STOKR, a Luxembourg-based platform that provides blockchain-powered solutions for alternative investments and securities tokenization, launched its first public-market real-world assets product, a registered security CMSTR issued through a Luxembourg Securitization Fund. Tokenised CMSTR Notes are fully backed by MicroStrategy Inc. shares of class A. Every Note represents 100 shares of Microstrategy as a token.

The launch raised multiple questions within the 'savvy investors' community on Twitter. Those who managed to get through the announcement, which was a complicated read filled with acronyms, are now trying to visualize the CMSTR structure.

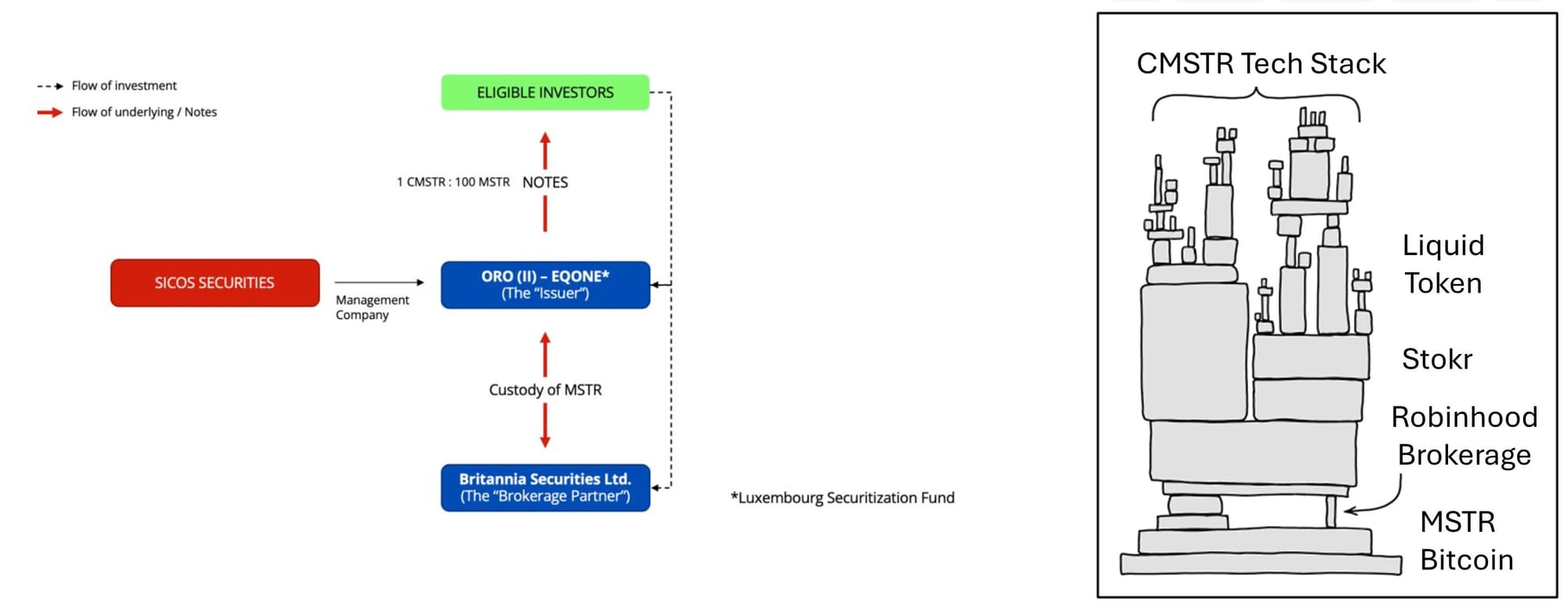

STOKR's own explanation, which is closer to the diagram on the left, emphasizes that the MSTR stocks are held in a regulated brokerage account. Luxembourg Securitization Fund, protected against bankruptcy, tokenizes the stocks and issues registered securities CMSTR, while STOKR is the technology provider.

CMSTR was launched on a Bitcoin sidechain, the Liquid Network, built for digital assets issuance. This Layer 2 is designed to provide faster settlements and make traders' activities more efficient than those on the mainchain.

MicroStrategy describes itself as the world’s first Bitcoin development company and now reportedly holds 214,400 BTC, meaning that each share of the company is backed by approximately 0.012 BTC.

STOKR explains that the strong correlation between MSTR and BTC means that the notes allow "the establishment of bitcoin-basis trading of the underlying MSTR." Other experts add that the product turns Microstrategy shares into a kind of P2P tradable currency that can be stored in a hardware wallet and traded independently of NASDAQ's limited hours with no slippage.

Well-known crypto enthusiast and cryptographer Adam Back claimed that the product has multiple advantages, including the possibility of benefiting from the correlation between the company's shares and BTC without manually trading the MSTR:BTC pair and the fact that with MSTR, investors are outsourcing BTC leverage.

this market has advantages as follows:

— Adam Back (@adam3us) May 9, 2024

- 24x7 market (not 9:30 - 4pm NYC)

- a new way to look at swing trading MSTR priced directly in BTC

- avoids needing to take two trades each time

- trustless swaps and limit orders

- hardware wallet support

- 0.0001 CMSTR can be transferred

Forty CMSTRs valued at over $5 million were issued on April 29. CMSTR has been live for trading on SideSwap since May 7. As of May 15, the order book did not look encouraging, with the total volume rather small.

The lack of trading fuss can be explained by the fact the asset is simply out of investors' reach. The tokenized asset is currently available only for EU professionals (except Germany and Luxembourg) and non-U.S. qualified investors. Also, the product is closed for AML high-risk countries such as Iraq, the Russian Federation, Seychelles, and many others. The notes are tradable at a minimum amount of 0.0001 CMSTR (or 0.01 MSTR, or around $12.6). However, with the minimum subscription and redemption of $150,000, the requirement to provide tax ID, the necessity to confirm eligibility for the investment, and other requirements, it is not easy for retail investors to access CMSTR, which was already noted by many users on social media.