Tangible DAO, a U.K.-based issuer of USD-pegged stablecoins (USDR) backed by tokenized real estate (TNFTs), has just announced the launch of 're.al', a permissionless L2 for tokenized RWAs, or in other words, a platform allowing others to issue and trade tokenized real-world assets. Built on Arbitrum Orbit, the new ecosystem looks set to become the main focus of Tangible, as ecosystem coin $TNGBL has also been migrated to $RWA. This will be used to reward token holders with revenue from projects built on re.al.

We've been busy the past few months. Restoring USDR to 100% CR, developing several new products and, most importantly, preparing for the launch of https://t.co/NWUN5J2P31: the first permissionless L2 for tokenized RWAs.

— Tangible 🏠💙 (@tangibleDAO) March 4, 2024

We'll have many updates to share in the coming weeks,… https://t.co/rwWFEO7Q8A

The ecosystem also includes Pearl, an exchange for tokenized RWAs, and Stack, focused on their borrowing and leverage. Tangible itself will also remain a part of the ecosystem as the tokenization protocol for re.al. The project aims to "bring off-chain yields on-chain, from rental income to T-Bills."

“Through tokenisation and DeFi composability, we will redefine asset ownership and value creation, transforming the way RWAs are bought, sold, and leveraged on-chain.”

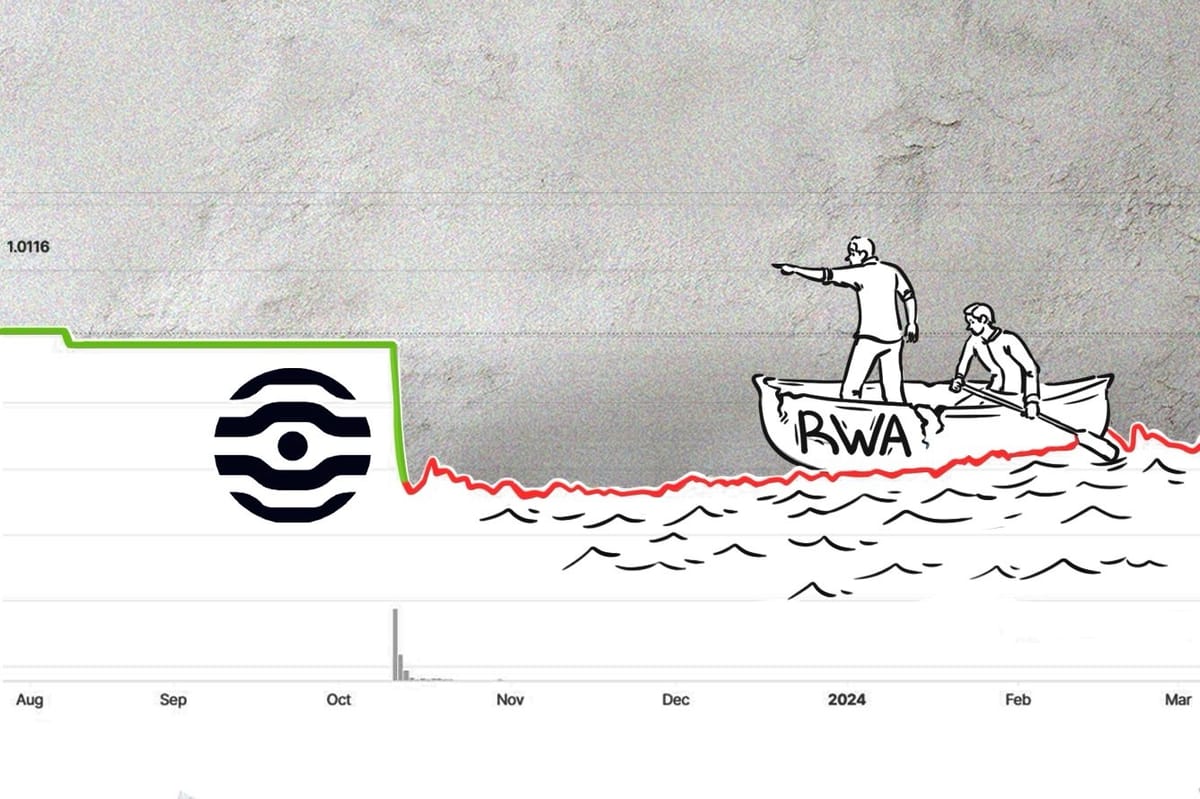

Tangible's previous focus was the native yield Real USD (USDR) stablecoin, which was backed by 'safe' tokenized real estate assets in the form of tangible NFTs. Unfortunately, a series of redemptions last October caused liquid assets, in the form of DAI stablecoins, to be drained from its treasury, while illiquid real estate assets couldn’t be sold quickly enough, causing USDR to depeg, dropping to around 50 cents.

In February, the company promised to make users whole, offering 90 cents on the dollar paid in DAI and 10 cents in $TNGBL. However, the team has since reportedly managed to restore USDR collateralisation to 100%, although no further details of the redemption have yet been announced. At the time of writing, USDR was trading at $0.70.

re.al will reportedly go live in two weeks, with a 'flashy' new promotional website just launched. We will continue to observe whether Tangible's pivot is successful and leads to a USDR repeg.