It’s been a busy week for the Securities and Exchange Commission (SEC) legal team. A legal team, let’s not forget, whose bills are covered by U.S. taxpayers.

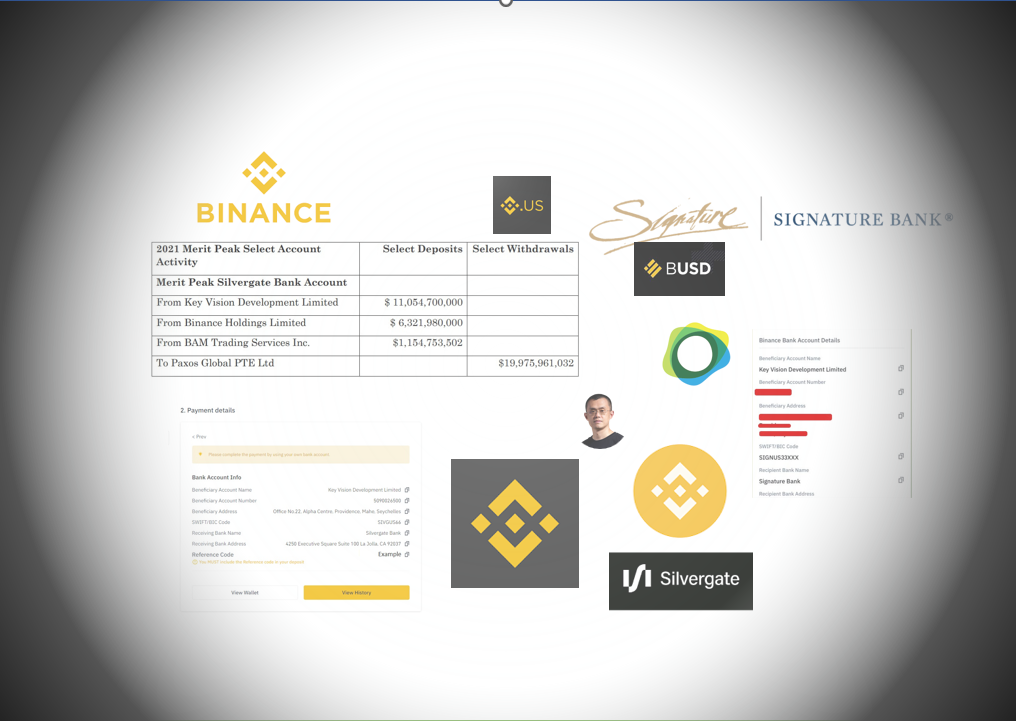

On Monday it filed a suit suing Binance-US and CZ, for mishandling customer funds, lying to just about everyone and indulging in a spot of manipulative trading. On Tuesday, after it had finished suing Coinbase, it asked a federal judge to temporarily freeze the assets of Binance.US. And on Wednesday it filed supporting documents for the asset freeze, showing that Binance (and associated companies) had shifted some $70 billion through the recently-failed ‘crypto’ banks, Silvergate and Signature.

Binance, for its part, claimed it had done nothing wrong and would vigorously defend against the action… and anyway, that money didn’t belong to customers, and transferring funds to various global locations, including entities in Kazakhstan (oasis), Lithuania and the Seychelles, is all in the course of normal business operations.

It should be noted that the SEC did not put forward any theory as to why key Binance staff were moving this money around. And while the movement of such large amounts of money requires banks to file a suspicious activity report (SAR), the regulator did not say whether such reports had been filed by Silvergate or Signature.

The New York Times first reported the filing, noting an instance in February 2022, when $20 million flowed into one of Binance’s Silvergate accounts, and a few days later $19.9 million flowed out of it. On another occasion, a “Binance account at Signature reported $1 billion in deposits and $1.3 billion in withdrawals all in the same month.”

So is the SEC’s attempt to justify a freeze on assets just based on Binance moving (albeit very large) sums of money around?

Bloomberg took up the gauntlet and instantly upped the ante to $70 billion, with $50 billion in deposits for Binance-related parties facilitated by Silvergate, and over $19 billion handled by Signature.

In 2020 and 2021, a Binance entity called Key Vision moved more than $13 billion through Silvergate Bank, with almost all of this eventually going to an entity called Merit Peak, which the SEC says is also controlled by CZ.

Over the period from 2019 to 2021, Merit Peak accounts received a grand total of $22 billion, most of which was paid to a foreign affiliate of Paxos, which was issuing the BUSD Stablecoin at the time.

Binance had already told Reuters that customer deposits were not being commingled with company funds, and that users who sent money were buying the Binance-branded Stablecoin rather than making deposits.

It is hard to know whether Binance was deliberately obfuscating the money trail (although obviously not very well if the SEC knows where it all went), or was forced was use a network of shell companies due to the lack of regulatory clarity and crypto support in the U.S.

It would seem presumptuous to use the movement of money as justification for freezing assets before at least giving Binance the opportunity to explain the transfers (as it already had with the Paxos funds).

But then… the SEC is seeming rather presumptuous these days.

It’ll all end in tears, as our mother used to tell us. And we shall here to Observe when it does.