For all the key details of new Distributed Ledger Technology (DLT) projects in the banking world, real-world asset (RWA) tokenization, stablecoins, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

CBDC Updates

The Deutsche Bundesbank has released some interesting research concerning the potential impact of a digital euro. It's found that just 45.9% of Germans would use this CBDC if no interest was offered — rising to 57.3% if interest rates matched what bank deposits receive.

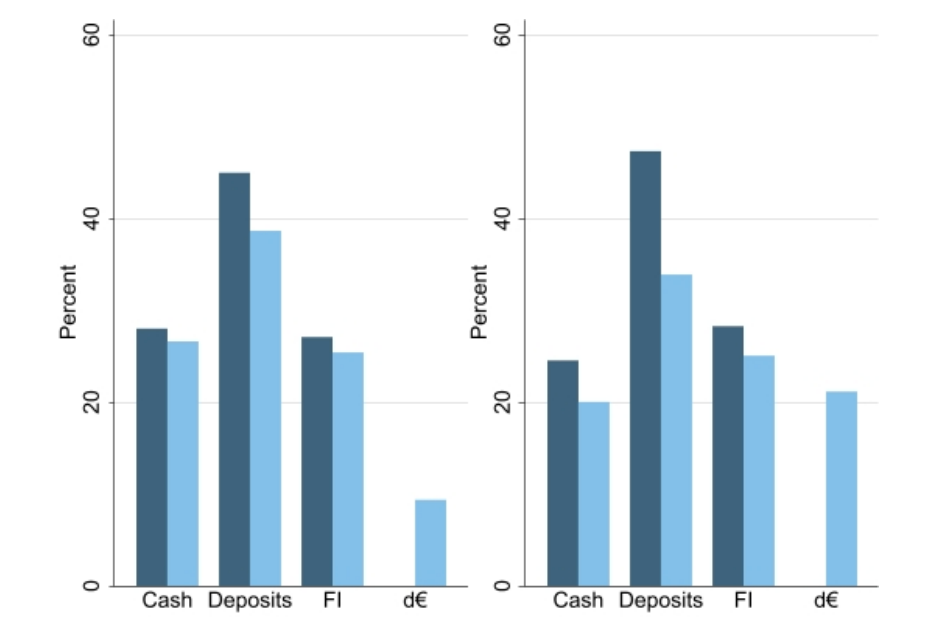

Researchers also examined how a digital euro would affect the use of cash, bank deposits and other financial instruments. The left chart above shows responses from all those who responded to the study, while the right focuses on people who say they are keen on this CBDC. Dark blue bars depict portfolio decisions without a digital euro being introduced; light blue bars represent how the market might change after it's launched.

As you can see, there could be a marked drop in demand for bank deposits once a CBDC launches. Interestingly, the Bundesbank report recommends digital euro holdings among consumers should be capped at a maximum of €2,500 — less than the €3,000 touted by some European officials.

The Bank of Japan's revealed that it may tap into revenue streams potentially generated by a digital yen. Although it wants to detach personal information from transaction histories, a report's suggested anonymized data on past purchases could be sold to interested parties if consumers consent.

Boasting high levels of adoption in digital payments, Chile's central bank has concluded that there's no need to develop a CBDC there... for now. It's going to keep an eye on what's happening in major economies, and may revisit the issue in future.

Meanwhile, Pakistan's finance minister has said a central bank digital currency could help shield women in the country from financial abuse. Speaking at a World Economic Forum session in Saudi Arabia, Muhammad Aurangzeb reportedly said:

"The government is providing cash to the poor women of Pakistan. Women say that the male family members take cash from them ... The women want to get the cash through the digital wallet."

Banking DLT and Tokenization Initiatives

Tokenized transactions at Mastercard have surged — growing 50% in Q1 when compared with the same period last year. One in four transactions on its vast network are now tokenized, with CEO Michael Miebach believing this will only continue to grow. Speaking to investors on an earnings call after Mastercard's latest results were released, he said:

"Whether online or through a wallet provider, our tokens deliver an elevated level of security when payment credentials are shared between the bank and the merchant. This improves the performance of a client's portfolio while supporting new ways to pay. This key differentiator creates a flywheel effect. Lower fraud, higher approval rates and a better consumer experience bring more transactions involved into the Mastercard network, which in turn drives more payments revenue and brings more data."

And BlackRock, the world's largest asset manager, has led a $47 million funding round in Securitize, which is continuing its push to digitize capital markets on the blockchain. Securitize has recently facilitated Blackrock's first tokenized fund, BUIDL, launch on Ethereum blockchain. BlackRock's CEO, Larry Fink, has repeatedly spoken of his belief that every financial asset will be tokenized one day — opening the door to a new multitrillion-dollar market.