For all the key details of new blockchain projects in the banking world, real-world asset (RWA) tokenization, and central bank digital currency (CBDC) updates, the Observers 'Banking and CBDC Roundup' has you covered.

On January 29, the UAE sent its first cross-border digital dirham payment via the mBridge CBDC platform. mBridge is a collaboration between four central banks (China, Hong Kong, UAE and Thailand) with the participation of the Swiss-based Bank of International Settlements (BIS). However it is significantly influenced by China, as the technical development and major components, such as the consensus algorithm, are authored by the Chinese. Some observers see mBridge as another attempt by China to overcome the reliance on Western financial infrastructure, such as SWIFT.

The interesting part of the mBridge design is that, technically, a central bank does not need its own CBDC to join, because the platform can connect directly to a Real Time Gross Settlement (RTGS) system and convert central bank reserves to digital currency.

Nevertheless, many countries continue to develop the technology. Last week, the Bank of Japan brought up necessary legislative changes at an initial meeting with the country's government. The BOJ is in the final, testing stage of its CBDC project, which was launched in 2020.

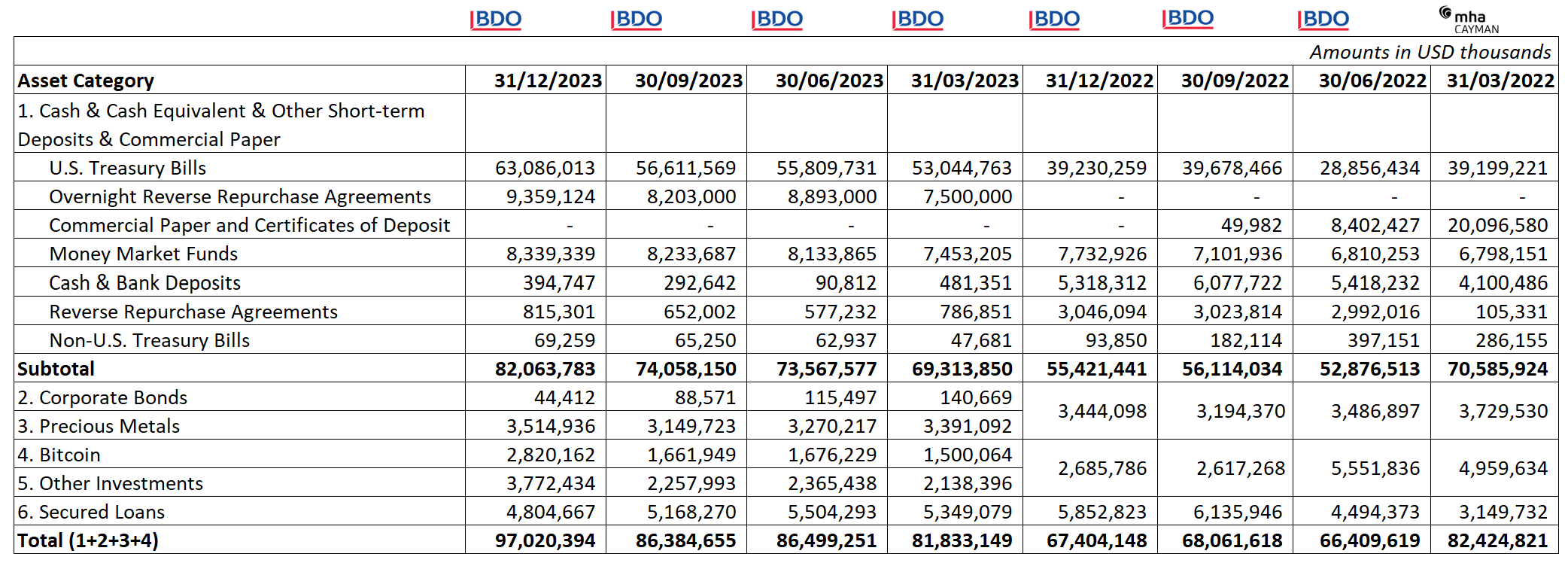

Meanwhile, commercial digital currency projects such as stablecoins see much stronger traction than CBDCs without any legislative or political backing. Tether posted another record quarterly profit this week along with its regular reserve attestation.

The main reserve categories rose in line with the stablecoin issuer's increased capitalization. The Bitcoin and Other Investments categories (presumably crypto) have almost doubled since the beginning of the year; however, most of the increase is attributable to the price increase of the underlying assets.

Tether's main contender, Circle, continues its strategy to extend its presence on different blockchains. This week, it announced the launch of USDC on RWA focused platform Celo. The Celo governance body is considering including USDC as an official gas currency for their blockchain.

While blockchain companies are focusing on Real World Assets, the drop in demand for real physical assets, U.S. Commercial Real Estate (CRE) and the unfavorable monetary environment is bringing down commercial banks. Ironically, a bank that acquired assets from a failed crypto bank a year ago has been hit by this non-crypto-related crisis. New York Community Bank, which purchased assets of the troubled Signature Bank, saw its shares sink 37% after announcing a dividend cut and charging off multiple real estate loans.

On top of this, some banks, such as the family-owned Vast Bank in Oklahoma, have chosen to exit the crypto market. The bank is removing the option for cryptocurrency investments through its mobile app, a service that was introduced in collaboration with Coinbase and SAP software in 2021.