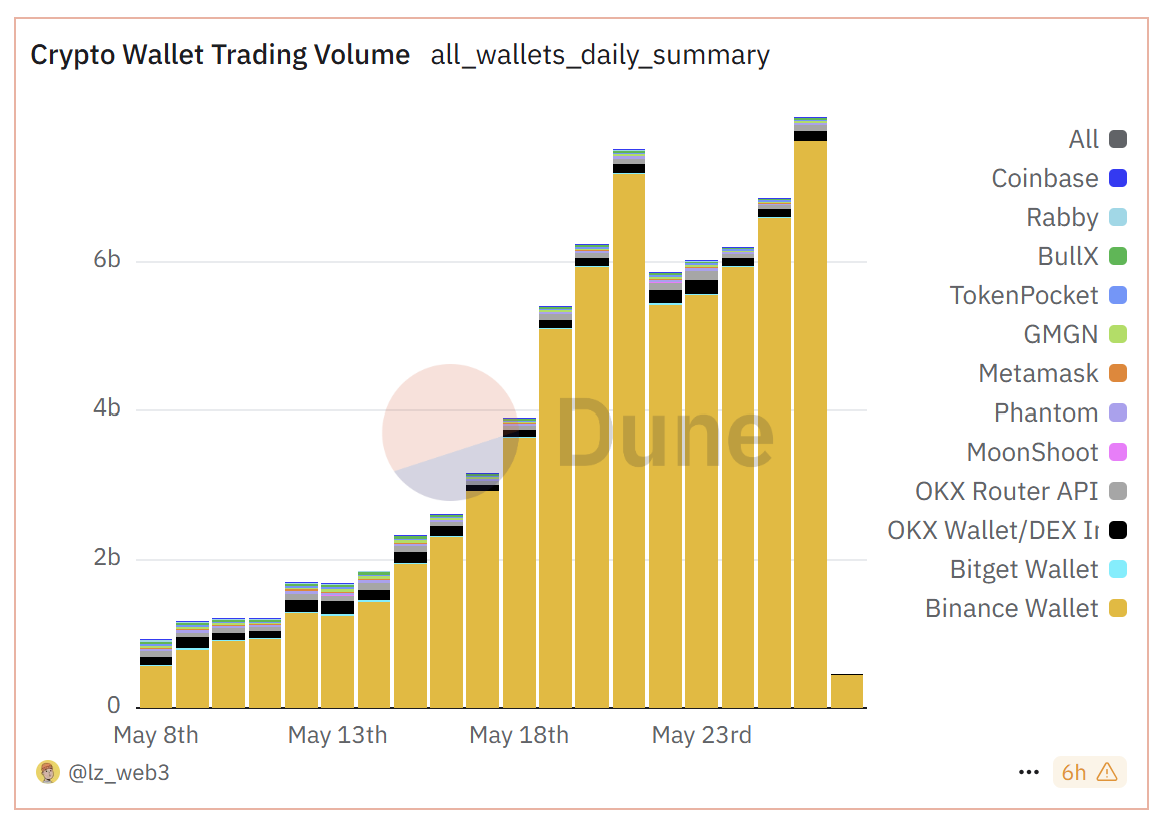

Trading activity on the Binance Wallet has exploded this month. On May 26, it reached $7.6 billion in daily volume — a huge jump from just $200 million at the beginning of May. That is more than 35 times higher in less than a month, which is a pretty rare thing to see.

This isn’t just random growth. Binance launched its own crypto wallet in 2023. It is self-custodial, which means only the user controls the funds. The wallet lets people track their Web3 assets easily and trade across many different networks without leaving the app. It is fast, simple to use, and has access to Binance’s deep liquidity.

