On March 14, Hong Kong's central bank, the Hong Kong Monetary Authority (HKMA), kicked off phase 2 of its much-anticipated central bank digital currency (CBDC) pilot program, the e-HKD.

The second phase builds upon the findings of Phase 1, which explored the basic functionalities of an e-HKD and its potential impact on the financial system. Phase 2 dives deeper into specific areas identified as promising, the HKMA said. These areas include programmability (allowing the e-HKD to be programmed for specific purposes), atomic settlement (ensuring instantaneous completion of transactions), and tokenization. For the latter, HKMA has recently launched Project Ensemble sandbox to study the interoperability of e-HKD with other forms of tokenized money.

However, the HKMA isn't limiting itself to these initial areas. The program actively encourages proposals for entirely new use cases that leverage the unique capabilities of a CBDC.

Phase 2 of the e-HKD Pilot Programme has been launched to explore the potential of a digital Hong Kong dollar in the areas of programmability, tokenisation and more. Do not miss out on this opportunity to make your mark – apply by 17 May.

— HKMA 香港金融管理局 (@hkmagovhk) March 14, 2024

#eHKD #CBDC #DigitalMoney pic.twitter.com/cvVDdeVEyy

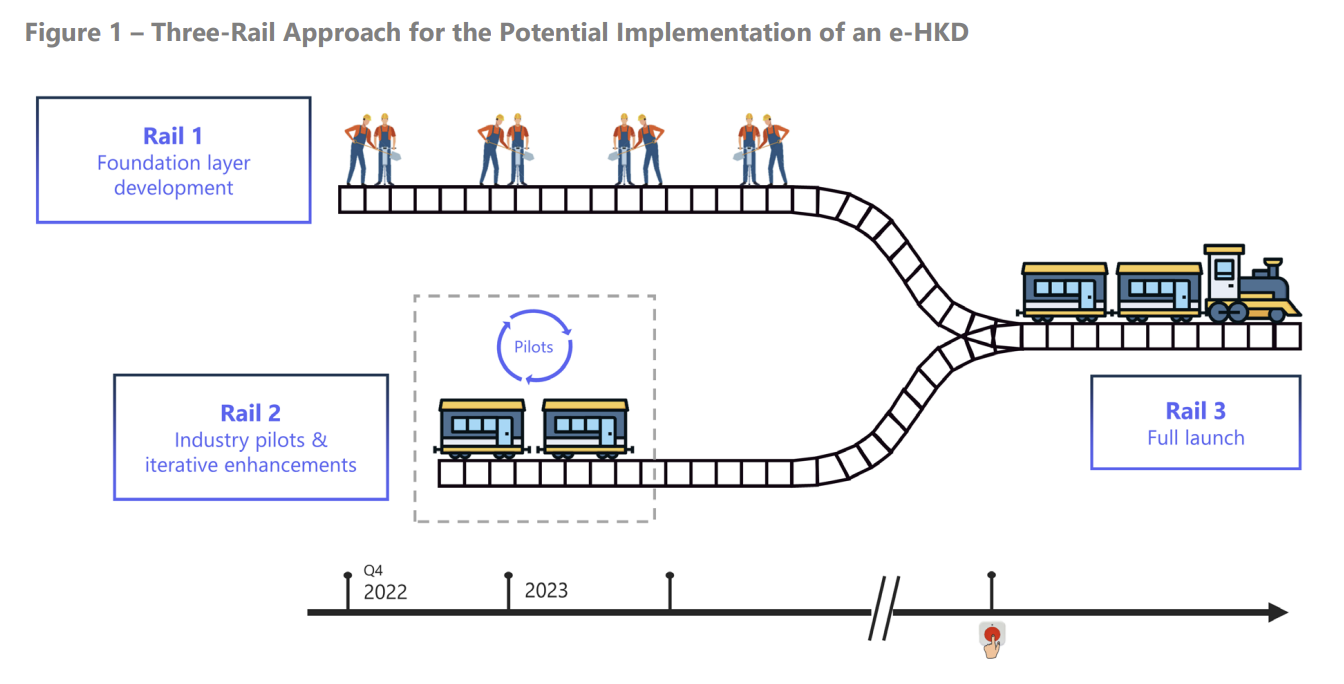

Hong Kong's CBDC project traces its roots back to 2017 when the HKMA initiated research on the wholesale CBDC (project LionRock/mBridge). In 2021 the research of retail CBDC (e-HKD) started and culminated in the official launch of the pilot in November 2022. Both CBDCs are part of Hong Kong's ambitious "FinTech 2025" strategy, а government initiative fostering widespread adoption of digital financial solutions by 2025.

The HKMA's dedication to CBDC exploration is clearly demonstrated by its ongoing efforts to equip Hong Kong to issue digital currency at wholesale and retail levels. This commitment has already attracted prominent players in the financial world. Notably, payment giant Visa announced its collaboration with local heavyweights HSBC and Hang Seng Bank on a digital Hong Kong dollar pilot test in November 2023. This pilot involved the tokenization of deposits, essentially creating digital representations of traditional deposits stored on a secure blockchain ledger, all backed by the solid foundation of a bank balance sheet.

In parallel with these industry pilots, HKMA is examining the architecture of the underlying foundation for the retail CBDC. HKMA has not yet decided if it will be based on the distributed ledger technology. Additionally, as part of Project Aurum, HKMA is testing the feasibility of the technological stack that integrates a wholesale interbank system and a retail e-wallet, focusing on privacy considerations.

Industry actors have until May 17, 2024 to apply for e-HKD Phase 2 slots. This includes established players like banks and payment service providers, along with innovative FinTech companies, and even potential end-users such as merchants and consumers. According to its website, the regulator is particularly interested in proposals demonstrating cutting-edge innovation, improving the customer experience, and having a clear path for real-world market testing. The HKMA also seeks ideas that comply with current regulations and showcase the potential benefits of an e-HKD for Hong Kong's financial system. Selected participants will have until mid-2025 to test and refine their proposed use cases within a safe and controlled environment. We have marked our Observation calendar accordingly.