For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, stablecoins and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

Work on developing the digital euro continues at pace. The European Central Bank has unveiled seven new workstreams to develop the rulebook for this CBDC. Experts in user experience, payment certifications and risk management are being invited to apply until April 5. Other areas of focus include how consumers and merchants will interact, interoperability among business users, and the development of dispute management services.

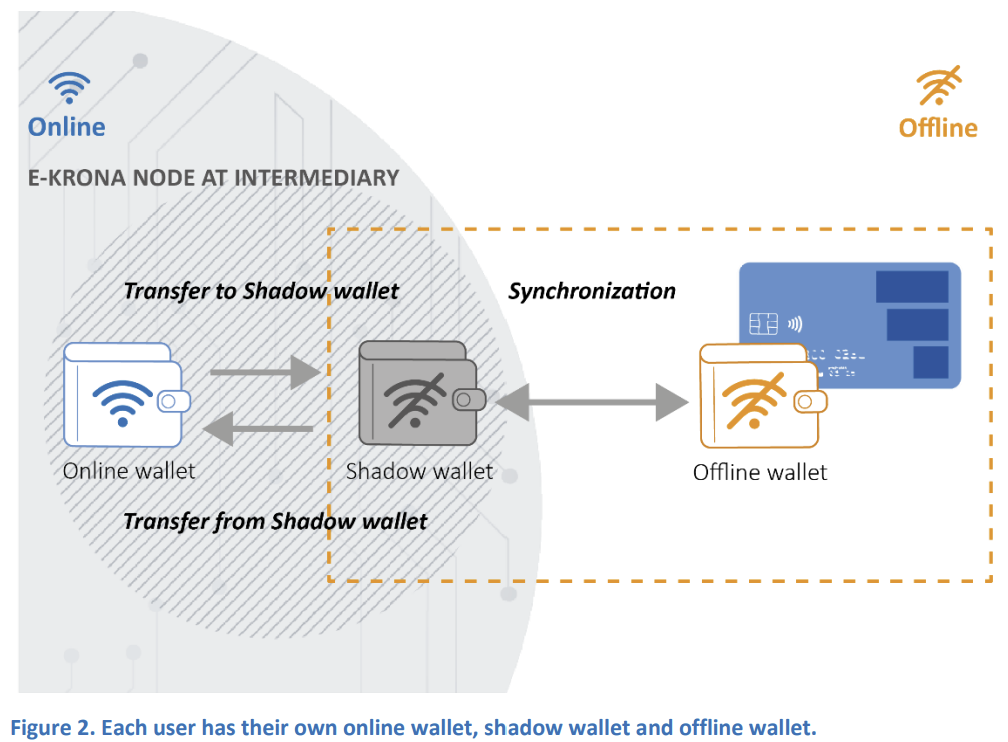

Meanwhile, Sweden's central bank has warned that offline payments could be a sticking point if the country decides to issue an electronic version of the krona. The new report on the pilot's Phase 4 which focused on offline use, suggests that "secure and functional offline solution requires a lot of development cooperation work in terms of technology, regulations and processes". The main area of concern surrounds when offline CBDC cards are transacting via mobile phones as those lack the security features for payment processing.

