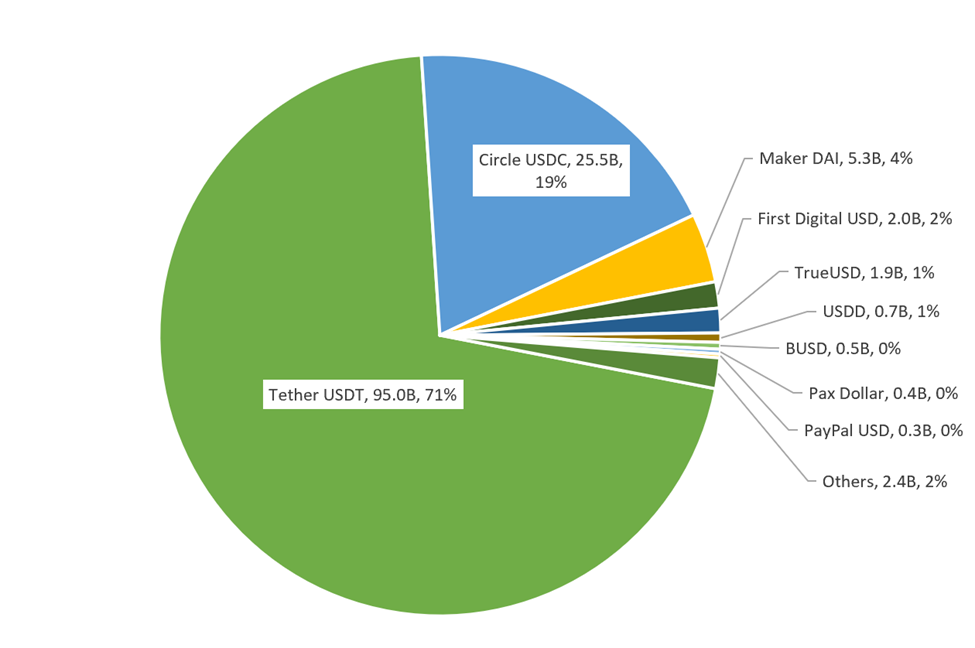

Tether’s USDT is one month from potentially reaching a $100 billion market cap. Its market share in the stablecoin segment is also growing, reaching more than 70% of the total market cap. The closest rival, Circle’s USDC, has lost half of its capitalization since we last checked in, although it has just reported an all-time high number of wallets with balances of $10 or more.

The only ‘decentralized’ stablecoin, MakerDAO’s DAI, has also lost 40% of its capitalization during 2023, yet still holds third position overall. It should be noted, however, that the project now has only a quarter of its volume operating according to the original model, while the rest follows Tether’s model of tokenized dollars issued against fiat.

A recent addition to the stablecoin race, First Digital’s FDUSD, has attracted an impressive $2 billion in volume, leaving more experienced players such as Justin Sun’s TUSD and USDD, Binance’s BUSD and Pax Dollar in the dust. The project was launched in June 2023 by the Hong Kong-based First Digital Group and skyrocketed its supply due to a zero-fee promotion on Binance.

The vastly more promoted launch of the PayPal stablecoin in 2023 had a vastly more modest success, with only $300 million capitalization after 6 months of operations.

So what has made Tether the preferred product for the blockchain? The answer to this question might also hint at what could be a winning feature for so many struggling Central Bank Digital Currencies (CBDCs)

The first thing to note is the choice of rails: a full 50% of USDT is transacted on the cheap and fast Tron, while an equivalent 50% of USDC is on Ethereum with its high transaction fees and frequent clogging.

A second factor, in our opinion, is Tether’s balanced position when it comes to compliance. In contrast, Circle tried to be ‘more Catholic than the Pope’, blocking addresses associated with the sanctioned Tornado cash mixer without receiving any official instructions to do so from an authorized agency. This resulted in an immediate outflow of around $2billion of funds from USDC to USDT.

Tether is also displaying a cooperative approach with U.S. lawmakers, but doing it without excessive euphoria. Instead it reports with the minimum legal transparency, remains in an off-shore jurisdiction and is not thought to be considering an IPO.

Tether's dominance could also be down to Circle's bet on DeFi not paying off as well as it had hoped. USDC managed to secure more than half of the market share in decentralized exchanges and other dApps. However, the significant contraction of DeFi since its peak in 2022 has brought USDC volumes down. USDT, on the other hand, is a coin of choice for Latin American, African and Asian remittances and daily spending – a market that can only grow.

In this respect, Tether is winning the digital currency race not only among stablecoins but also among CBDCs, essentially issuing a digital dollar in lieu of the United States. The current leader in the CBDC league, China’s digital renminbi, has announced a milestone of 950 million transactions per year, less than 2/3 of all USDT transactions. The total digital renminbi transaction value of $250 billion is also just a fraction of USDT’s impressive $11.6 trillion in 2023. While other countries are struggling to digitalize their currencies, the dollar is moving on blockchain rails without any research papers, customer studies or lawmaking support.

Tether's stablecoin is also an impressive business enterprise. $100 billion market cap puts it in the range of companies like UBS, CityGroup and BlackRock, and its reported annualized revenue of $4 billion is in line with the financial industry’s averages.

Tether’s unique niche between the money minting and payments business, between traditional and decentralized finance, between the regulated and wild economies makes it one of the most interesting operations of the 21st century.