The reserve report audited by Milan based BDO Italia, is the second publication of Tether’s reserves after the company announced that it engaged this top firm for monthly reserve audits. Previously, the company had also published its reserves, but they were reviewed by less reputable Cayman based accounting firms. As with the first audit report, this one is applied only to the reserves report and not financial statements of Tether. There is an Emphasis of Matter paragraph, which, if translated from audit jargon, means the auditors provide unmodified, “clean" opinion on the statement but attract investors’ attention to significant assumptions or circumstances disclosed in it.

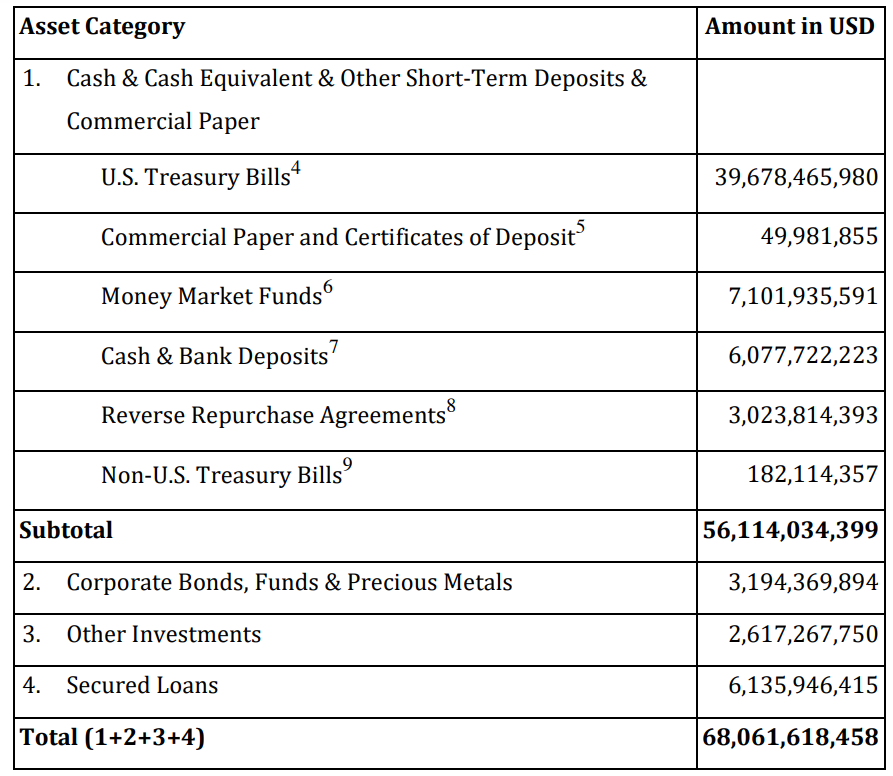

The corresponding figures are as of 30 September 2022 and do not have a comparable for any previous period. The whole reserve report is six pages long with an “assertion” of assets (USD 68,061,618,458) and liabilities (USD 67,811,510,720, of which USD 67,805,112,981 relates to digital tokens issued). The breakdown of assets is compiled as follows:

Tether proudly reports a large share of US T-bills in its reserves 58% and up to 82% of funds classified as Cash and Cash Equivalents and Other Short Term Deposits. This is a significant improvement since the company announced its plan to limit the exposure to commercial debt.

The reserve report is signed by Jean-Louis Van Der Velde, CEO of Tether and Bitfinex. The Chief Financial Officer of Bitfinex and Tether, Giancarlo Devasini, who left his Milan based surgeon career in 1992, was not included in the report’s signees.

Within the notes to the report we can see a disclaimer that “This report is prepared using the recognition and measurement principles of IFRS …, but does not contain sufficient information in terms of general presentation, required primary statements, and disclosures in order to comply with IFRS.”

In particular, “Tether tokens issued have been classified as refund liabilities in line with IFRS 9, which are repayable on demand, and are recorded at the contractual redemption value of the tokens. This is the same standard that regulates accounting for the refund of returned products. While this standard allows to reasonably estimate the amount of “goods” likely to be returned, Tether report accounts all tokens in circulation as potentially refundable. The only adjustment done is 1% redemption cost (USD 678,051,129). Worth mentioning, if we add back this discount, the reported liability of Tether will fall short of reserve assets by around USD 400 million.

There is no mention about reserves of the company formed from the retained earnings. However, since the last quarter, the net reserves (assets less liabilities) have increased by around USD 60m million, which was also mentioned by the CTO of Tether, Paolo Ardoino in his tweet:

New #tether attestation is out!! (As of 30 September 2022)

— Paolo Ardoino 🍐 (@paoloardoino) November 10, 2022

As promised the CP reduced to 50m (0 as of now).

Increased US T-BILL.

60m more in exceeding reserves for a total of 250m.

Increased percentage of cash and cash equivalents to 82%.

Proud of the work of the team! 🔥 https://t.co/4t8UDwonHT

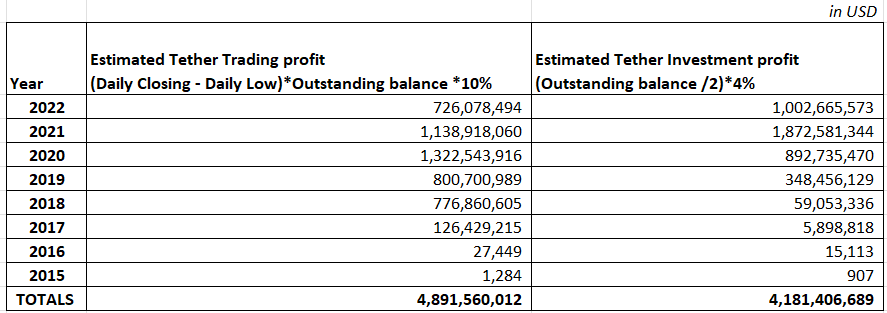

If we apply an average rate of return of pension funds of say 4% to the half of the outstanding balance of Tether, then we will come to investment return of around USD 4 billion since the launch of USD. Assuming the other half is kept liquid to trade when needed to protect its peg and only 10% of the reserves applied on deviations so far, we can arrive at a similar figure USD 4.8 billion for trading profit as well.

In any case, the amounts are significantly larger than the quarterly $60 million retained and twitted by Tether. So, we can assume that either Tether incurred losses on some of its investments or the earnings were distributed to the shareholders.

The report also has a paragraph about two civil litigation proceedings against Tether and/or its subsidiaries. The names, amounts and other details of the parties are not mentioned, but there is a positive improvement over the three such cases mentioned in the previous report.

Otherwise, the report is a great improvement in transparency compared to other players in crypto industry and over the previous Tether reports. We hope one day we will have a chance to observe full financial statements of Tether.