The U.S. Securities and Exchange Commission is investigating the initial offering of the Binance Coin (BNB) cryptocurrency, which was launched in 2017.

At the moment, the SEC is investigating the native token of the Binance Coin (BNB) crypto exchange. The Commission is investigating the activities of Binance Holdings Ltd. According to the Bloomberg report, an investigation is underway for potential violations of U.S. securities laws.

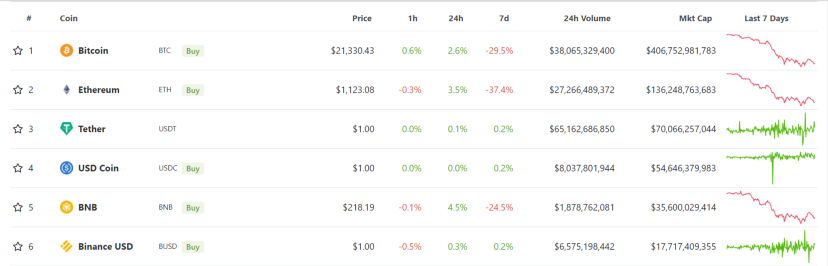

During the launch in 2017, Binance created its tokens through an ICO, which was distributed among the company’s supporters and employees. Binance Coin was also on open sale, as a result, it was possible to generate about $15 million, which went to the development of Binance. It is worth noting that today the token is the fifth most popular in the world, according to CoinGecko.

The case was initiated because the SEC believes that the initial placement of coins in 2017 is equivalent to the sale of a security that should have been registered with the agency. But Binance did not register their token as a security.

Tokens can be in the sphere of influence of the SEC if investors buy them in order to make a profit, finance a company or a project. This was introduced into legislation by the decision of the US Supreme Court of 1946.

According to Binance, representatives of the exchange will not disclose details of the case yet, but will cooperate with the investigation.

“it would not be appropriate for us to comment on our ongoing conversations with regulators, which include education, assistance, and voluntary responses to information requests.” — declared in Binance.

There is also information that the SEC is investigating possible trading abuses by Binance insiders. And also the American subsidiary is being checked properly, Binance.US , created in 2019, is separated from its global counterpart. Relative to this, Binance made a statement that the companies are different organizations.

“Binance.US is a separate US-focused trading platform that services US users by offering products and services that are compliant with US federal and state regulations,”.

It is worth noting that Binance has abandoned the plans outlined in the official ISO document to spend 20% of the exchange’s profit each quarter on the BNB buyback. This change was a reaction to legal advice “indicating the possibility of a misunderstanding of the security” in some regions, Zhao explained in a blog back in 2020.

If the SEC proves that BNB is a security, then the Binance case will become a copy of the Ripple Labs Inc. case. In December 2020, the SEC sued the firm and two of its executives for violating the rules for selling the XRP token. The situation is similar to today: Ripple believes that the token functions as a means of exchanging virtual currency, and the SEC is confident that the token should be regarded as a security. Investigations and trials are still underway in this case.

An interesting fact is that the SEC has started to be interested in platforms and their tokens, not at their birth, but when they have been successfully operating for several years, and the tokens strengthening in the market. In the case of the Binance token, it was issued in 2017, and the investigations begin in 2022, five years later. Furthermore, the securities Commission became interested in the XRP token in 2020, although the token has been functioning since 2013.

The expert community also does not see consistency in the actions of the SEC. Legal expert Collins Belton commented on the situation as follows:

It’s been 5 years and it’s mcap is higher than most US companies, why wait this long to take potential action if you’re concerned about potential harm? Letting things balloon only to prick it once massive seems like a recipe for inducing consumer harm rather than staving it off.

It cannot be said that Binance did not follow the legal aspects of its work, but on the contrary tried to protect it self from court cases. Now we can only watch for ongoing developments, and as Ripple’s example has shown, this may take several years.