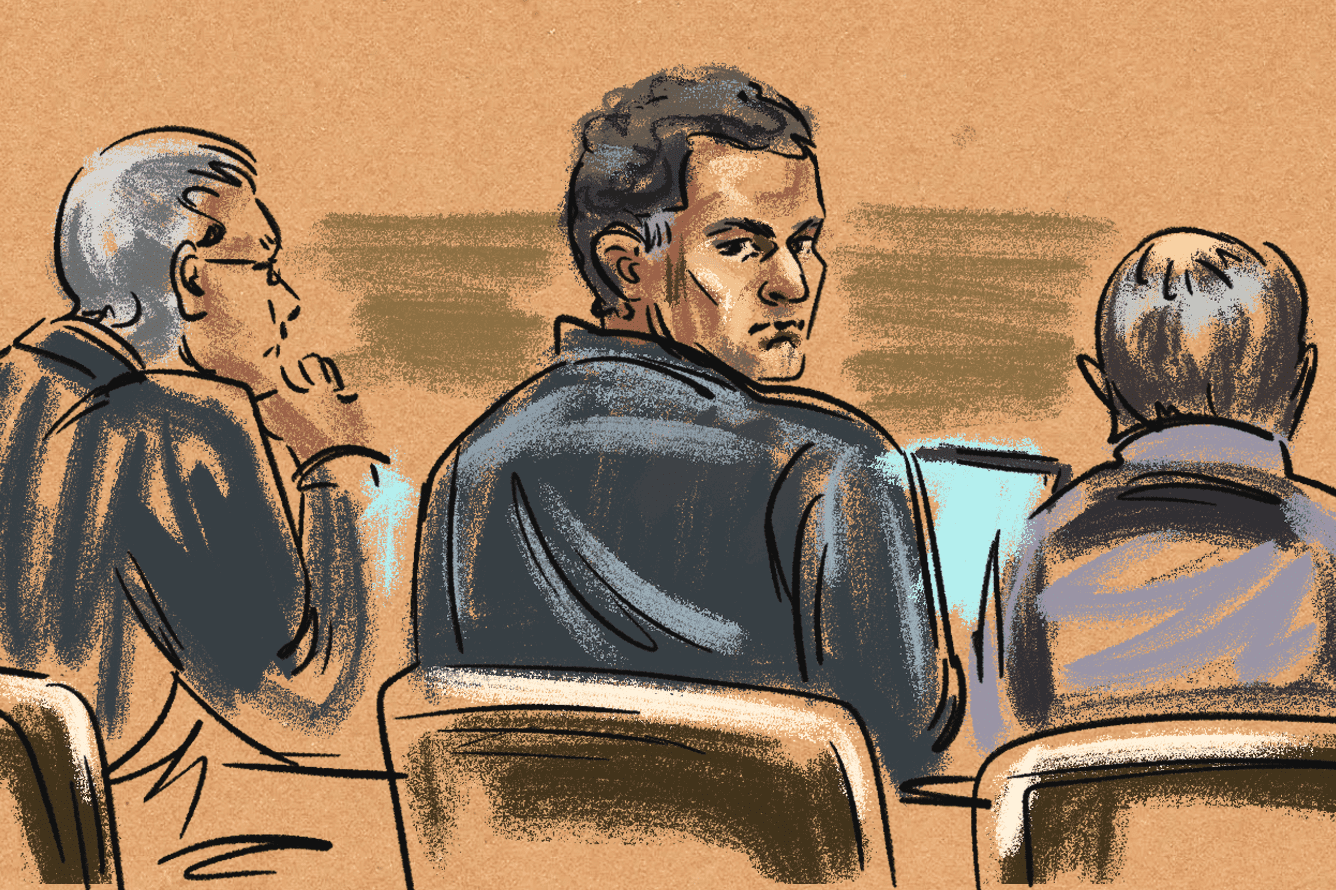

This week, we finally saw the beginning of the Sam Bankman-Fried trial, which is expected to last until November 9th. Both sides have presented their opening arguments and called some of their witnesses.

The prosecution has tried to depict Bankman-Fried as an impudent liar and prove to the jury that FTX's clients were (wrongly) led to believe the money they stored with the exchange was safe. According to the DOJ, Sam Bankman-Fried lied to customers and investors, using Alameda Research as a partner in crime to "steal customers’ funds."

The first witness was a cocoa bean trader, Marc-Antoine Julliard, who says he lost $100,000 with FTX after he decided to diversify into cryptocurrency trading. He said that he was under the impression there were “strong financials behind the company” and that his choice of FTX mainly had to do with the celebrities and venture funds attached to the brand.

The prosecution’s second witness was Adam Yedidia, a good friend of Bankman-Fried, who worked as a trader at Alameda in 2017 and later as a software engineer for FTX in 2021. According to his testimony, he was worried by the amount of Alameda’s liabilities towards FTX and voiced his concerns to Bankman-Fried, who answered that the debt should be settled between the companies within six months to three years. He said he resigned the day before the exchange filed for bankruptcy after he learned from another developer that Alameda was not only holding the funds but using them to pay its debtors.

Gary Wang, the former chief technology officer and co-founder of the exchange, said that he, Bankman-Fried, Bankman-Fried's ex-girlfriend and former Alameda Research CEO Caroline Ellison, and FTX Director of Engineering Nishad Singh committed multiple forms of fraud. He highlighted Alameda's ability to withdraw unlimited funds from the exchange and to have an unlimited negative balance, as well as a line of credit of $65 billion. He said that transactions using users’ funds were possible due to a code amendment that he implemented at Bankman-Fried’s direction.

“We gave special privileges to Alameda Research to allow it to withdraw unlimited funds from FTX and lied about it,” – Wang said.

Among other witnesses was Paradigm co-founder Matt Huang, whose company invested around $278 million in FTX and FTX U.S. and currently values the FTX equity it holds at “zero dollars.” He also mentioned that Bankman-Fried was “very resistant” to having investors join the board of directors at FTX and spent more time working on the Alameda project rather than the exchange.

Meanwhile, the defence has been trying to depict Bankman-Fried as simply a nerd acting in good faith and that the exchange’s clients should be held accountable for their choice to buy and trade crypto through FTX. Mark Cohen, Bankman-Fried’s attorney, said in his opening statement that “Sam didn’t defraud anyone” and that just because people lost money doesn’t mean there was a fraud.

According to the defence, all the privileges mentioned were part of Alameda’s role as a primary market maker and having a negative balance was a key feature for any other market maker too. FTX's reliance on Alameda to deposit funds was allegedly well known, and there was no secret door for transactions between the companies. It was claimed that Bankman-Fried assumed the exchange was allowed to loan funds to Alameda as part of the companies’ business relationship. The defence also highlighted the role of Binance in the FTX’s collapse.

“Running a startup was like building a plane while you’re flying it... It’s not a crime to be the CEO of a company that files for bankruptcy,” - claimed the defence.

The trial will resume on October 10th starting with the conclusion of Wang’s testimony. It is likely that Caroline Ellison will then be called next. She and Nishad Singh have already pleaded guilty and are assumed to be cooperating with the prosecution, a fact that Cohen has already used to raise doubts about their credibility. Over the coming weeks, we also expect to see Sam Trabucco, the former CEO of Alameda Research, SkyBridge Capital's founder Anthony Scaramucci, Sam Bankman-Fried's parents and his brother Gabriel called to the stand.

No major surprises were revealed during the first few days of the trial, but we are looking forward to new details and arguments and, of course, to the eventual ruling, which might shape the future of crypto litigation in the U.S.