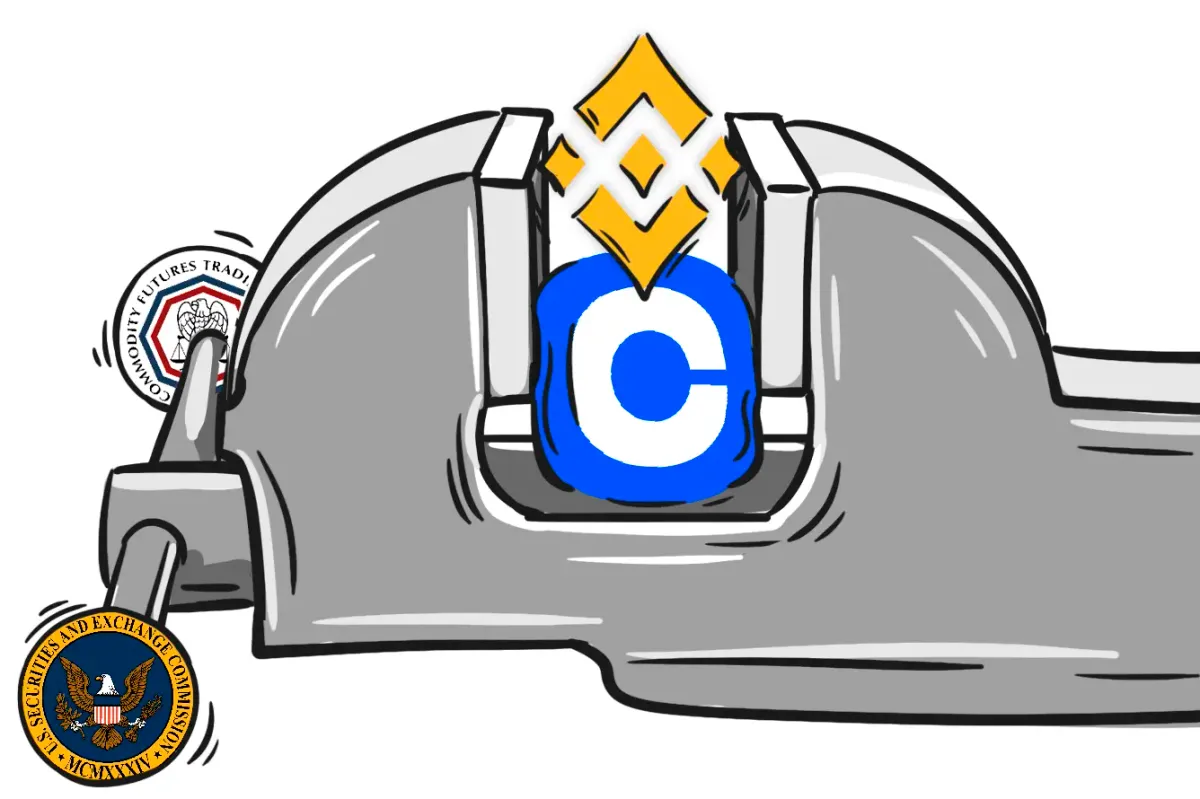

The U.S. Commodities Futures Trading Commission (CFTC) initially filed a lawsuit against Binance and CZ this March. The exchange was accused of failing to register and violating U.S. derivatives laws.

The SEC joined the crypto exchange witch hunt in the Summer. Firstly, the regulator sued Binance and its founder Changpeng Zhao for various alleged securities law violations in June. Then, the very next day it also sued Coinbase, for operating as an “unregistered broker, exchange and clearing agency.”

However, both exchanges have been unwilling to go down without a fight, and so have vigorously defended their corners, with Coinbase also criticizing the authorities for attacking crypto instead of providing proper regulation.

In August, Coinbase filed a motion to have the SEC lawsuit against it dismissed, arguing that the exchange does not trade in securities. It also suggested that the SEC had misapplied the Howey Test, which in itself is a controversial tool considered by many as unsuitable for determining whether a modern concept like cryptocurrency is a security.

On October 3, the SEC replied to the motion and asked the court to reject it, repeating that the various cryptocurrencies Coinbase listed were investment contracts under the Howey test.

The SEC’s arguments today would mean that everything from Pokemon cards to stamps to Swiftie bracelets are also securities. As @repritchie made so clear last week, that is simply not the law, nor should it be. 4/7

— paulgrewal.eth (@iampaulgrewal) October 3, 2023

Then, in its latest October 24 filing, Coinbase has tried to have the suit tossed out once more. The main argument is (again) that the SEC was granted the authority to regulate only securities and has no power over cryptocurrencies. Coinbase contests the SEC’s definition of an investment contract, calling it “insupportable”, and accuses the regulator of “radical expansion of its own authority”. The filing asserts that the SEC, “claims authority over essentially all investment activity—and thus the right to define its own regulatory ambit, constrained only by its own ambition.”

By arguing that any purchase in which the buyer hopes for an increase in value constitutes an investment contract-and therefore a security-the SEC is attempting a radical expansion of its own authority. Only Congress can do that as the major questions doctrine makes clear. 2/3

— paulgrewal.eth (@iampaulgrewal) October 24, 2023

Meanwhile, on the other side of the same battlefield, we can Observe the Binance and CFTC skirmish. In July, CZ and Binance’s lawyers made a filing to dismiss the case against the exchange, claiming that the CFTC had overstepped its authority.

More recently, on October 23, the attorneys filed another statement in support of this motion. The main argument is that the CFTC is trying to regulate foreign individuals and corporations that reside and operate outside of the United States, ignoring the “fundamental legal principle that U.S. law governs domestically but does not control the world.”

“The Court should reject the CFTC’s effort to use its attack on the non-U.S. Defendants in this case as a Trojan horse in order to achieve worldwide regulatory reach—which would have consequences far beyond this case and not intended by Congress.”

Curiously, Both Binance and Coinbase’s strategies and wording are very similar: replace ‘SEC’ with ‘CFTC’, ‘securities’ with ‘derivatives’ and change some minor details – and there it is. Do you think the two competitors might eventually join forces to fight for the future of crypto? That would be a battle we’d love to see.