For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

The provision of crypto services to banking institutions seems to be trending this week: Conio, an Italian FinTech co-owned by Poste Italiane and Banca Generali, announced that it had teamed up with Coinbase as a liquidity provider to give clients, including many banks and financial institutions, expanded coverage of up to 50 tokens. Meanwhile, in neighbouring Switzerland, Rulematch is a new crypto exchange targeted purely at banks and financial institutions. It uses Nasdaq technology and launched with the support of seven banks and securities firms, including Spanish giant BBVA.

Deutsche Bank has also been maintaining its active support of blockchain-based projects the week: The bank-backed custody specialist Taurus has partnered with FinTech lending platform Teylor to tokenize SME business loans for secondary trading on Taurus' TDX marketplace. And Deutsche's asset management arm DWS has announced its intention to launch a euro stablecoin in a joint venture with Galaxy Digital and Flow Traders.

Not to be left out, two of Turkiye's largest banks have launched new crypto initiatives: Akbank has acquired the local crypto company Stablex, while professing its desire to become a key player in the digital asset space. Meanwhile, Garanti BBVA has released its own crypto wallet app, allowing users to send and receive bitcoin, ether and USDC.

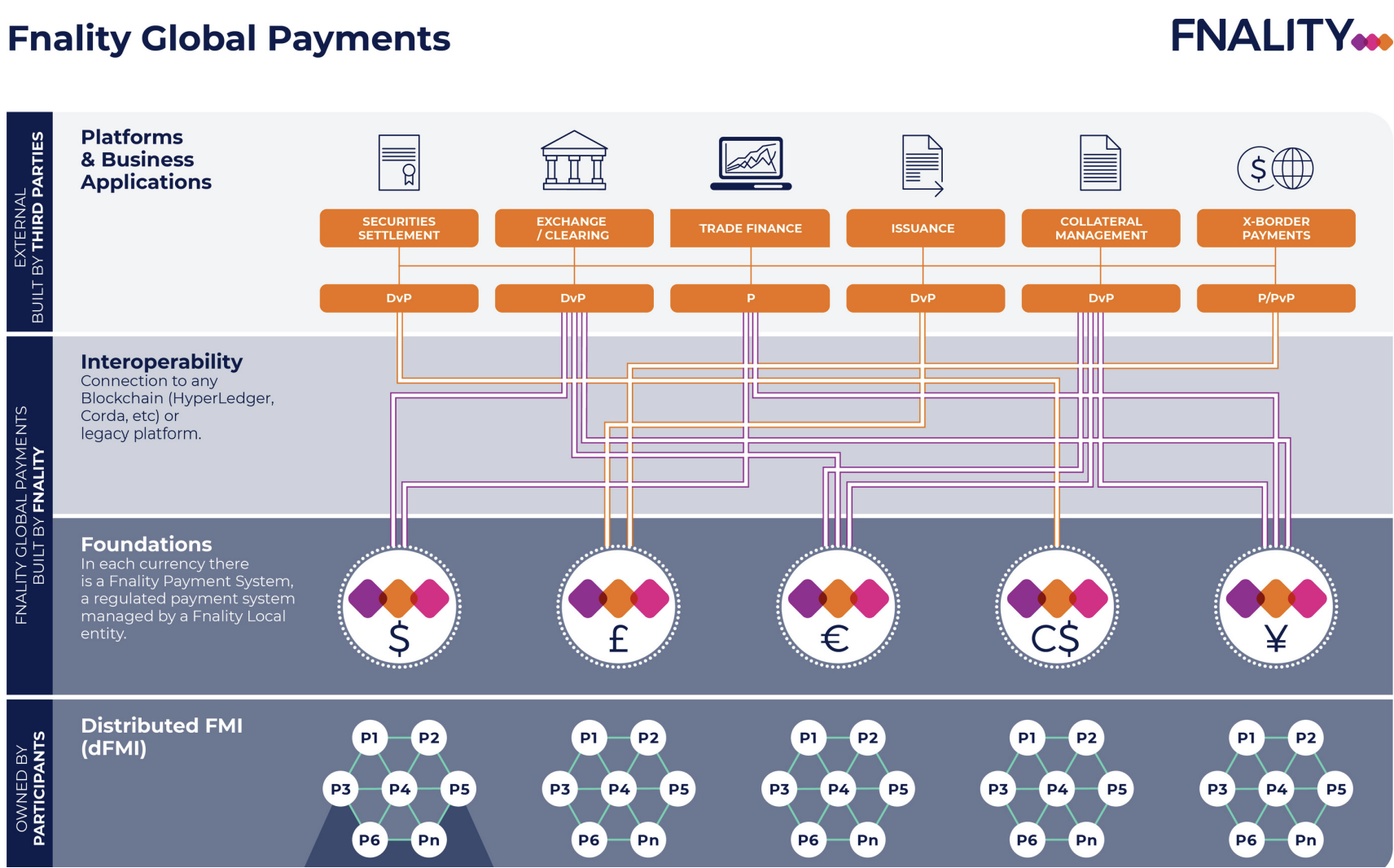

In the U.K., Fnality took its Sterling Fnality Payment System live, with the participation of shareholders Lloyds, Santander and UBS. The announcement marked the world's first live transactions involving digital representations of money held at a central bank, in this case, the Bank of England.

The governor of the Bank of Korea has said that the introduction of CBDCs should be a matter of urgency around the globe, to lessen the economic risks caused by the instability and widespread use of stablecoins. While Kazakhstan has successfully completed the first month-long phase of its CBDC implementation, publishing a report of initial findings and considering the next steps for the digital tenge.

Japan's JCB credit card firm has launched the Phase 2 pilot project of its CBDC project JCBDC which was launched in 2o22 together with French identity technology company Idemia, and Malaysian FinTech company Soft Space. In Phase 2, they will test transferring the CBDC funds between devices using NFC and without Internet connectivity.

Finally, Ripple has released its CBDC white paper, pushing the technology as a solution to expand financial inclusion, streamline cross-border payments and support monetary policymaking.