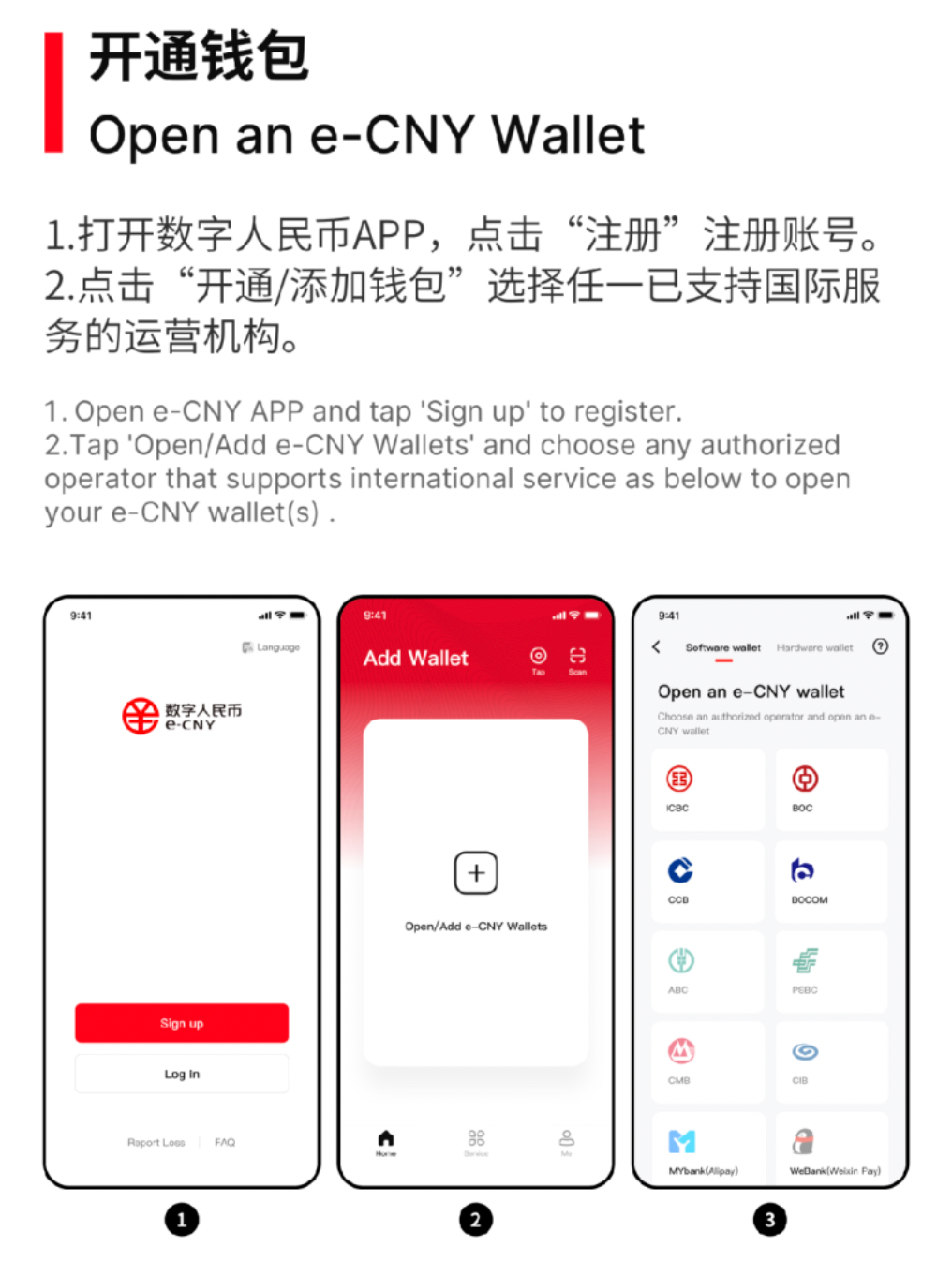

Over in China, a new guide in English has been released to help visitors use the digital yuan, with detailed instructions on how to open a wallet. Once a dedicated app is downloaded to smartphones, mobile phone numbers from over 210 countries can be used to register an account. Connecting international bank cards eliminates the need for continual top-ups. The easy-to-understand document could give tourists a taste for what CBDCs look like in practice, as China remains one of the few major economies to launch one worldwide.

Hong Kong has now kicked off phase two of its much-anticipated pilot program for the e-HKD. This stage will explore whether the CBDC can be programmed for specific purposes, as well as tokenization and facilitating instantaneous settlements. However, the Securities and Futures Commission has warned that "a cornucopia of tools straight from science fiction movies is conspiring to make the most vigilant of us fall prey to increasingly sophisticated scams" — with fraudulent companies falsely claiming to be involved in the e-HKD pilot.

Finally this week, BlackRock — the world's largest asset manager — has unveiled plans to launch its first tokenized fund in partnership with Securitize. The investment giant, whose spot Bitcoin ETF is a market leader, is following in the footsteps of rivals including Citibank and JPMorgan. Ethereum has been chosen for the project.

The BlackRock USD Institutional Digital Liquidity Fund — otherwise known as BUIDL for short — "seeks to offer a stable value of $1 per token and pays daily accrued dividends directly to investors' wallets as new tokens each month." The fund is set to invest 100% of its assets in cash, T-bills and repurchase agreements.