Lido Finance (LDO) is a decentralized liquid staking protocol. In exchange for crypto assets, LDO provides StakedETH (stETH) tokens. Lido places these tokens in the Ethereum Beacon Chain, the predecessor of Ethereum 2.0 (ETH2).

Haven’t you heard about liquid staking? Click here.

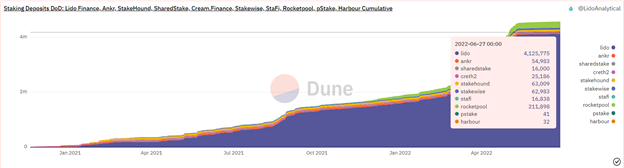

Lido is a leader in providing liquid staking services. According to LidoAnalytical (on the website dune.com), as of June 27, Lido has more than 4 million ETH staked (more than 90% of all liquid staking providers). This amount is twenty times higher than the share of Rocketpool, the next liquid staking service provider on the list.

Since the end of May, there has been a discussion in the Lido community about whether steps should be taken to reduce the dominance of Lido in the field of liquid staking. Why is market dominance bad? The same logic works here as in classical finance. If the service provider becomes solely dominant, then it will turn into a monopoly. And what does it threaten? Centralization.

Basically, it is the formation of Lido as a monopoly that worries users and people important to the Ethereum community. Vitalik Buterin and Danny Ryan expressed their opinion about monopoly in liquid staking.

After a month of discussion, the voting started on June 24, which will end on the first of July. Most likely, the voting results have already been determined, because already at this stage 99.77% of users (67 million LDO) voted for the option “no, don’t self-limit.” We are waiting for the final results and continue to observe.