For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

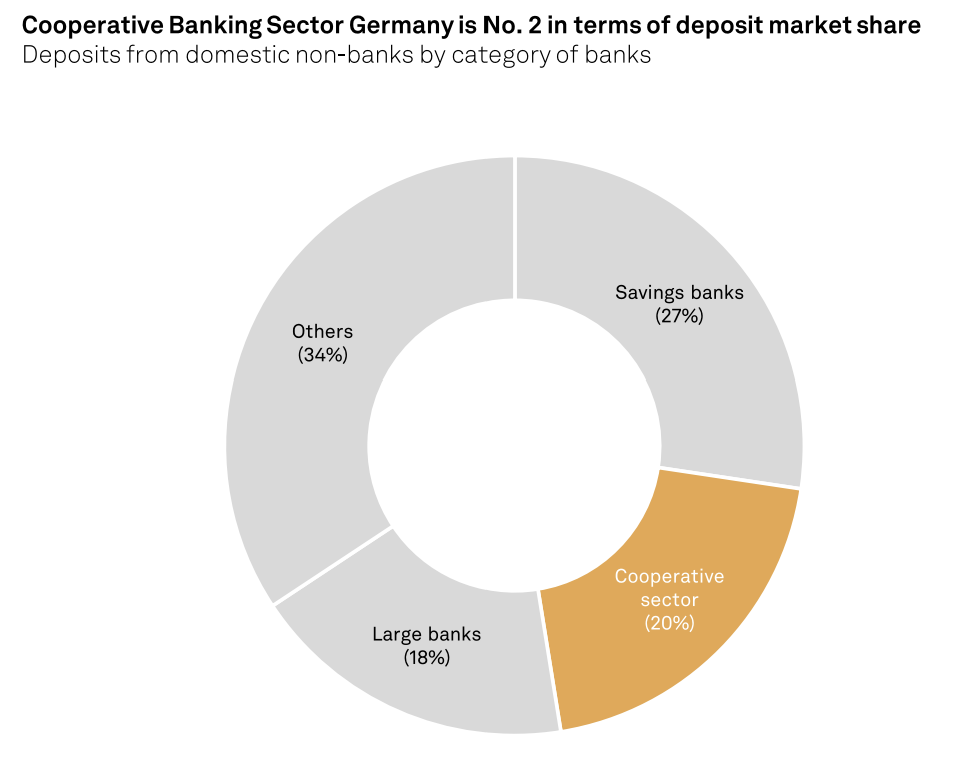

Fresh from launching a crypto custody platform in November, Germany's DZ Bank now plans to offer crypto trading to customers, with a pilot scheme scheduled to start later this year. DZ Bank is the central institution (serving as a central bank) for "Volksbanken Raiffeisenbanken Cooperative Financial Network", which includes more than 700 banks in Germany.

Another crypto-linked institution, the FTX-associated Farmington State Bank, which was subject to a Federal Reserve enforcement action last year, has now had that enforcement action terminated... which would be good news, if not that the reason for the enforcement action being stopped was because Farmington has wound down operations and "no longer functions as a bank."

Some sweet collaborations between decentralized and centralized FinTech. Robinhood has integrated Metamask for its users. Now true adepts can use the non-custodial wallet and keep the keys to their crypto.

Not really decentralized, although still an important part of the crypto industry, Tether has announced a $25 million Series A investment in Oobit, a mobile payments application. Oobit's app empowers crypto holders to Tap & Pay at over 100 million retailers accepting Visa and Mastercard worldwide.

India's CBDC pilot continues to progress, with the latest developments being programmability and offline usage tests. Reserve Bank of India Governor Shaktikanta Das has been championing programmability as a key factor in the evolution of money.

In RWA tokenization news, Hashnote has made its yield-bearing USYC token available through the Copper crypto custody service. USYC is based on reverse-repo operations involving treasury bills, which involve buying and holding the assets overnight with an agreed higher sale price the following day.

And finally, Swiss banking giant UBS has announced the launch of a tokenized warrant in Hong Kong. The underlying asset is an options call warrant with Chinese smartphone manufacturer Xiaomi, which has been tokenized on the Ethereum blockchain and sold to the OSL exchange.