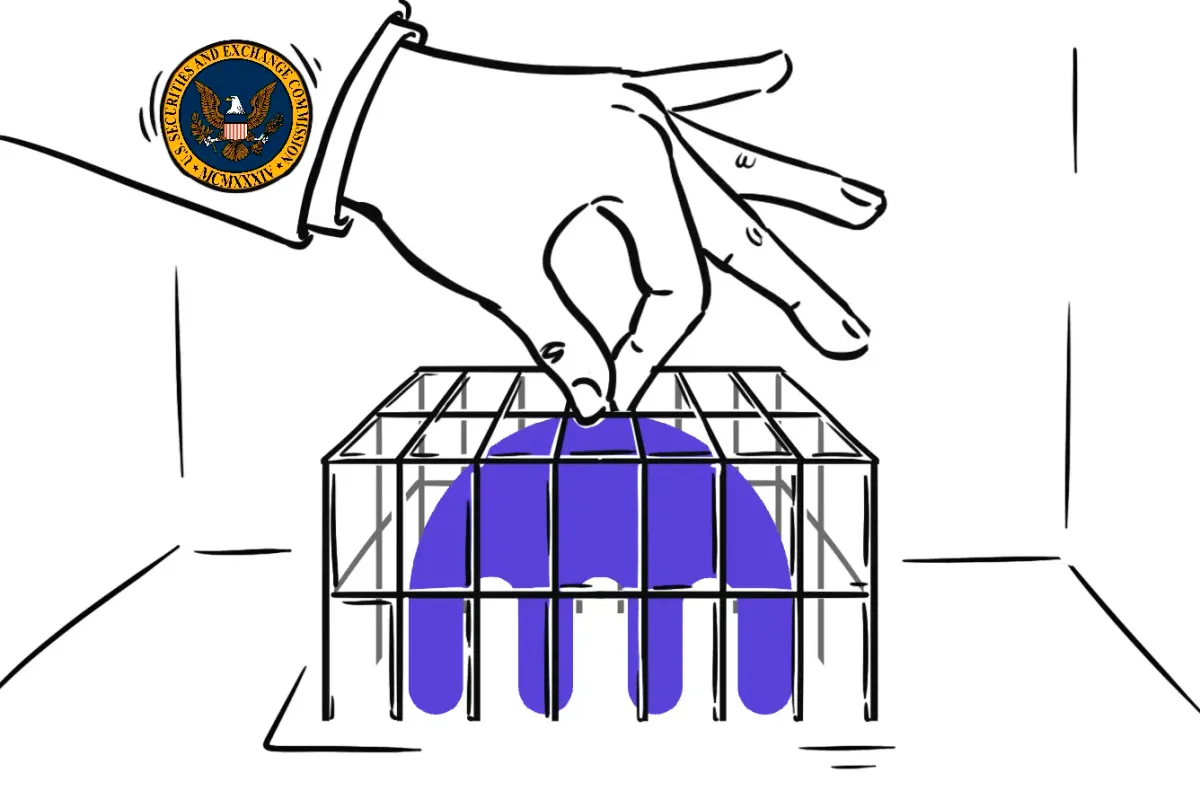

On November 20, the U.S. Securities and Exchange Commission (SEC) filed yet another complaint against a major crypto exchange. This time, Kraken pulled the short straw. The regulator alleges that Kraken failed to register as a securities exchange, broker, dealer and clearing agency. Referring to the exchange’s independent auditor, it also claims that the exchange unlawfully commingled up to $33 billion worth of customers’ crypto assets with its own, creating “a significant risk of loss.”

“Kraken’s business practices, deficient internal controls, and inadequate record keeping present a range of additional risks.”

The lawsuit represents another attempt by the SEC to police the industry. The regulator (as always) mentions the 70-year-old Howey test and insists that crypto assets are securities contracts and, thus, are to be controlled by the SEC.

“By operating a platform on which crypto assets are offered and sold as investment contracts, Kraken’s operations place it squarely within the purview of U.S. securities laws.”

Kraken immediately rejected the SEC’s complaint and promised to vigorously defend its position in court. The exchange's statement specifically highlights that no funds were lost and that the complaint doesn't allege any fraud. It also states that considering crypto assets as investment contracts is “incorrect as a matter of law, false as a matter of fact, and disastrous as a matter of policy.”

The exchange believes that the case will fail, providing the Ripple case as an example. Meanwhile, Kraken promises to continue to provide services to its clients without interruption.

“It [the complaint] includes big dollar amounts but does not allege a single one of those dollars is missing or misused.”

The SEC has been extra tough on the crypto industry in 2023. This year, the regulator has focused on leading figures and key organisations: prominent crypto companies such as Celsius, Genesis, Gemini, and Nexo have faced SEC charges for various infractions, not to mention the ongoing lawsuits against Binance and Coinbase. In this context, suing Kraken, the world’s third largest exchange according to CoinMarketCap rating, would seem a fairly expected and obvious step.

However, the agency’s crypto asset policy is getting increasingly confusing. Gary Gensler's changing position on key issues, including SEC guidance and Bitcoin ETF approvals, has raised multiple discussions across news outlets and social media. A U.S. Representative has even called Gensler “ineffective and incompetent.”

Commenting on the Kraken lawsuit, Coinbase CPO Faryar Shirzad tweeted, “The rule of law requires that the rulers apply actual laws.” Kraken has also mentioned that “the SEC is demanding compliance with a regime that doesn’t exist.”

Both statements are fair. The crypto community is looking forward to seeing a proper crypto framework in the U.S.

Meanwhile, we continue to Observe the SEC vs crypto exchanges war.