Recent observations by Bitcoin researchers suggest that Bitcoin mining maybe even more centralized than previously thought. Researchers claim that several Bitcoin mining pools, previously considered independent, share identical methods for prioritizing transactions. This similarity raises suspicions that these pools may actually be under the control of a single entity.

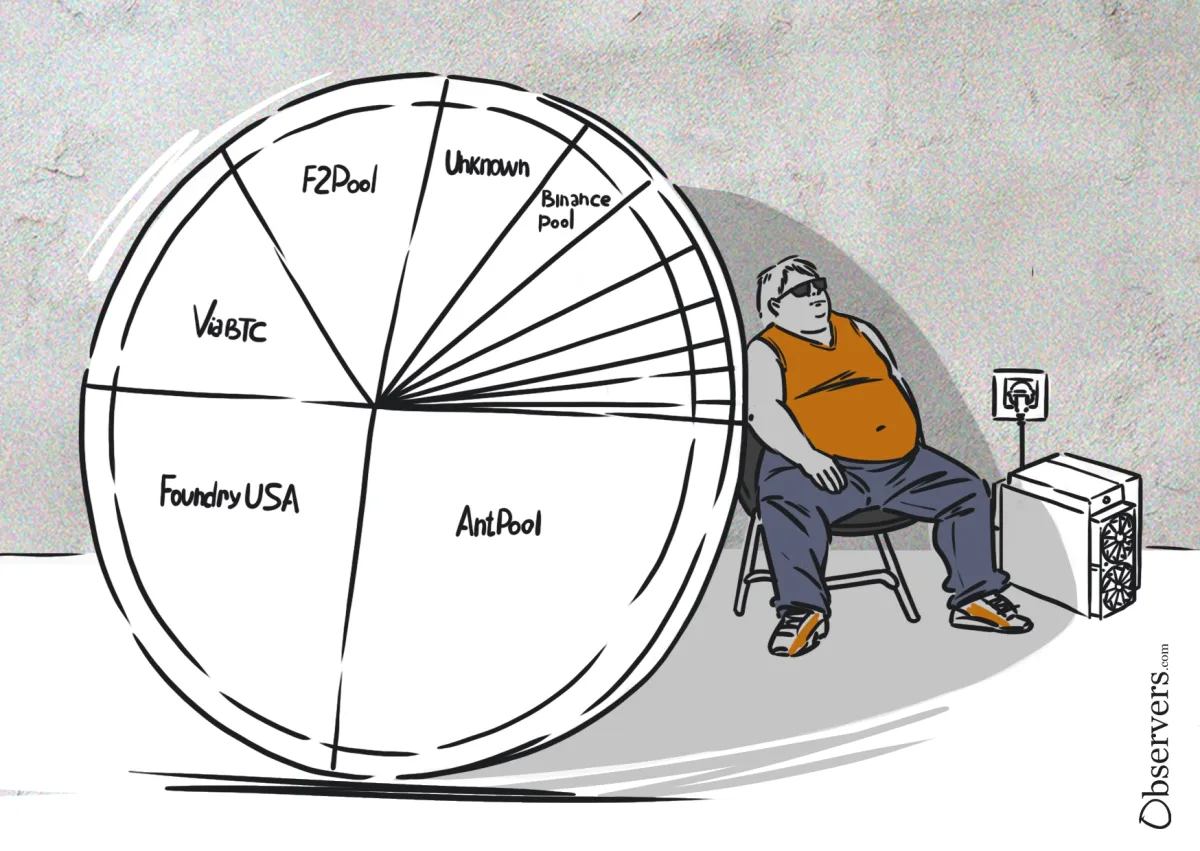

According to the data from Blockchain.com, the top three Bitcoin mining pools control over 64% of the total Bitcoin hashrate, indicating a centralization issue. Centralization is problematic because if any single party controls at least 51% of the network’s computing power, they can dictate which transactions are processed and potentially alter the network’s transaction history to double-spend coins.

Interestingly, the ownership of many pools remains unknown, and there is speculation that some may be controlled by a single entity, potentially centralizing the network even more. Bitcoin developers have already started to uncover evidence supporting this theory.

One such Bitcoin developer, 0xB10C, suggests that the top pools might be more centralized than initially thought, with AntPool alone potentially controlling almost 50% of all Bitcoin hash power. His findings indicate that several pools, including BTC.com, Binance Pool, Poolin, EMCD, Rawpool, and possibly Braiins, not only use the same transaction prioritization template as AntPool but also direct their Coinbase and transaction fees to the same custodian used by Bitmain.

In fact, a single custodian now manages the Coinbase addresses of at least 9 pools, which collectively represent 47% of the total hashrate. This points to a potential scenario where AntPool might be utilizing third-party pools to disguise its dominance in the sector.

Notably, AntPool, the largest player in the market with a 27% “official” share, is owned by Bitmain—the dominant manufacturer of Bitcoin mining equipment. This dual dominance of both equipment manufacturing and hashrate share by Bitmain is a startling revelation.

This situation has also garnered attention from other Bitcoin developers. During a podcast discussion, Matt Corallo, also a Bitcoin developer, supported the findings of 0xB10C and acknowledged the possibility that nearly 50% of the hash power could be centralized under one entity.

Bitmain is not the only large crypto company trying to control Bitcoin’s hash power. For example, Foundry USA, a pool with a 23.5% market share, is owned by Digital Currency Group. This firm is a major investor in the crypto world, owning businesses like Grayscale and many others.

Additionally, ViaBTC, the third-largest mining pool, has Bitmain as its sole investor. It has achieved significant success recently, especially after mining the first block following the Bitcoin halving on April 20. The ‘epic’ satoshi contained in this block was sold for 33.3 BTC.

AntPool and Bitmain, as well as other large miners, have significant investments in Bitcoin and are unlikely to act fraudulently as it could harm the network and their business. However, their control over a large part of the network poses a risk because it centralizes power, creating a potential single point of failure or attack.

Bitcoin whitepaper had no mention of any special mining caste. The incentive in the form of issued coins was designed to motivate network nodes to stay honest and compensate for their operational costs. However, currently, the network nodes and mining actors are effectively separate.