The Bank for International Settlements (BIS) recently published its Annual Economic Report 2023, presented as three interwoven threads: a macroeconomic look back, a macroeconomic look ahead, and the journey forward for the digitalization of the financial system.

The first two chapters look at the recent financial challenges in controlling inflation, and how stability can be maintained once this has been achieved.

However, the third chapter gives an unashamedly optimistic outlook on the digitalization of money, claiming that:

“the system could be on the cusp of a major technological leap. Following the dematerialisation of money from coins to book entries and the digital representation of those ledger entries, the next key development could be tokenisation – the digital representation of money and assets on a programmable platform.”

Tokenization enables both the improvement of existing financial processes and the creation of entirely new possibilities, argues the BIS, through the implementation of smart contracts and other technological advancements made by the blockchain industry in recent years.

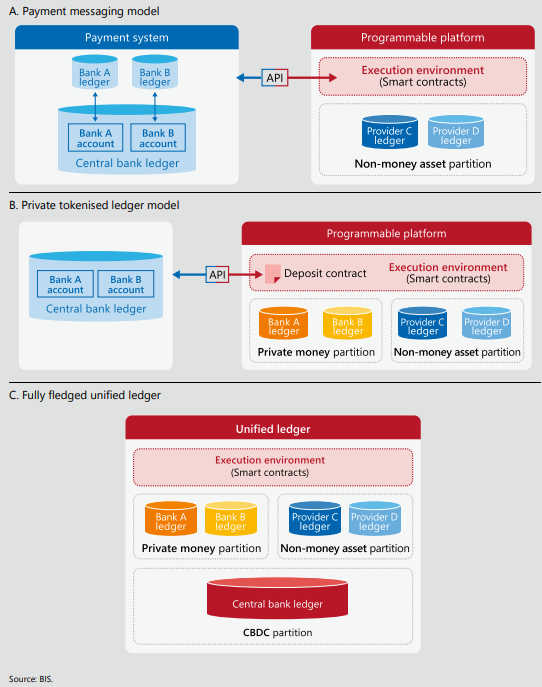

One of the key limitations of the current system, highlighted by the report, is that financial databases are largely proprietary and siloed, requiring third-party messaging systems to interact with each other and presenting an incomplete picture to the participants of the system.

Instead, the BIS suggests a unified ledger, combining central bank money, tokenized deposits and tokenized assets on a programmable platform. This could not only improve existing processes but also enable innovative financial arrangements that are not practical within the current system.

The report explores a use case for peer-to-peer payments, especially those involving cross-border transactions and foreign exchange (FX). The current methods are complex and opaque to users, relying on multiple messaging systems, differences in operating hours, and a number of risks including FX settlement risk.

With a unified ledger this could be achieved using atomic settlement, with all asset transfers and exchanges happening within a single transaction.

Furthermore, the report notes that such a programmable ledger could enable new innovations in supply chain processing, with smart contracts incorporating real-time delivery information making automatic payments on the receipt of goods, or initial part-payments when suppliers acquire the raw materials with which to make them.

Finally, the report states that multiple ledgers may coexist to support different use cases, although these would be connected by application programming interfaces (APIs) to ensure interoperability and a level playing field.

As we recently Observed, the BIS has been busy developing such an API to support retail CBDC functionality, with a ledger-agnostic design and a unified set of commands to enable third-party front-ends to interface with back end account information.