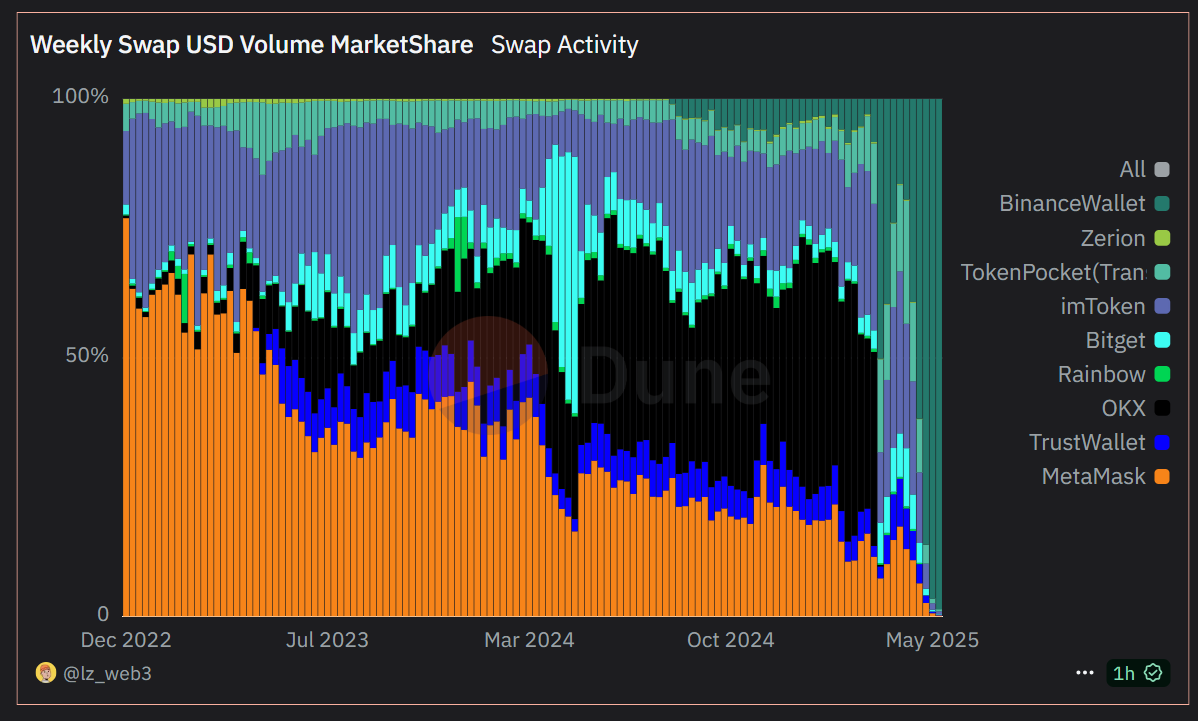

While other wallets also have experienced upticks in activity, none have come close to the scale of Binance’s recent growth. Historically, MetaMask was the dominant force in wallet-based trading, particularly within the Ethereum ecosystem. But Binance’s rapid ascent has redefined what is possible in this space, reaching a level of user activity and trading volume that even MetaMask hasn’t approached.

The key driving force behind this growth is Binance’s existing exchange ecosystem. Unlike standalone wallets such as MetaMask or Phantom, the Binance Wallet is built directly into the main Binance app. This seamless integration eliminates onboarding barriers and leverages the platform’s vast user base, enabling instant access to Web3 without requiring separate downloads or setup.

User growth has mirrored this volume spike. Since the start of May, daily active users of the Binance Wallet have grown 4.5 times, climbing from around 27,000 to over 150,000. By comparison, Phantom, the leading Solana wallet, sees about 30,000 daily users, while MetaMask has around 20,000.

This discrepancy reveals a key insight: Binance Wallet users are significantly more engaged in trading than users of competing wallets. And that is not accidental.

Binance has built powerful incentives to encourage wallet usage. Central to this is the Alpha section and its associated points program. Users earn Binance Alpha Points daily based on their wallet balance and trading volume. The more you trade and the higher your balance, the more points you accumulate, which can then be redeemed for access to exclusive token launches and Alpha airdrops.

Binance also hosts trading contests from time to time, some offering serious prizes, including multi-million-dollar rewards. It is no surprise that users are getting more active, especially when there is something to win just by doing what they would already be doing.

Some critics may question whether this strategy is sustainable, suggesting that Binance is simply throwing money at user growth. However, there is a strong case to be made that it is an effective long-term play. Wallet users tend to be loyal, especially when the experience is smooth, the trading tools are powerful, and there is a real opportunity to earn by simply participating.

At the moment, no other retail wallet is operating at this level. Binance appears to have found a formula that works — and for now, they’re capitalizing on it.

Binance in the Institutional Custody Segment

In the institutional space, Binance has been steadily advancing its custody offerings.

Ceffu (formerly known as Binance Custody) provides a compliant, institutional-grade custody solution, featuring advanced security technologies such as Multi-Party Computation (MPC) and customizable multi-approval workflows. It also offers insured, segregated cold storage through its Qualified Wallet, ensuring that assets are securely held off-exchange.

Binance’s institutional custody services are complemented by a suite of tools designed to meet the needs of corporate clients such as Binance Mirror and risk management tools from TRM Labs.

Overall, the growth of Binance's Wallet and institutional custody services reflects the broader momentum of the group’s performance. While trading fees from its centralized exchange—across both spot and derivatives markets—remain Binance’s primary revenue driver, the company’s 2024 report marked a major milestone: user assets under custody reached an all-time high of $160 billion, with over $30 billion in net inflows.