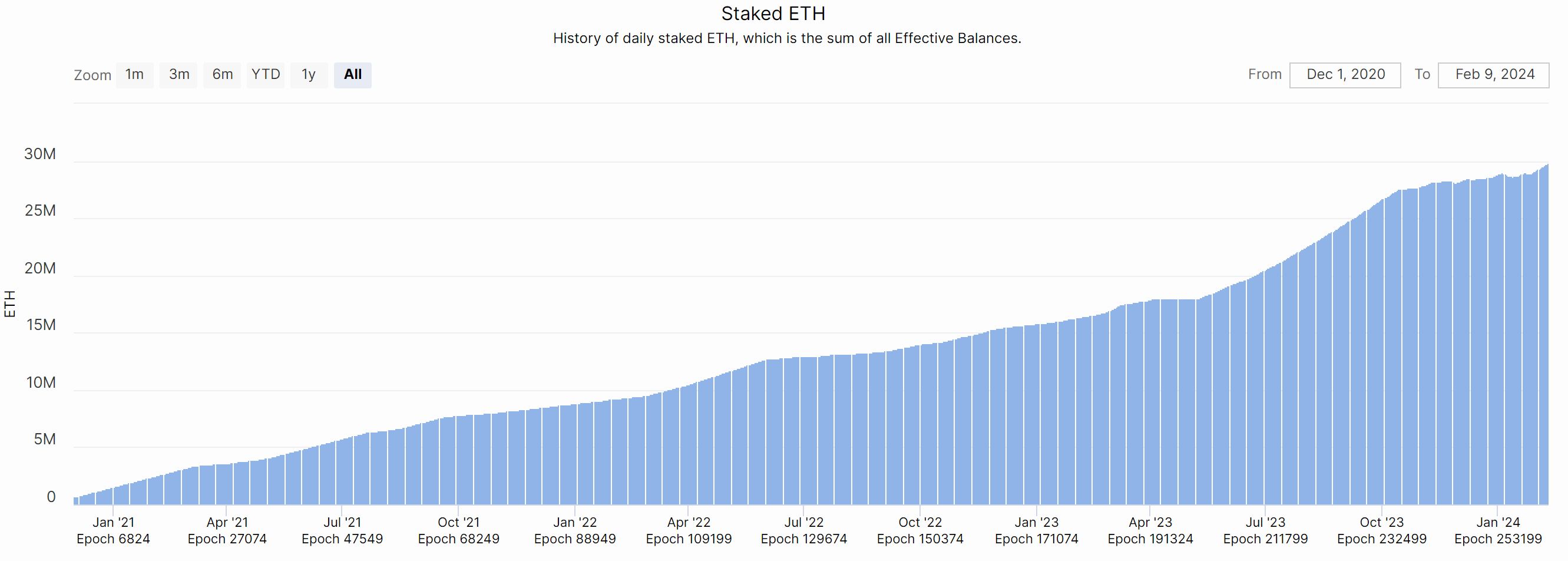

Ethereum has achieved a significant milestone since its transition to Proof of Stake (PoS) in September 2022, with over 30 million ETH, representing more than 25% of the total supply, now staked. Remarkably, the quantity of staked ETH has been consistently increasing, with only a few months showing a decline in the staking figures since the switch.

Staking currently offers rewards of approximately 4% APR, presenting a clear advantage over holding unstaked ETH. Furthermore, engaging with liquid staking providers, such as Lido, allows users to retain liquidity of their ETH while still reaping the rewards of staking.

Presently, over 30% of stakers utilize services from Lido and other similar providers. There has been a lot of discussion in the Ethereum community about Lido's dominance and the risks of centralization. However, this has not seemed to deter either stakers or Lido users.

Another Ethereum liquid staking service, EigenLayer amassed an impressive $6 billion in the last 2 months. In the last week only the jump in TVL was almost $4 billion.

While the higher staked rate of Ethereum increases the number of newly issued ETH, the network is balancing the total supply by burning a portion of its transaction fees. Due to overall strong network activity, Ethereum is in a deflationary phase, with its supply now at its lowest point since the Shanghai upgrade.

This, coupled with reduced selling pressure, has led some, like Ethereum community member and investor Ryan Berckmans, to speculate that Ethereum’s price could potentially reach between $12,000 and $27,000 within 18 to 30 months.

Another potential catalyst for Ethereum’s price surge is the anticipated approval of an Ethereum Spot ETF in the spring. Despite mixed opinions on its likelihood, there are indications that major institutional players are actively working towards its realization.

Beyond price considerations, Ethereum has continued to advance technologically since transitioning to PoS. The network is gearing up for the significant “Dencun” upgrade, which has already been implemented across all Ethereum testnets, including Goerli, Sepolia, and Holesky, with a mainnet launch targeted for March. The upgrade is expected to reduce Layer 2 transaction fees by approximately 90% attracting more L2 activity to the chain.

The Dencun upgrade, combined with the reduced selling pressure from miners, and the potential approval of a spot ETF, should further encourage staking and could positively influence ETH’s price. In light of these developments, Ethereum is well-positioned to excel in the current market cycle.