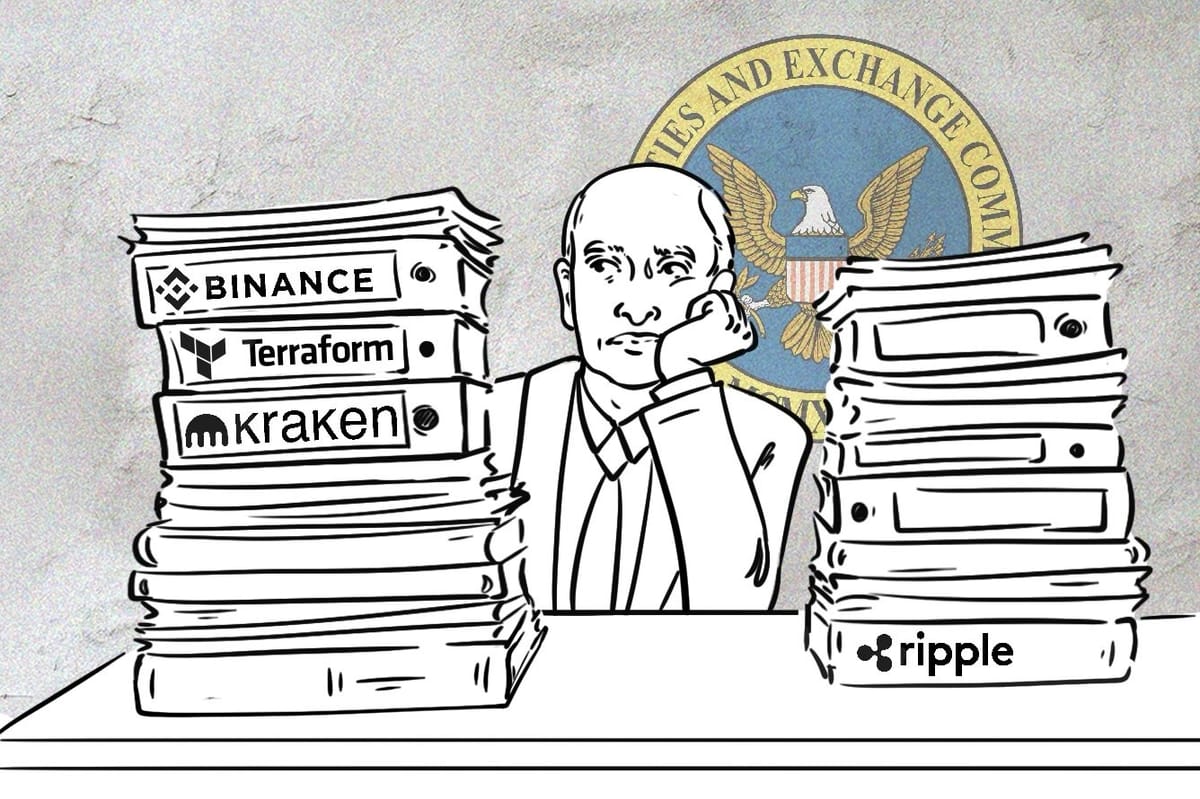

The SEC filed a lawsuit against Payward Inc. and Payward Ventures, collectively known as Kraken, in November 2023. The SEC alleges that Kraken operates as an unregistered securities exchange, broker, and clearinghouse. The SEC argues that Kraken facilitates the trading of unregistered securities in the form of certain cryptocurrencies and that it mixes customer and company funds.

Kraken denies these claims, saying that the traded assets are not securities but commodities and that the SEC is overstepping its authority. Kraken also pointed out that it had already settled charges related to a staking service earlier in 2023 and that the current lawsuit does not allege fraud or customer harm.

Kraken warns of SEC overreach

Kraken filed a motion to dismiss the lawsuit on February 22, arguing that the Major Questions Doctrine (MQD) provides grounds for dismissal of the case. Kraken asked the court to apply the doctrine, an unprecedented event that would revolutionize the future of crypto regulation.

Kraken’s argument hinges on this principle, asserting that the SEC’s action is both extraordinary in scope and lacks the requisite clear congressional backing.

"The SEC should not be permitted to expand its own jurisdiction; that is Congress’ decision."

Various other crypto exchanges, such as Coinbase, Binance, and Ripple, have invoked the MQD in their own legal defense against the regulator. Coinbase's efforts to apply the doctrine were stopped last month when a judge ruled in favor of the SEC, therefore dismissing their MQD defense.

