SWIFT completes another phase of its CBDC trials. The focus is on cross-border settlements between different CBDCs. The conclusion so far is that their existing systems can handle it.

💡 SWIFT (the Society for Worldwide Interbank Financial Telecommunication) is financial messaging system servicing interbank transactions worldwide. It was founded in 1970s and is headquartered in Belgium. In 90s SWIFT successfully embraced internet technologies that improved automation, security levels in the financial industry and costs to the users. SWIFT does not perform clearing, or settlement functions and it does not hold any accounts on behalf of its members. According to SWIFT corporate website, the system services 11,000 institutions in 200 countries.

For a number of years SWIFT has been researching blockchain technology, digital assets and CBDC, in particular. Given its strong international connections and experience, it is obviously a strong candidate to lead the next technological transformation.

SWIFT issued the first report on the state of their trials in May 2021. At that time, in collaboration with Accenture, SWIFT Innovation Hub outlined the main directions of CDBC research worldwide, and the possible roles SWIFT could play. According to that document SWIFT envisaged itself as the role of technical operator and solution provider for national CBDC systems, providing ‘cross network support”, in particular.

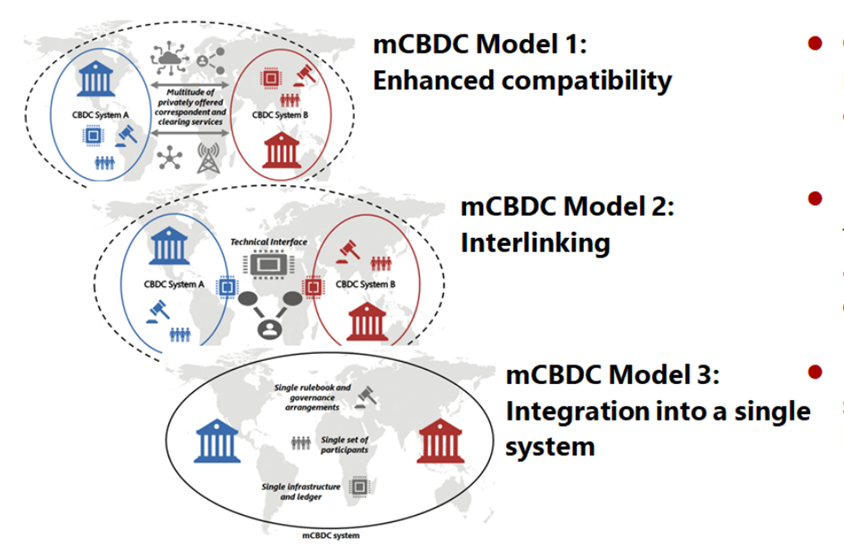

The recent report covering the second phase of trials and research done in collaboration with Capgemini is mainly about interlinking of multiple CDBCs and, or existing payment networks. SWIFT structured its research according to the taxonomy proposed by BIS: Model1 – CDBC islands with transfers between them performed by private actors such as SWIFT now, Model2 – CBDCs with common technical interface and clearing system and Model3 – a single mCBDC system with multi-currency slots for each participant.

While the first phase of SWIFT research focused on solving the BIS Model 1, in the second phase SWIFT reports solution for the Model 2. It is worthwhile mentioning that the recent BIS report on the future of the monetary system also cites technical interface through API. The recent report on CBDC trials comes right after the paper of BIS on the future of the monetary system.

In their Model2 CBDC to CDBC research SWIFT used two blockchain platforms: Banking consortium’s Corda and ConsenSys’s Quorum. Both platforms are permissioned blockchain hybrids, having little adoption in traditional banking, and are largely unwelcomed in the ultra decentralized community. The technical description of the transfer involves smart contracts, messaging, escrow and SWIFT existing tools, but overall, imitate centralized bridges are used between blockchains.

The fiat to CBDC transfer experiment SWIFT used mock RTGS (inter-banking clearance) network on one side and CDBC Corda on the other side. Transaction was also successfully processed using a series of technical transactions, again based on existing SWIFT technologies.

Overall, the Model2 mCBDC is solved in the same way as Model1, if its is assumed that SWIFT provides the common standard and gateway for the contacting CBDCs. If there are other solutions and certain CBDCs choose them over SWIFT then we are back to Model1 case.

The ambition of SWIFT is well understood and backed by solid market experience. However, experience in not the main factor in disruptive processes and SWIFT’s bet on existing technologies might be short sighted. We will observe and see if the expected BIS Model3 solution brings more breakthrough into the space.