For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

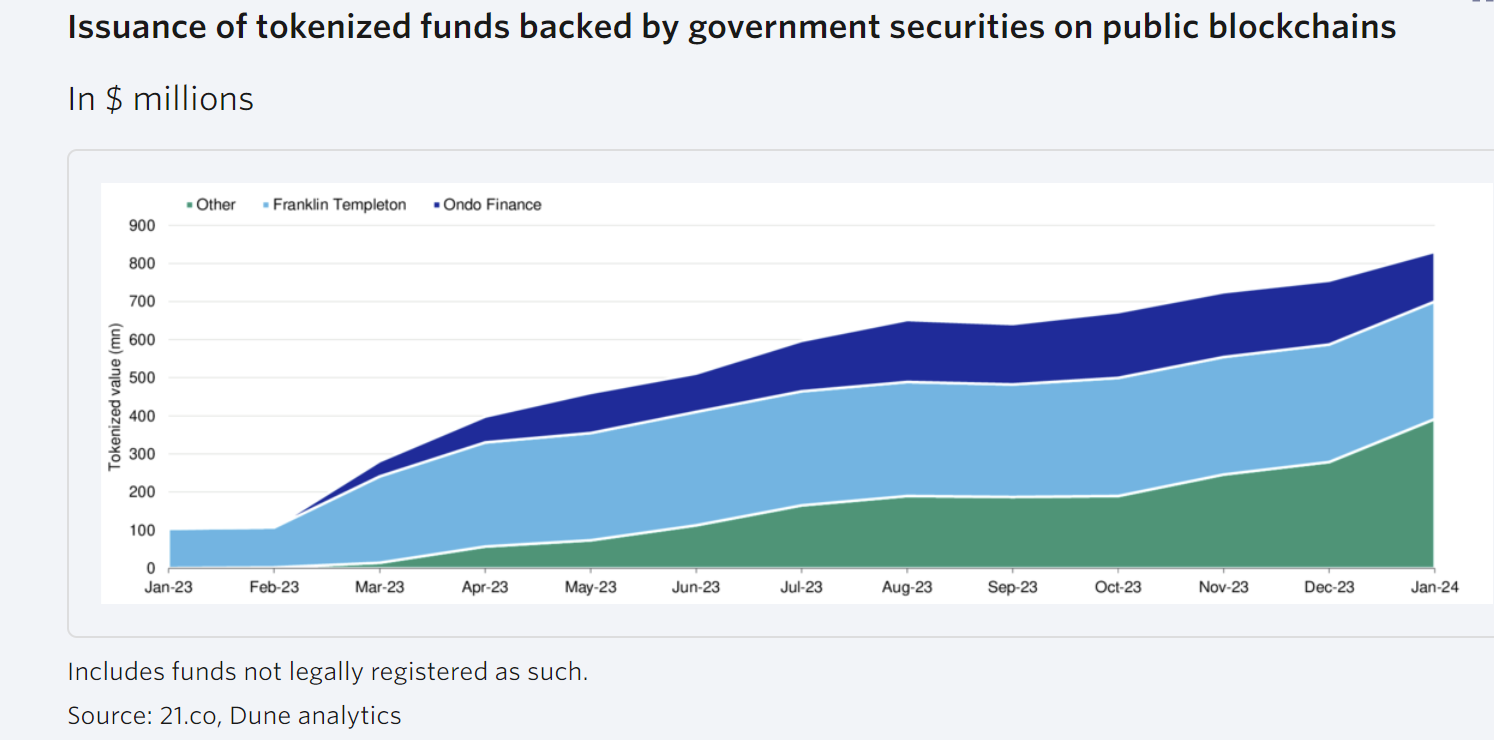

Starting off with the tokenization of real-world assets, global credit ratings agency Moody's has recently published a report showing "untapped market potential" in the growth of tokenized funds, which are making investing more efficient. However, it does warn that such funds might also introduce technology-related risks.

We might well see some of that growth in Thailand, as the country's SEC this week scrapped a previous 300,000 baht ($8,450) limit on investments in tokenized real estate and infrastructure projects.

Egypt's government has firmly attached its flag to the CBDC pole, as local press reports that the Central Bank of Egypt is preparing to issue a digital pound by 2030. This forms part of the government strategy for the newly re-elected president's third term, which runs from 2024 until 2030.

And local press in Jamaica has finally caught up with last November's news on the country's own CBDC. The Bank of Jamaica is apparently working to modify the existing Jam-Dex currency (although hopefully not the name), to make it a more accommodating ecosystem. While Jam-Dex launched in July 2022, it has suffered adoption setbacks so far due to a lack of existing POS integration and only a single compatible wallet provider.

Finally to the U.S., where hating on crypto is as popular as ever in some quarters. Presidential contender Ron DeSantis has long worn his distaste for CBDCs on his sleeve, passing legislation in May to prohibit the use of any future CBDC in Florida, to "protect the personal finances of Floridians from government overreach and woke corporate monitoring."

This week, fellow presidential contender Donald Trump decided that he too wanted a piece of the CBDC-hating action, and vowed that he would never allow a CBDC to be issued, calling it a threat to Americans' freedom. Furthermore, four additional state senates have introduced bills that exclude CBDCs from the definition of money in their jurisdiction: South Carolina, South Dakota, Tennessee and Utah. The move is likely to make any potential future introduction of a CBDC more difficult.

Instead, the U.S. FedNow service is reporting good traction since its launch last July. It could be that U.S. has different plans for its path to CBDC.

But enough talk of CBDCs, Wyoming-based Custodia bank can't even get a master account with the Federal Reserve. Custodia argues that it has been held to a higher standard than non-crypto related banks and is being unfairly shut out of the Fed system. The state of Wyoming, which is notably crypto-friendly, is stepping in to add some weight to Custodia's case.