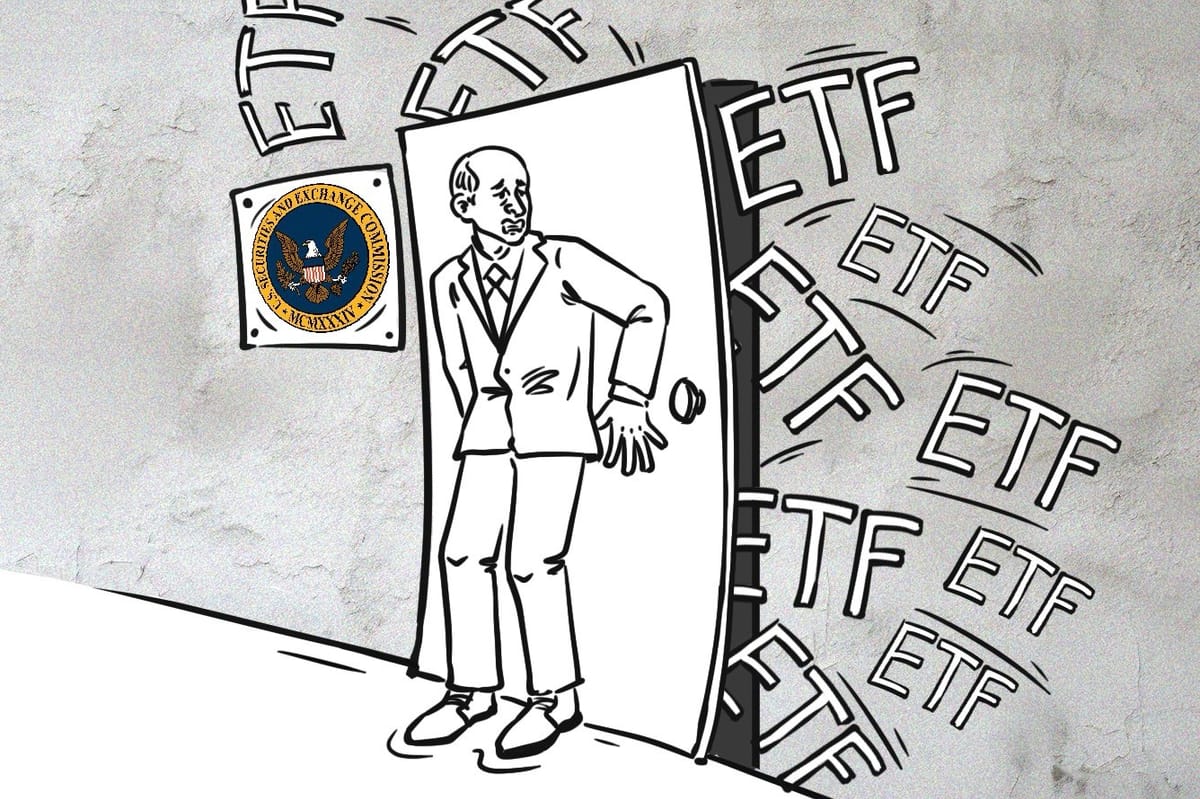

The approval - or denial - of at least two spot bitcoin exchange-traded funds (ETF) is now upon us. At some point today, the U.S. Securities and Exchange Commission (SEC) has to give its decision on proposals from Ark Invest and 21Shares.

After a false alarm yesterday when the SEC's X account was reportedly 'compromised' and a hoax approval confirmation posted, the entire industry has been holding its collective breath in anticipation. It has been alleged that the SEC did not have two-factor authentication enabled, and many have questioned how a key regulator of financial markets could be so lax on its own security.

While less than half of financial advisors questioned believe that an ETF will be approved in 2024, the market, including the SEC, appears to be actively preparing for their launch. Here are our Observations as the deadline looms.

According to some sources, SEC officials are actively engaged in communication with the would-be ETF issuers. After amending their S-1 forms and announcing new fee rates on Monday, the companies received feedback from the authorities the same day. According to a person familiar with the matter, the comments are connected to minor details in S-1 forms and should not delay the deadline for a potential ETF approval, as Coindesk reported.

The promptness of the SEC response and the fact that the agency is still engaged in conversation with the applicants just days before the deadline has raised hopes among the community that the SEC will this time give a clear answer on spot bitcoin ETFs. Meanwhile, some have suggested that the latest comments instead could be a reason for another delay.

Another encouraging fact is that former SEC Chairman Jay Clayton said in an interview with CNBC that the approval of the first spot Bitcoin ETF for trading in the U.S. is “inevitable,” and there is “nothing left to decide.” He explained that over the past five years, the agency had to deny every application of that kind due to unsafe market conditions and lack of proper infrastructure and that by now, the market dynamics for Bitcoin have improved significantly, allowing the authority to finally make the big step.

The positive anticipation has been heating up the market. BTC price has risen as it has risen in recent weeks and months, reaching $47,000 on Tuesday after the hoax approval before dropping back. Approval might push Bitcoin’s price even higher, while a delay or refusal could change the trend, according to an expert from LMAX Group. Standard Chartered has stated that the SEC is expected to approve spot bitcoin ETFs this week and predicted that the coin could reach $200,000 by the end of 2025, calling the approval a key driver of the price upside.

While the market is waiting in - mainly positive - anticipation, Gary Gensler has stayed true to himself, warning about the significant risks of crypto investments, including frauds, scams, price volatility, etc. This could be considered a final warning before making ETFs available for the general public, or equally a justification for a(nother) denial.

It remains to be seen whether the SEC will approve one or more of the open spot bitcoin ETF applications - and let’s remember that despite all the positive news and media hype, denial is still an option.

What happens after the decision is a different story. In the bull scenario, millions of people and financial institutions will become exposed to Bitcoin and thus dependent on it, which would hopefully make the authorities more friendly and accepting (but probably not less strict) towards crypto assets. The bear case is also possible as there are high chances that crypto is not mature enough for this kind of "popularity" and that the decentralised essence of Bitcoin will eventually prove a poor fit for the traditional financial system.