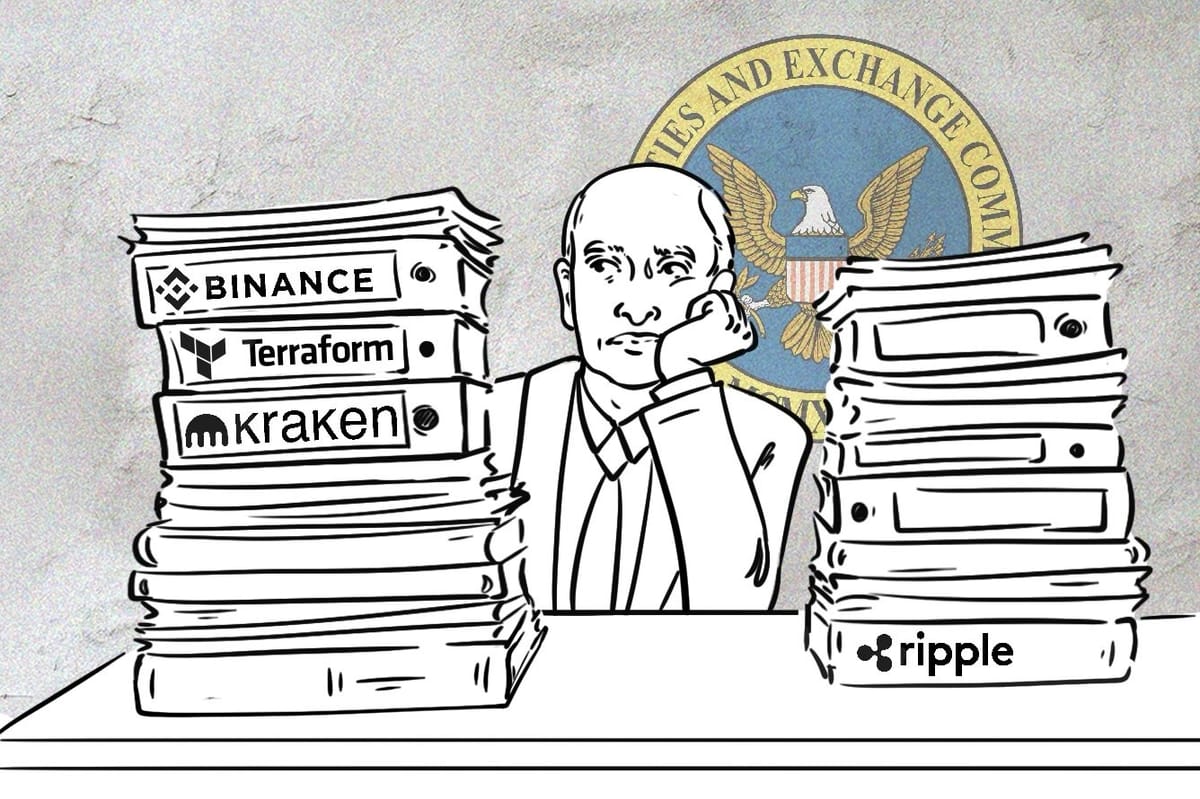

The U.S. Securities and Exchange Commission (SEC) has recently faced pushback from several major industry names (and state attorney generals) over its increasingly tenacious pursuit of all that is crypto. Many accused the agency of 'overreach', and Crypto Mom, SEC Commissioner Hester Peirce, continued to bemoan the regulator's "enforcement-only" approach, at ETHDenver.

SEC delivers a "near-mortal blow" and pushes for more

The regulator accused Binance.US (BAM Trading Services) of stonewalling its investigation in a joint status report filed on March 5 with a Washington DC District Court. The SEC alleges that the American arm of the popular crypto exchange has been "unable or unwilling" to provide information crucial to the ongoing probe, which started in June 2023, prompting the agency to seek legal intervention to force cooperation.

The SEC complaint mainly focuses on asset custody and liquidity. The regulator claims that Binance.US has not adequately demonstrated that it lacked access to private keys or other methods to access customer assets. They cite BAM's refusal to fulfil basic legal discovery requirements (providing attachments, metadata and written responses) to justify court intervention.

In response, BAM vehemently denies the SEC's accusations. It maintains it has fully complied with all information requests, which it characterizes as overly broad. It also requests the court to terminate the expedited discovery process, suggesting it believes the SEC's demands are excessive.

Furthermore, BAM calls the SEC claims regarding customer asset custody unfounded. It claims to have exceeded its obligations by providing the SEC with thousands of documents related to every aspect of its asset custody practices. This includes sworn statements, monthly reports, and facilitating the inspection of shared custody devices holding customer assets.

Last December, Binance.US COO Christopher Blodgett said in a deposition included in a March 5 filing that any banking institutions potentially partnering with the "radioactive" exchange "can reasonably expect a nasty subpoena from the SEC."

"At the highest level, it’s dealt a near-mortal blow."

Blodgett opined that the SEC accusations might have irreparably damaged the firm, with over $1 billion in outflows as customers fled the platform, more than 200 employees laid off, and at least a 75% drop in revenue, in addition to a host of negative reviews.

