Ondo Finance recently made headlines by transferring $95 million into a tokenized fund managed by BlackRock, aimed at facilitating instant settlements. It's the first time a crypto protocol has used such a fund to boost its services.

The move sparked significant excitement in the Real World Asset (RWA) tokenization sector, prompting a surge in market values for Ondo Finance, and various projects within this sector, with increases ranging from 30% to 100%.

At the forefront of this sector is Ondo Finance, boasting a market capitalization of $1.3 billion and a tokenized asset portfolio of around $200 million. The firm’s approach focuses on tokenizing stable, income-generating assets from the traditional financial sector, thus blending the best features of traditional finance with Web3 world.

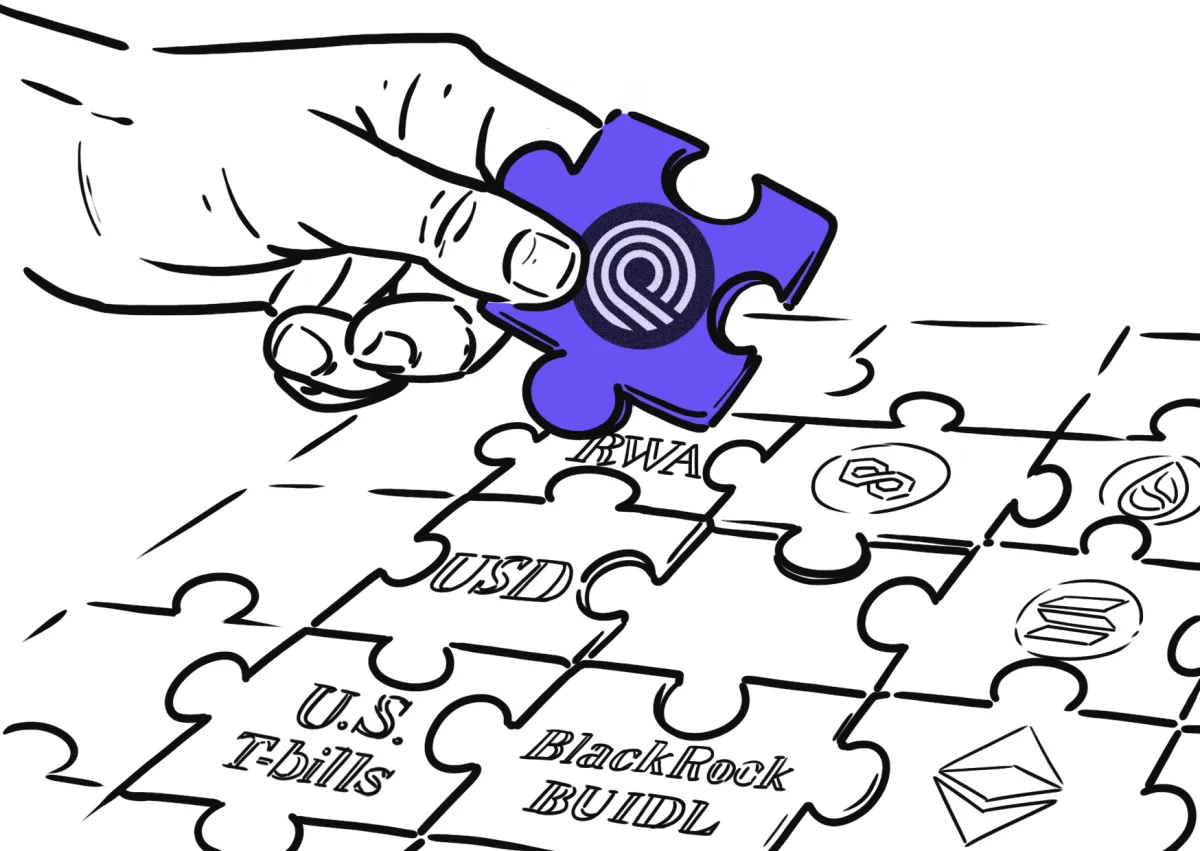

Ondo Finance’s offerings include several RWA strategies. Its flagship, the OUSG fund, has assets of around $100 million and offers liquid exposure to short-term U.S. Treasuries. By moving OUSG funds into BlackRock’s newly launched BUIDL, Ondo Finance will enable its users to enjoy instant, round-the-clock subscriptions and redemptions. This is a significant improvement over the previous system, where OUSG redemptions could take several business days due to the constraints of traditional securities settlement times.

It is worth noting that the OUSG fund is exclusively available to accredited investors who have passed rigorous Know Your Customer (KYC) checks. For the retail market, Ondo offers the USDY stablecoin, which comes with a native yield. This project invests in short-term U.S. Treasuries and bank deposits, among other strategies, to generate returns for its users.

USDY is currently supported on multiple blockchain platforms, including Ethereum and Solana. It offers an Annual Percentage Yield (APY) of about 5.2% and has a Total Value Locked (TVL) of $127 million.

In the pipeline is the OMMF fund, which Ondo plans to use for tokenizing U.S. government money market funds. This will also be restricted to accredited investors.

To launch these new and innovative products, Ondo is actively bringing in leaders from the traditional finance world. The co-founder, Nathan Allman, once worked at Goldman Sachs and is now the CEO. Katie Wheeler, who currently serves as the Vice President of Partnerships at Ondo, previously held the position of Vice President at Circle and Blackrock. Adding to their high-profile team, they recently hired Ian De Bode, who led digital assets at McKinsey, as their Chief Strategy Officer.

These innovative steps have led to a more than tenfold increase in Ondo’s valuation since January of this year. The entire RWA sector has experienced substantial growth over the last several months and is now valued at around $9.3 billion.

Given the vast potential, these developments may just mark the beginning of the tokenization movement within traditional finance. With its leading-edge solutions, Ondo Finance is well-positioned to play a pivotal role in this evolving landscape. We will keep Observing these exciting developments.