Kraken argues that allowing the SEC's actions to continue could establish a "dangerous precedent" and enable regulatory agencies to assume broad enforcement powers over emerging technologies and economic sectors. This would potentially disrupt the established balance of power between Congress and the regulatory agencies, which, according to Kraken, could undermine the foundational principles of democratic governance.

On February 27, eleven attorneys general from various U.S. states filed an amicus brief in support of Kraken, alleging that the SEC is acting beyond its regulatory authority.

"Whether dubbed 'the major questions doctrine' or basic preservation of the separation of powers, Congress has not conferred on the SEC wholesale regulatory power over this industry, and accepting the SEC’s theory encroaches on Congress’s legislative role. This agency action should therefore be treated with skepticism."

Do the SEC's actions trigger the MQD?

The recent amicus brief argues the doctrine should not apply to the SEC's actions against Kraken:

"For nearly a century, the SEC has regulated the national securities markets... The relative novelty of the investment asset does not make the SEC’s use of its longstanding authority 'unheralded' or 'transformative,' such as would trigger the major questions doctrine."

The brief argues that the MQD is only triggered in extraordinary cases involving significant assertions of agency authority that lack clear congressional authorization. It emphasizes that the MQD aims to preserve Congressional intent and the separation of powers, suggesting that its application should be limited and clearly justified.

"The SEC’s enforcement action is neither 'extraordinary' nor 'economically significant.'... It is simply a continuation of the SEC’s gradual process of clarifying the application of the securities laws through incremental enforcement actions—a process it has applied to address potential new securities since its creation in 1934."

The use of existing judicial standards (like the Howey test) to assess new financial products ensures that the SEC is working within its established legal boundaries, making the MQD irrelevant in this context.

The brief counters the claim that the lawsuit is of major economic or political significance, which would necessitate the application of the MQD. It argues that the SEC’s regular enforcement activities do not equate to a major economic impact that would trigger the MQD, as these actions are typical of the regulator's historical regulatory functions.

The article "Another Way to Rebut Major Questions Arguments" by Phillips and Baumann, published in the Yale Journal on Regulation on March 30, offers insights into how agencies can address challenges posed by the MQD when implementing new regulations. Instead of focusing solely on how rules are created, they suggest a strategy for handling MQD during litigation. They argue that the doctrine should mainly apply to significant, legislative-like agency actions that bind the public or specific industries.

The SEC has been proactive in regulating crypto assets through the Howey test to determine whether they qualify as securities. Despite challenges under the MQD, recent court rulings, like the Coinbase case, have favored the SEC, highlighting that its enforcement actions are routine applications of existing laws rather than transformative new rules.

The article emphasizes that court-based enforcement actions (like those taken by the SEC) fundamentally differ from legislative actions. Enforcement actions apply existing laws and do not create new legal standards, thus they should not trigger the MQD concerns about agencies overreaching their authority.

Phillips and Baumann argue that the very nature of judicial enforcement actions, which involve applying the law to specific cases, supports the idea that these actions should not be subject to the MQD. This is because they do not extend agency jurisdiction but rather involve courts determining the scope of the law.

What next?

It is not over for Kraken yet. Its defense against the SEC is particularly interesting because it not only contests the legal basis of the allegations but also claims that the lawsuit was a retaliatory act by a "politically compromised agency."

Kraken claims the SEC's actions are in retaliation for the exchange's public criticisms of the agency's regulatory approaches, especially its handling of the burgeoning crypto sector. This argument of "political retaliation" stems from the timing of the SEC's legal actions, which closely followed public testimony given by Kraken’s Chief Legal Officer, Marco Santori, before Congress. In this testimony, Santori critiqued what he perceived to be the SEC's overreach in the crypto industry.

The upcoming court decision will determine the SEC's level of authority in regulating the crypto space. A win for the SEC could set a precedent for stricter oversight across the industry, while a Kraken victory, especially one based on the MQD, could limit the regulator's reach and pave the way for clearer congressional involvement.

Timeline of the Case

- November 20, 2023: The SEC files a lawsuit against Kraken, charging the crypto exchange with operating as an unregistered securities exchange, broker, dealer, and clearing agency.

- February 22, 2024: Kraken files a motion to dismiss and invokes the major questions doctrine.

- February 27, 2024: 11 attorneys general file an amicus brief in support of Kraken, arguing that the SEC exceeds its regulatory authority.

Observing moneytech and cryptoMathilde Adam

Observing moneytech and cryptoMathilde Adam

- April 9, 2024: The SEC files its opposition to the dismissal motion.

- April 16, 2024: Law experts file an amicus brief filing alleging that the major questions doctrine does not apply to the SEC.