Tether, together with BDO, has released the latest Consolidated Reserves Report (CRR) for 2022. Let's delve in for more detail.

#Tether Continues To Demonstrate Strength Of Reserves, Reveals $700m Profits For Q4/2022 In Latest Attestation Reporthttps://t.co/NlPLC3Qil9

— Tether (@Tether_to) February 9, 2023

This is the third quarterly report audited by Milan based BDO Italia. Previously, the company had also published its reserves, but they were reviewed by less reputable Cayman based accounting firms. As with the previous audit reports, this one is also applied only to the reserves report and not financial statements of Tether. There is an Emphasis of Matter paragraph, which, if translated from audit jargon, means the auditors provide unmodified, “clean" opinion on the statement but attract investors’ attention to significant assumptions or circumstances disclosed in it.

Commercial paper reserves are reduced to zero.

One of Tether's main goals for 2022 was to reduce commercial securities in reserves to zero. This step was supposed to make the company's work more transparent. With every month in 2022, the number of commercial papers in the reserves of stablecoin decreased, and in October Tether managed to completely get rid of commercial papers in its reserves.

3/ In 2022, Tether, as promised, reduced to 0 commercial papers, and just before the end of the year promised a reduction of secured loans throughout 2023. The process started already.

— Paolo Ardoino 🍐 (@paoloardoino) February 9, 2023

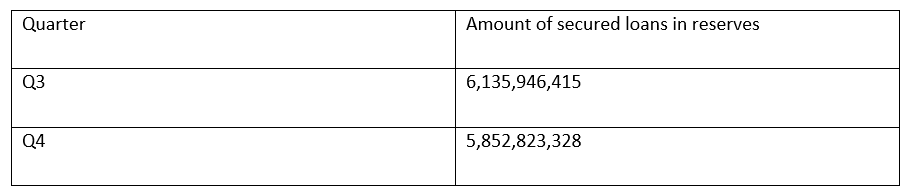

A slight reduction in Secured Loans category.

In 2022, the company also set a course to reduce the number of secured loans. According to the plan, Tether will reduce the number of secured loans to zero during 2023. According to Tether, secured loans have been reduced by $300 million. Secured loans category includes so called "loaned" Tether coins, they are put into circulation directly, without exchange for fiat. The reserves report for the third quarter disclosed the total amount of these loans to the tune of $6.1 billion, classified as "Secured loans" in the reserves table.

Assets exceed liabilities.

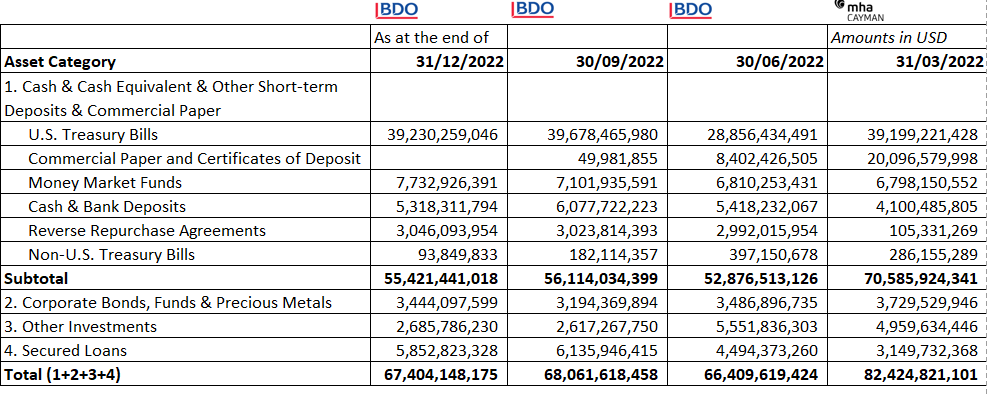

According to the report, as of December 31, 2022, Tether's consolidated assets amount to about $67 billion, while the company's consolidated liabilities amount to about $66 billion. Thus, the excess reserves amount to approximately $960 million. This means that consolidated Assets exceed consolidated liabilities.

“The Management of the Company asserts the following as of 31 December 2022: -The Group’s consolidated total assets amount to at least US$ 67,044,148,175 -The Group’s consolidated total liabilities amount to US$66,083,530,757, of which US$66,057,260,169 relates to digital tokens issued -The Group’s consolidated assets exceed its consolidated liabilities”

The distribution of the company's assets is as follows.

Tether profits.

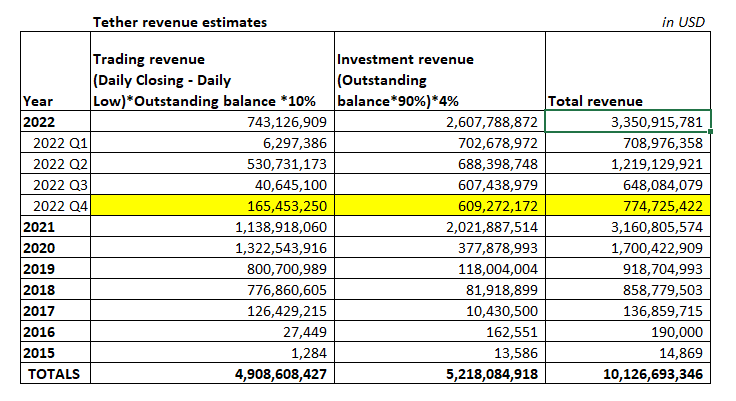

Together with the announcement of the report, the company, for the first time, has disclosed some information about its profits. A message on the official website of Tether, says that the company received more than $700 million in profit for the last quarter of 2022 and that the profit went to the reserves of the stablecoin.

We tried to understand the sources of Tether profits by applying the following assumptions to its investment and trading activities:

- Investment rate: 4%, funds invested under this rate: 90% of market cap;

- Trading activities: the difference between USDT daily low and closing price, funds used in trading 10% of market cap.

”This latest report demonstrates its commitment to transparency and highlights a $300 million reduction in secured loans, more than $700 million net profit added to Tether reserves in the last quarter 2022, and the highest percentage to date of assets allocated in US Treasury Bills, with direct exposure of over 58%.” - it is written in the message.

With the above assumptions, we have arrived at quite close figures for the reported Q4 results. If applied to all historical periods of Tether, one can assume that the company did more than $10 billion in revenue since 2015.

Results of 2022 for Tether.

We can say that in 2022, despite all the difficulties, Tether was quite successful. USDT is still the most popular stablecoin, dominating the crypto market. Commercial securities according to the plan are reduced to zero. Despite the crisis in the industry, the company is making a profit and working on new projects. It seems that CTO of Tether, Paolo Ardoino, is also satisfied with the results of 2022:

“With the presentation of this latest consolidated reserve report, Tether continues to deliver on our promise to lead the industry in transparency. After a tumultuous end to 2022, Tether has once again proven its stability, its resilience and its ability to handle bear markets and black swan events, setting itself apart from the bad actors of the industry. Not only were we able to smoothly execute over $21 billion dollars in redemptions during the chaotic events of the year, but Tether has on the other side issued over $10 billion of USD₮, an indication of continued organic growth and adoption of Tether. Last quarter, Tether generated over $700 million in profits, adding to its reserves. We are proud of how Tether has continued to be a driving force in rebuilding trust within the crypto industry and we are determined to continue to set a positive example for our peers and competitors alike.”

We will continue our observations on the activities of Tether and their USDT stablecoin. We will be waiting for the next quarterly report and will definitely inform you about the news!