Terraform calls out "government overreach"

Terraform Labs, the company behind collapsed stablecoin TerraUSD (UST) and its native token Luna, is locked in a dispute over the legal fees associated with its ongoing SEC lawsuit. A request from Terraform Labs to pay Dentons, a law firm, a substantial $166 million retainer has drawn the ire of the regulator, which argues that the "staggering" figure could be better used to compensate investors who lost money during the TerraUSD crash in May 2022.

According to Reuters, the SEC claims that Terraform Labs has not adequately justified the cost, and that funds were diverted towards an "opaque slush fund" controlled by the company, echoing similar concerns raised during the investigation into Binance.US.

In a reply filed on March 4, Terraform Labs pushed back against these accusations and defended their right to choose their own legal counsel. It said that securing competent representation in such a complex case with potentially severe consequences requires a hefty retainer. They portray the SEC's opposition as a "troubling example of government overreach" designed to hinder their defense by limiting access to qualified legal resources.

Kraken gets support from 11 attorneys general

There has been no respite for the SEC of late, as the lawsuit against cryptocurrency exchange Kraken also took a new turn last week, with several state attorneys general (AGs) filing a joint amicus brief supporting Kraken.

Last November, the SEC filed a lawsuit against Payward Ventures, Kraken's parent company, accusing the exchange of offering unregistered securities through its staking program, which allows stakers to gain rewards by validating transactions on the underlying blockchain network. The SEC contends that this program falls under their regulatory purview as it satisfies the criteria of the Howey Test, a legal precedent from 1946 still used by the agency to determine if an investment qualifies as a security. Furthermore, the SEC alleges that the exchange actively promoted and listed 11 unregistered securities while additionally commingling customer and corporate funds.

However, the amicus brief, filed by eleven AGs from Arkansas, Iowa, Montana, Mississippi, Nebraska, Ohio, South Dakota, and Texas, argues that the SEC is exceeding its authority by attempting to regulate activities under individual states' jurisdiction.

The brief notes the importance of upholding state sovereignty and highlights the lack of clear congressional intent granting the SEC authority over cryptocurrency staking programs. It further warns of potential negative consequences, including regulatory uncertainty and market disruption, if the SEC's approach prevails.

The crux of the argument lies in the SEC's classification of cryptocurrency as an 'investment contract'. The state officials contend that this broad categorization could undermine existing state-level consumer protections and regulations specifically tailored for the evolving crypto space. They argue that many existing state laws offer more robust consumer safeguards than the federal securities laws under the SEC's jurisdiction. The AGs also pointed out their states' past involvement in helping to shape the legal understanding of investment contracts within the financial sector.

The state officials expressed apprehension that any potential SEC victory in the Kraken lawsuit could nullify state-level regulations and consumer protection mechanisms, potentially hindering innovation and leaving consumers vulnerable within the crypto ecosystem.

Kraken, echoing arguments made by other exchanges, has challenged the lawsuit through a motion to dismiss, claiming the SEC's accusations are poorly defined and exceed their regulatory authority. This legal battle has drawn significant interest, attracting amicus briefs from industry groups and prominent figures like Senator Cynthia Lummis, who shares similar concerns and arguments.

SEC in "Enforcement-Only" Mode

In a pointed critique delivered at the ETHDenver conference on February 29, Hester Peirce, SEC Commissioner and a long-time proponent of clearer cryptocurrency regulations, launched a direct attack on her employer's current approach. Peirce, well known for her dissent over several SEC rulings concerning cryptocurrency, argued that the agency's overreliance on enforcement actions, rather than establishing a clear regulatory framework, is actively hindering innovation within the industry.

Hester Peirce Fireside: What's America's Crypto Future?

— ETHDenver 🏔🦬🦄 (@EthereumDenver) March 1, 2024

Presented by @HesterPeirce the SEC Commissioner & moderator MacKenzie Sigalos from @CNBC

Watch the full video below 👇 pic.twitter.com/MEVnSXhA6L

According to Peirce, this "enforcement-only mode" creates a significant roadblock for cryptocurrency projects and developers. Without a defined set of rules to navigate, these businesses are forced to operate in an environment of constant uncertainty.

"Our job is to figure out where the securities laws are implicated to try and help people get disclosure where there are securities, and then let people make their own decisions."

Peirce's criticism goes beyond the absence of clear regulations, to concerns that the SEC might have a fundamental bias against cryptocurrency itself. This stems from the agency's perceived hesitancy to engage with the industry in a constructive manner. By prioritizing enforcement actions over fostering open dialogue and establishing clear guidelines, Peirce believes that the SEC risks sending a chilling message that discourages innovation and pushes beneficial blockchain technologies offshore.

It's important to note that Peirce isn't advocating for a complete free-for-all in the cryptocurrency space. She acknowledges the need for investor protection and a level of regulatory oversight. However, her focus lies on establishing a balance between safeguarding investors and fostering a vibrant and innovative cryptocurrency industry within the United States. Such a framework, Peirce argues, would not only protect investors but also allow the United States to remain at the forefront of blockchain technology development.