For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

Zimbabwe presented its new 'structured' currency this week, ZiG. The new paper notes will circulate alongside U.S. dollars, reportedly making up around 85% of transactions in a heavily dollarized economy. The governor of the Reserve Bank of Zimbabwe (RBZ), John Mushayavanhu defined "structured currency" as a currency pegged to "a bundle of foreign exchange assets, potentially including gold."

Despite having the same name as the previously announced ZiG digital gold tokens, the two won't be interchangeable. In fact, RBZ said ZiG tokens will be renamed GBDT (Gold Backed Digital Token) and used only as investment instruments.

The (newly named) GBDT was introduced in 2023 in a bid to make smaller denominations of the local physical gold coin Mosi-oa-Tunya available to the population to invest in and even extend its use to fully circulating money. Since May 2023, only around $15 million worth of tokens were issued and no advances were made in the digital infrastructure to support its retail use. It was during the presentation of the paper ZiG notes, that RBZ Governor explained GBDT will remain only as an investment instrument.

Making better news than Zimbabwe's digital currency during the past week were:

- India's e-rupee, extending the pilot distribution to non-bank payment system operators. The deputy governor of India's central bank shared the news, alongside an update on the adoption statistics: 4.6mln users, 400,000 merchants, and 22 million transactions in 1.5 years.

- The Bank of Thailand summarized the results of its 2023 retail CBDC testing project. The test was divided into foundation and innovation tracks, and both concluded with positive results, according to the published report.

- European Central Bank has selected participants for the first wave of wholesale CBDC settlement tests to start in May. The list is dominated by German banking institutions.

Looking to connect the fragmented initiatives of the world's central banks, this week BIS unveiled Project Agorá. The project builds on BIS's unified ledger concept and will attempt to connect different wholesale CBDCs through tokenized deposits of commercial banks. The participating central banks are the Bank of France (for the Eurosystem), Bank of Japan, Bank of Korea, Bank of Mexico, Swiss National Bank, Bank of England, and the Federal Reserve Bank of New York.

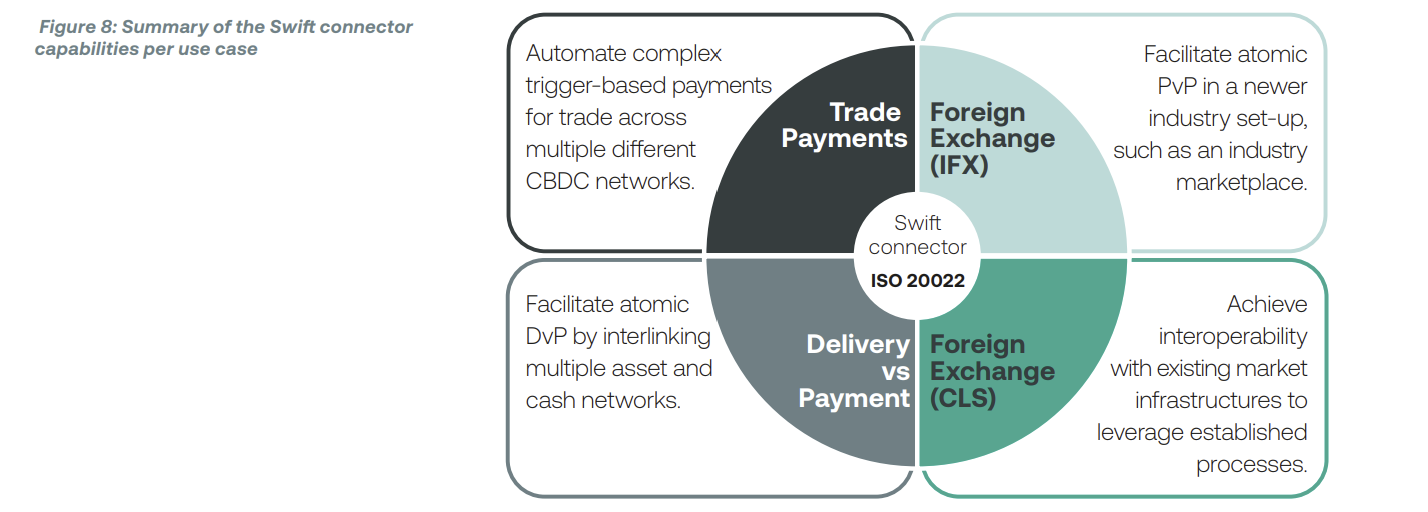

Another institution aiming to connect the world's CBDCs, Swift, published a report on successful tests with its most recent release of the Swift connector.

Swift has been exploring the field since 2021 and is issuing updates regularly, claiming its existing infrastructure is sufficient to handle all expected currency digitalization needs.

In the commercial segment, tokenization of deposits is also the main direction for DLT innovation. Japanese regional bank Hokkoku moved the trend to Japan by launching Tochika stablecoin backed by bank deposits. The technology behind this innovative platform is developed by Digital Platformer, leveraging Hyperledger Iroha, developed by Soramitsu.