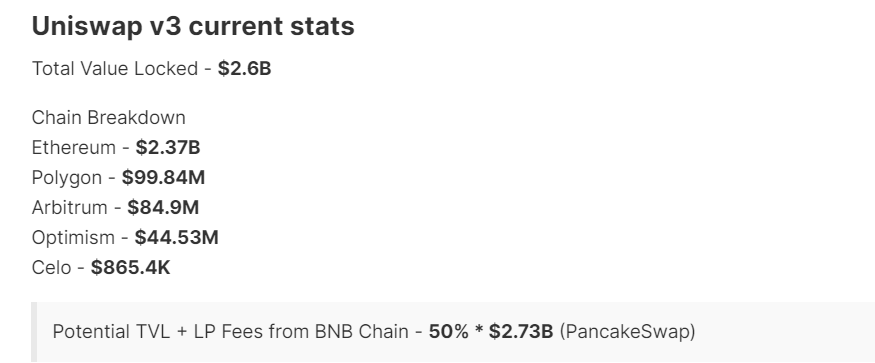

Uniswap v3, the world’s largest decentralized exchange by trading volume, is facing the expiry of their Business Source License 1.1 (BSL), which was launched on April 1st, 2021, and restricts the external use of their source code for 2 years. On April 1st, 2023, any competitor will legally be allowed to use the Uniswap v3 source code and deploy it on any blockchain they choose to replicate the DEX’s UI and functionality. For this reason, the Uniswap community wants to get ahead of potential copycats and deploy on the most popular protocols themselves, including BNB Chain.

Over the past several weeks the Uniswap DAO has held a series of governance proposals, which ended with 66% of DAO delegates voting in favor of the move. Delegates with major voting power including Ethereum software company ConsenSys and Compound Finance founder Robert Leshner voted in favor of the proposal.

An interesting twist in this story led to a review of the decentralized governance again: there was disagreement on the bridge to facilitate the expansion to BNB Chain. The two contenders left standing after many community discussions were Wormhole and LayerZero. Wormhole was ultimately chosen, but not without some significant contention from LayerZero backer and web3-renowned VC firm Andreessen Horowitz (a16z).

A16z holds 15 million UNI tokens, which is 1.5% of the total supply, but revealed after an initial vote that their custody structure prevented them from actually using the tokens to support their position. If their tokens had been used to vote, the 15 million swing would have changed the outcome of the vote and LayerZero would have been chosen, given that Wormhole only won by 11 million votes.

Despite this, Uniswap Foundation Executive Director Devin Walsh stated in a Feb 1st post on the Uniswap governance forum that they would move forward with the results of the most recent vote, which did not include a16z’s tokens.

Porter Smith, a partner at a16z, responded by outlining the firm’s dissatisfaction with the decision to use Wormhole, pointing to concerns about centralization and security and citing the bridge’s $326M exploit from last year along with other vulnerabilities.

“As Uniswap token holders, we are ultimately interested in the long-term success of the Uniswap protocol. We hope to see the Binance deployment process restarted so that all bridge providers can participate in a formal assessment process. We will evaluate all bridge providers in good faith and subsequently vote in the best interest of the Uniswap protocol’s future growth and success,” Smith went on to say.

Some instances of online speculation accuse a16z of advocating for their own financial interests rather than what is best for Uniswap, and others have offered the opinion that a16z as one entity shouldn’t be able to vote at all because their tokens are merely under management for investors and their collective vote doesn’t represent the will of each investor. One Twitter user asked rhetorically “should CZ vote with tokens that are locked on Binance?”, to which the Binance CEO replied “No, we will not do that. We let the community decide.”

The controversy was hashed out in the governance forum, and as a result the Uniswap Foundation has introduced a new cross-chain bridge assessment process which all parties appear to be satisfied with. The new process will aim to remove inefficiency in the governance process, provide greater clarity around the proposed bridges, and support delegates and community members in making informed decisions.

According to Uniswap’s website, they intend to have a final report including an assessment of all considered bridges published by March 27, just 5 days before their BSL expires and competitors can start copy-pasting their code.

Over the past few months, the Uniswap DAO has seen several proposals to expand the protocol to other blockchains as well, including Moonbeam, StarkNet, and Boba Network. Many more proposals are expected to go live before April 1st. Given the popularity of Uniswap within the Web3 ecosystem, a slew of new deployments could revitalize the enthusiasm surrounding decentralized trading and asset acquisition. We continue to observe.