In June the EigenLayer project launched its protocol on the Ethereum mainnet after being tested for three months on the Ethereum Goerly testnet. The protocol allows users to restake their ether (ETH) on other applications and earn additional rewards. These other applications, for their part, can utilize Ethereum security primitives instead of developing their own validation protocols.

The transition of the Ethereum blockchain to a proof-of-stake (PoS) mechanism heated up the staking business on the largest blockchain. The share of staked ether has increased from 12% to 17% in just a few months and is expected to increase further. As more Ether gets staked to secure the network, the staking yield per ether falls. Annual staking yield, recently at 5%, is estimated to fall to 3% by year’s end and below 1% at some stage. This gives rise to many solutions that help stakers to leverage their staked capital by reusing it.

When ether is staked through Lido, Rocket Pool and other liquid staking solutions the protocols issue special staking tokens that can be utilized on other applications in decentralized finance. For example, they can be used as collateral for borrowing more crypto. This, in turn, created an investment leverage method called looping, whereby staking tokens are converted back into the original staked assets and staked multiple times. Pendle is another staking derivative that allows users to choose a preferred leverage on their staking investment.

Unlike looping and Pendle, EigenLayer increases the return on the staked capital by adding more options to its core utility - providing security on PoS protocols. Users can choose to participate in validating other protocols on Ethereum (and on other chains in the future) and get more rewards. The project whitepaper calls this 'pooled security' and explains that with EigenLayer stakers can connect to the nodes of any supported application and its validation services. However, the slashing risk (the conditions which can lead to the loss of the stake) increases, as stakers 'sign up' under the requirements of these new protocols.

If a staker who is restaked on EigenLayer is proven to have behaved adversarially while participating in an additional protocol, then that staker’s funds will be subject to slashing and are frozen and prevented from further staking on any project with EigenLayer. In a recent discussion, Vitalik Buterin, the co-founder of Ethereum, suggested that using EigenLayer is a good option for emerging DeFi projects.

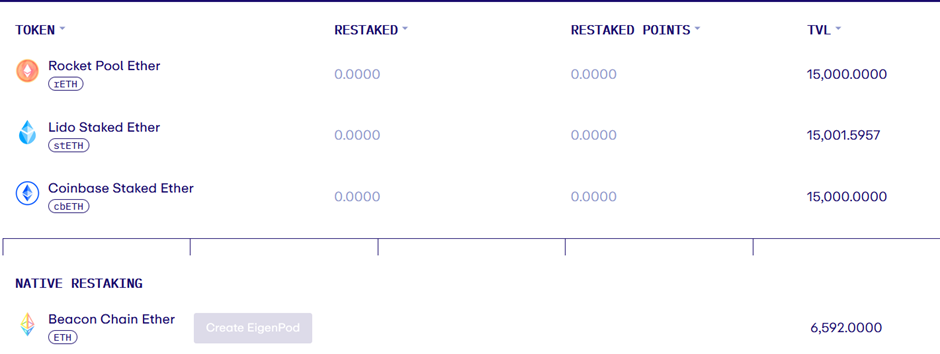

Besides native ETH, EigenLayer allows the restaking of Rocket Pool, Lido and Coinbase staking tokens.

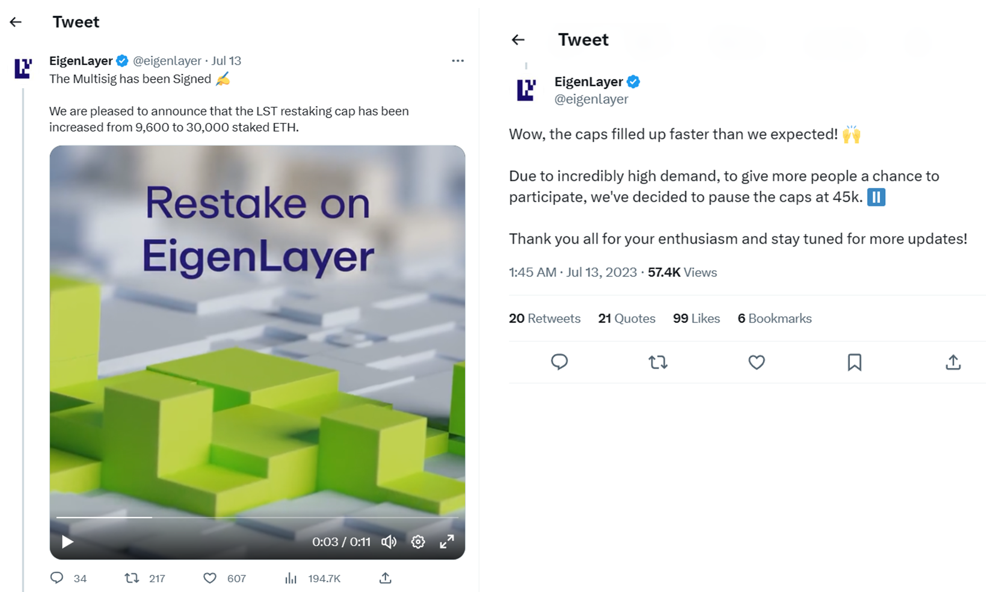

On July 13 EigenLayer announced that it will allow the restaking of more of these tokens on its protocol, increasing the cap from 9,600 ETH to 30,000 ETH. Within minutes after the announcement, the spots were fully utilized and the cap was increased to 45,000 ETH (just under $90 million)

EigenLayer is an interesting initiative since it aims to improve both the financial and technical properties of the blockchain. It has already attracted the attention of investors. In March this year EigenLabs, the development entity behind the protocol, raised $50 million in a Series A funding round led by Blockchain Capital. We believe this project's journey has just begun and there will be many more updates and milestones that we are excited to Observe.