Recent announcements by companies from both the digital asset and TradFi industries highlight the growing prominence of real-world asset (RWA) tokenization within the blockchain industry.

TradFi Embraces Blockchain Tech

Jenny Johnson, CEO of Franklin Templeton, one of the world's leading asset managers, emerged as a vocal advocate for the integration of blockchain into traditional finance (TradFi). During a panel discussion at Consensus 2024, Johnson declared that blockchain technology would be "transformational" for the existing markets and emphasized the need for all investors to understand its implications.

Another TradFi behemoth, BlackRock, which manages more than $9 trillion worldwide, recently launched the BUIDL tokenized fund on Ethereum. Along with meme-coin and NFT transfers, the Ethereum blockchain now registers transactions for this fund, including dividend payments of $1.2 and $1.7 million that were already paid out in BUIDL tokens.

While securities tokenization follows a smooth and natural path, it is not as straightforward for other RWA markets.

The More Traditional An Asset Is, The More Data It Needs. Chainlink Targets RWA Tokenization Challenges

One limitation of blockchain technology is its inability to connect to the off-chain world. To solve the double spending problem, blockchains are inherently isolated, and any input or output requires external agents such as oracles.

Being one of the early players in the oracle field, Chainlink holds a strong position in the tokenization industry. Co-founder Sergey Nazarov's has recently reinforced the company's commitment to providing the infrastructure needed to unlock the potential of tokenization in RWA.

In his presentation, titled "Bringing Global Assets Onchain," Nazarov outlined Chainlink's vision for RWA tokenization mechanisms such as Unified Golden Record, - a single on-chain record that contains not only the ownership details but also a set of data about the assets that is continuously updated via the oracle systems.

In addition to oracles, Chainlink also leverages its Cross-Chain Interoperability Protocol (CCIP), which enables secure cross-chain communication and token transfers. CCIP facilitates the seamless integration of tokenized assets across different blockchain networks, expanding the potential reach and impact of RWA tokenization.

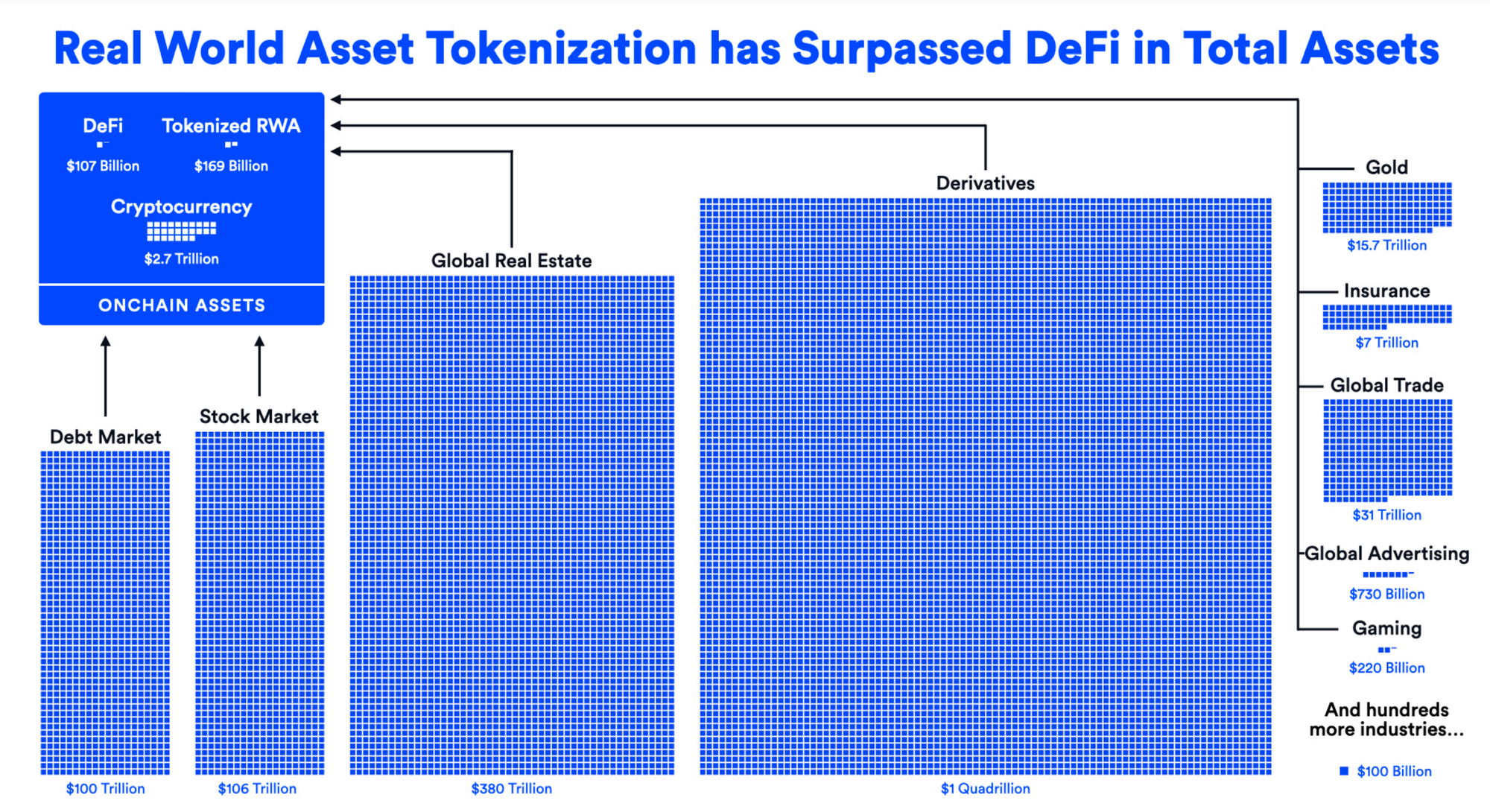

The potential market for RWAs is immense, with analysis suggesting hundreds of trillions of dollars worth of assets could be brought onto the blockchain. A report by Boston Consulting Group projects the tokenized asset market to reach $16 trillion by 2030. According to Chainlink, RWA tokenization has surpassed the DeFi sector in terms of the value of total assets.

Multi-Purpose Tokens (MPT) and Digital Identifiers (DID): Ripple Unveils A Set of Tools for Compliant Tokenization

David Schwartz, Ripple's CTO, unveiled the firm's roadmap for its XRP Ledger (XRPL), which also gears the firm with tools for embracing the tokenization wave. It includes the launch of Oracles in Q2, Decentralized Identifiers (DIDs), and the introduction of Multi-Purpose Tokens (MPTs) later this year.

DIDs are self-sovereign identifiers managed directly by the owner, enabling secure and verifiable digital identities. They facilitate compliance with KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations by providing tamper-proof, verifiable credentials. DIDs allow institutions to manage user identities across various DeFi applications, ensuring that only authorized individuals can access sensitive services. This enhances security, reduces fraud, and supports regulatory requirements by enabling a precise and reliable identity verification processes.

MPTs introduce flexibility to the XRPL by incorporating features such as on-chain metadata, freezing capabilities, and clawback functionalities. These features enhance compliance by allowing token issuers to freeze tokens during legal disputes or regulatory requirements and to revoke or reassign tokens in cases of fraud or lost access. MPTs ensure transparent, controlled asset management and meet security, regulatory, and efficiency standards.

All in all, the tokenization sector is growing and expanding rapidly, and we will continue to observe this space with interest.